Tax Reform

Comments

-

I thought that tax cut was going to lead to 4% growth year over year and pay for itself?

https://www.boston.com/news/politics/2018/05/30/us-economic-growth-revised-down-to-2-2-percent-rate-in-q1

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

How about we compound that issue with the least surprising news all year ..

http://thehill.com/policy/finance/391295-us-deficit-surges-to-530-billion-in-may-cbo

0 -

Randy Paul randstanding on the floor of the senate? The Obama phones are gone. What is Team Trump Treason going to cut next?mrussel1 said:How about we compound that issue with the least surprising news all year ..

http://thehill.com/policy/finance/391295-us-deficit-surges-to-530-billion-in-may-cbo09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Halfway through the year....people entitled to the Qualified business income tax deduction need to have roughly 40% of their estimated tax liability paid in by next Friday.

And still no clarifications have been offered on how this deduction works or what a specified business is.

Thanks IRS, doing great as always.0 -

huh....it's all very clear on my end.mookeywrench said:Halfway through the year....people entitled to the Qualified business income tax deduction need to have roughly 40% of their estimated tax liability paid in by next Friday.

And still no clarifications have been offered on how this deduction works or what a specified business is.

Thanks IRS, doing great as always.

Basically net income x 20% is the deduction. Certain service businesses (lawyers, doctors, accountants, etc) have a deduction phase out once their net income hits a certain point (roughly $160K single, $330K MFJ)

https://www.thetaxadviser.com/issues/2018/apr/understanding-sec-199A-business-income-deduction.html

Remember the Thomas Nine !! (10/02/2018)

The Golden Age is 2 months away. And guess what….. you’re gonna love it! (teskeinc 11.19.24)

1998: Noblesville; 2003: Noblesville; 2009: EV Nashville, Chicago, Chicago

2010: St Louis, Columbus, Noblesville; 2011: EV Chicago, East Troy, East Troy

2013: London ON, Wrigley; 2014: Cincy, St Louis, Moline (NO CODE)

2016: Lexington, Wrigley #1; 2018: Wrigley, Wrigley, Boston, Boston

2020: Oakland, Oakland: 2021: EV Ohana, Ohana, Ohana, Ohana

2022: Oakland, Oakland, Nashville, Louisville; 2023: Chicago, Chicago, Noblesville

2024: Noblesville, Wrigley, Wrigley, Ohana, Ohana; 2025: Pitt1, Pitt20 -

That's the basics. Gets more complicated than that though when you have clients in gray area service industries, multiple pass through entities.... some with losses, some with income. Then theres the whole rental income issue and if that's a business or an investment.0

-

ok so you are referring to some nuances there. Above you acted like there was nothing describing it at all.mookeywrench said:That's the basics. Gets more complicated than that though when you have clients in gray area service industries, multiple pass through entities.... some with losses, some with income. Then theres the whole rental income issue and if that's a business or an investment.

I've already been to 4 seminars that discuss the new shit. There is always gray areas until items get clarified.

Remember the Thomas Nine !! (10/02/2018)

The Golden Age is 2 months away. And guess what….. you’re gonna love it! (teskeinc 11.19.24)

1998: Noblesville; 2003: Noblesville; 2009: EV Nashville, Chicago, Chicago

2010: St Louis, Columbus, Noblesville; 2011: EV Chicago, East Troy, East Troy

2013: London ON, Wrigley; 2014: Cincy, St Louis, Moline (NO CODE)

2016: Lexington, Wrigley #1; 2018: Wrigley, Wrigley, Boston, Boston

2020: Oakland, Oakland: 2021: EV Ohana, Ohana, Ohana, Ohana

2022: Oakland, Oakland, Nashville, Louisville; 2023: Chicago, Chicago, Noblesville

2024: Noblesville, Wrigley, Wrigley, Ohana, Ohana; 2025: Pitt1, Pitt20 -

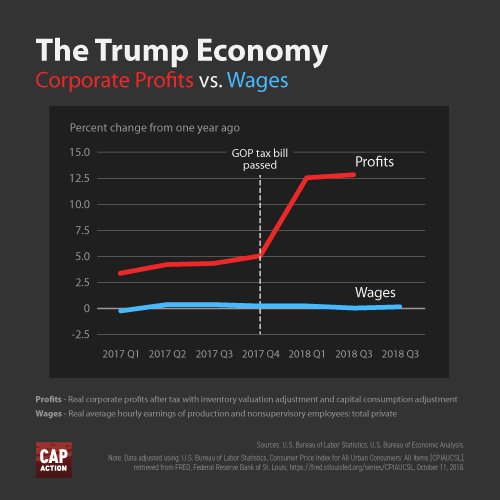

Just a reminder of who really benefits from the Team Trump Treason tax bill.

https://www.npr.org/2017/12/19/571754894/charts-see-how-much-of-gop-tax-cuts-will-go-to-the-middle-class

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

What did corporate America do with that tax break? Buy record amounts of its own stock

The White House promised '70 percent' of the tax cut would go to workers. It didn't.

https://www.nbcnews.com/business/economy/what-did-corporate-america-do-tax-break-buy-record-amounts-n8866210 -

Suckers.

How the Republican tax cuts are failing workers, in one chart - Vox https://apple.news/AuAU3Jm1NRI-734In5GJ-yA

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

The cited article is good and goes in a little more detail as well :Halifax2TheMax said:Suckers.

How the Republican tax cuts are failing workers, in one chart - Vox https://apple.news/AuAU3Jm1NRI-734In5GJ-yAWages were supposed to rise. Instead, they’ve fallen.

Also...

Inflation hits 6-year high, wiping out wage gains for the average American0 -

I thought that big huge corporate tax reduction was going to lead to money coming back and investments in the US? What did I miss? Oh right, I never believed that line to begin with.

https://money.cnn.com/2018/07/31/news/economy/foreign-direct-investment-switzerland/index.html

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Who here is surprised?

Trump's Tax Plan Is Failing to Give American Workers the Wage Growth He Promised - Newsweek https://apple.news/AxGsUZvbNRpSnqMtNgwTsPw

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

And that tax cut was needed again, why?

https://www.theguardian.com/business/2018/aug/16/ceo-versus-worker-wage-american-companies-pay-gap-study-2018

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Seems Americans just want to spend and spend and spend some more. It is a government for the people by the people, right? And it’s Faux news so you know it’s true. And fair and balanced.

Here's how much US households have saved - Fox News https://apple.news/AbRWAxXdNSk-bqjwo_JTOUw

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

#nowayjoseHalifax2TheMax said:More tax reform brilliance, brilliantly written to check a box and pay back the donor class. Team Trump Treason at it again. What will Team Trump Treason’s personal benefit be? Anyone? 3D? Anyone at all?

https://finance.yahoo.com/news/corporations-may-dodge-billions-u-234153823.html0 -

The U.S. budget deficit widened to $898 billion in the 11 months through August, exceeding the Congressional Budget Office’s forecast for the first full fiscal year under the Trump presidency.

https://www.sfgate.com/business/article/U-S-Budget-Deficit-Swells-to-898-Billion-13227880.php

0 -

Budget deficits? National Debt? Who cares? Not those Tea Baggers, that's who. Suckers.CM189191 said:The U.S. budget deficit widened to $898 billion in the 11 months through August, exceeding the Congressional Budget Office’s forecast for the first full fiscal year under the Trump presidency.

https://www.sfgate.com/business/article/U-S-Budget-Deficit-Swells-to-898-Billion-13227880.php09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

0

Categories

- All Categories

- 149.2K Pearl Jam's Music and Activism

- 110.3K The Porch

- 287 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help