Donald Trump

Comments

-

"Mostly I think that people react sensitively because they know you’ve got a point"0 -

Is Team Trump Treason’s other hand on her ass?Spiritual_Chaos said: 09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Just look how much of a simpleton this man is.....yes let's nuke a oncoming hurricane and the trade winds of nuclear fallout land right there in Palm Beach FL and his precious Mar Lago or the that other place in Miami. Damn that means I'd have to move, oh what a Brilliant genius this guy is turning out to be.Kat said:Why, of course. Let's nuke a hurricane heading to the U.S. so the trade winds that direct the hurricane will take the fallout directly to the place you want to protect. Only a stable genius would think of such a thing.

omg, someone get him out of there. This is the second time he's talked about nuking something.

Peace*We CAN bomb the World to pieces, but we CAN'T bomb it into PEACE*...Michael Franti

*MUSIC IS the expression of EMOTION.....and that POLITICS IS merely the DECOY of PERCEPTION*

.....song_Music & Politics....Michael Franti

*The scientists of today think deeply instead of clearly. One must be sane to think clearly, but one can think deeply and be quite INSANE*....Nikola Tesla(a man who shaped our world of electricity with his futuristic inventions)0 -

Meltdown is no troll in my book.HughFreakingDillon said:TROLL FIGHT!!!0 -

If that were to happen he would blame....g under p said:

Just look how much of a simpleton this man is.....yes let's nuke a oncoming hurricane and the trade winds of nuclear fallout land right there in Palm Beach FL and his precious Mar Lago or the that other place in Miami. Damn that means I'd have to move, oh what a Brilliant genius this guy is turning out to be.Kat said:Why, of course. Let's nuke a hurricane heading to the U.S. so the trade winds that direct the hurricane will take the fallout directly to the place you want to protect. Only a stable genius would think of such a thing.

omg, someone get him out of there. This is the second time he's talked about nuking something.

Peace

Hillary

Obama

Bill

Dems

SOCIALISTS

Disloyal Jews

Etc etc0 -

Don’t forget aboutBentleyspop said:

If that were to happen he would blame....g under p said:

Just look how much of a simpleton this man is.....yes let's nuke a oncoming hurricane and the trade winds of nuclear fallout land right there in Palm Beach FL and his precious Mar Lago or the that other place in Miami. Damn that means I'd have to move, oh what a Brilliant genius this guy is turning out to be.Kat said:Why, of course. Let's nuke a hurricane heading to the U.S. so the trade winds that direct the hurricane will take the fallout directly to the place you want to protect. Only a stable genius would think of such a thing.

omg, someone get him out of there. This is the second time he's talked about nuking something.

Peace

Hillary

Obama

Bill

Dems

SOCIALISTS

Disloyal Jews

Etc etc

Fake News

Peace,Love and Pearl Jam.0 -

wait, I thought Pence was worried about being alone with women not his wife?ikiT said:

_____________________________________SIGNATURE________________________________________________

Not today Sir, Probably not tomorrow.............................................. bayfront arena st. pete '94

you're finally here and I'm a mess................................................... nationwide arena columbus '10

memories like fingerprints are slowly raising.................................... first niagara center buffalo '13

another man ..... moved by sleight of hand...................................... joe louis arena detroit '140 -

not a fan of using being a woman as an insult.Your boos mean nothing to me, for I have seen what makes you cheer0

-

yeah, it IS insulting to women suggesting MS Lindsey is female.HughFreakingDillon said:not a fan of using being a woman as an insult.

_____________________________________SIGNATURE________________________________________________

Not today Sir, Probably not tomorrow.............................................. bayfront arena st. pete '94

you're finally here and I'm a mess................................................... nationwide arena columbus '10

memories like fingerprints are slowly raising.................................... first niagara center buffalo '13

another man ..... moved by sleight of hand...................................... joe louis arena detroit '140 -

Isn't it more of a gay joke? I feel like you're not sufficiently woke.HughFreakingDillon said:not a fan of using being a woman as an insult.0 -

need coffee.mrussel1 said:

Isn't it more of a gay joke? I feel like you're not sufficiently woke.HughFreakingDillon said:not a fan of using being a woman as an insult.

_____________________________________SIGNATURE________________________________________________

Not today Sir, Probably not tomorrow.............................................. bayfront arena st. pete '94

you're finally here and I'm a mess................................................... nationwide arena columbus '10

memories like fingerprints are slowly raising.................................... first niagara center buffalo '13

another man ..... moved by sleight of hand...................................... joe louis arena detroit '140 -

Covfefe?mickeyrat said:

need coffee.mrussel1 said:

Isn't it more of a gay joke? I feel like you're not sufficiently woke.HughFreakingDillon said:not a fan of using being a woman as an insult.0 -

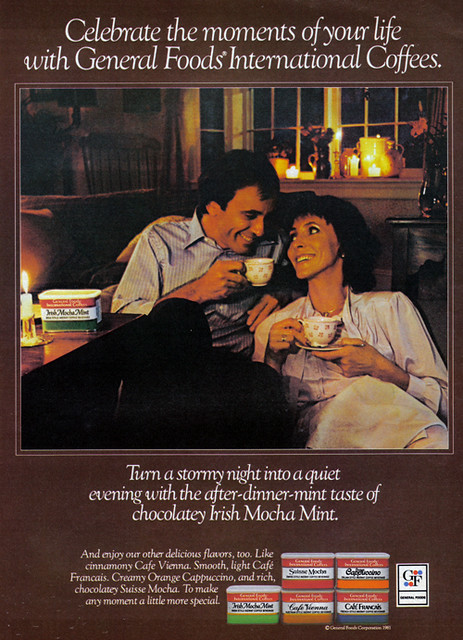

MMmmmm.. covfefe, a nuke and a hurricane... celebrate the moments of your life...dignin said:

Covfefe?mickeyrat said:

need coffee.mrussel1 said:

Isn't it more of a gay joke? I feel like you're not sufficiently woke.HughFreakingDillon said:not a fan of using being a woman as an insult.

0 -

The fix is in. Coupled with Putin on the ritz and you’ve got yourself a tailpipe of a party.

https://apple.news/AJth9dg2YT3qWEEeMMmagXA

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

-

For when Trumpito finally flames out...

Pence/Graham 2020

...ew.

Bristow 05132010 to Amsterdam 2 061320180 -

It's literally the best they have.Bristow 05132010 to Amsterdam 2 061320180

-

That is a fucking winnerCM189191 said:Remember the Thomas Nine !! (10/02/2018)

The Golden Age is 2 months away. And guess what….. you’re gonna love it! (teskeinc 11.19.24)

1998: Noblesville; 2003: Noblesville; 2009: EV Nashville, Chicago, Chicago

2010: St Louis, Columbus, Noblesville; 2011: EV Chicago, East Troy, East Troy

2013: London ON, Wrigley; 2014: Cincy, St Louis, Moline (NO CODE)

2016: Lexington, Wrigley #1; 2018: Wrigley, Wrigley, Boston, Boston

2020: Oakland, Oakland: 2021: EV Ohana, Ohana, Ohana, Ohana

2022: Oakland, Oakland, Nashville, Louisville; 2023: Chicago, Chicago, Noblesville

2024: Noblesville, Wrigley, Wrigley, Ohana, Ohana; 2025: Pitt1, Pitt20

This discussion has been closed.

Categories

- All Categories

- 149.1K Pearl Jam's Music and Activism

- 110.3K The Porch

- 284 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help