The next American Century- Republican primary over

Comments

-

Dukat had more personality.0 -

BinauralJam wrote:

Dukat had more personality. Is that from Star Trek? Shows: 6.27.08 Hartford, CT/5.15.10 Hartford, CT/6.18.2011 Hartford, CT (EV Solo)/10.19.13 Brooklyn/10.25.13 Hartford

Is that from Star Trek? Shows: 6.27.08 Hartford, CT/5.15.10 Hartford, CT/6.18.2011 Hartford, CT (EV Solo)/10.19.13 Brooklyn/10.25.13 Hartford

"Becoming a Bruce fan is like hitting puberty as a musical fan. It's inevitable." - dcfaithful0 -

lots of people voted for Obama because he is COOL!

WOOT!0 -

Get ready to go back...way back to a half century ago if he becomes President.

http://www.rollingstone.com/politics/bl ... n-20120515

What 'President Romney' Would Mean for Women

POSTED: May 15, 12:35 PM ET | By Nancy L. Cohen

Mitt Romney wants you to know that he and his party are "extraordinarily pro-woman" – "pro-opportunity for women, pro-moms, pro-working moms, pro-working women," as he put it on Fox News the other night. This idea Democrats are pushing of a Republican "war on women"? "Misguided, wrong, dishonest," he told Sean Hannity. "Look" – here came the pivot – "this is a race about helping America do a better job caring for the people of America.... The policies I’m promoting will get America back to work and assure greater prosperity for our citizens."

It was a telling exchange. Ever since Obama opened up a double-digit lead with women voters during the recent controversies over birth control, Republicans from Romney on down have worked hard to steer the conversation away from divisive social issues that make them look like religious nuts and back to more swing voter-friendly territory. "It’s still about the economy, and we’re not stupid," Romney proclaimed after all but wrapping up the GOP nomination late last month.

The conservative push to change the subject has basically succeeded, albeit with an assist from lousy job numbers. This is dangerous. Even if "the GOP war on women" – the metaphorical talking point – is dead, as at least one pundit has suggested, the GOP war on women – the real and continuing Republican drive to set back women’s rights and opportunities – remains very much alive.

And make no mistake: A Romney presidency will only escalate the assault. Let's take a look at exactly how, starting with the issue he says will attract women voters to the Republican ticket.

The Economy

American women earn on average 23 percent less than men – which adds up to an average loss of $383,000 in income over a working lifetime. Romney’s campaign couldn’t say recently whether their man would have signed the Lilly Ledbetter Fair Pay Act making it easier for women to file pay discrimination lawsuits (a law made necessary, by the way, because the conservative Roberts Supreme Court had eviscerated equal pay protection for women in its 2007 Ledbetter v. Goodyear Tire and Rubber Co ruling). All Romney himself could muster, eventually, was a grudging commitment to not repeal it. Democrats are pushing the Paycheck Fairness Act, which directly addresses the male-female pay disparity by putting teeth into the half-century old Equal Pay Act. Republicans oppose it and even deny the facts about wage inequality. Romney remains mum about his position on the bill.

It’s a safe bet that Romney won’t buck his party or its corporate sponsors for the sake of working women. He’ll undoubtedly say we should trust the "job creators" to fix whatever’s wrong.

Romney famously declared,"I like being able to fire people," and certainly he got a lot of practice during his tenure at the private equity firm Bain Capital (where women made up only 10 percent of 95 vice-presidents when Romney was in charge). And a President Romney will be issuing plenty of pink slips to at least one large group of working women: public employees. He proposes to cut government jobs as part of his plan to reduce the deficit and rein in Washington, jobs disproportionately held by women. (Of the 601,000 government workers thrown out of work since June 2009 due to budget cuts, two out three were women.)

A Romney presidency would inflict particular pain on women already struggling on the economic edge. The GOP nominee has warmly embraced the "marvelous" Ryan budget which ends Medicare in any recognizable form and would throw between 14 million and 27 million people off of Medicaid, around two thirds of them women. And then, if Romney and a Republican Congress succeed in repealing "Obamacare" – assuming it survives next month’s ruling at the hands of the Roberts Court – 17 million women due to get health coverage under the law will remain uninsured.

President Obama proposed a budget this year that protects the social safety net and includes a number of women-friendly measures, such as increased funding for child care, early education, and enforcement of labor laws barring gender discrimination. Romney lauded a budget passed by the Republican House that cuts childcare and reduces food and health care assistance for roughly 20 million children as "responsible."

All of which is to say: Under a President Romney, expect economic progress for women to grind to a halt. And what about women’s sexual freedom and reproductive rights? On those issues, be prepared for a warp-speed ride in reverse.

Abortion

"Do I believe the Supreme Court should overturn Roe v. Wade? Yes, I do," Romney said during one debate, talking about the 1973 Supreme Court decision that affirmed a woman’s constitutional right to an abortion. He also has called the decision "one of the darkest moments in Supreme Court history."

The next president will almost certainly have the power to determine whether Roe stands or falls. There is currently a 5-4 pro-Roe majority on the Supreme Court. Yet Ruth Bader Ginsburg, the Court’s most eloquent defender of women’s rights, including abortion rights, is 83 and in failing health, and likely to retire during the next presidency.

When asked what he will look for in a Supreme Court nominee, Romney name-checks the four anti-abortion conservatives on the Court: John Roberts, Antonin Scalia, Clarence Thomas, and Samuel Alito. And he has picked up endorsements from antiabortion PACs, such as the National Right to Life Committee, that impose an antiabortion litmus test on judicial nominees.

Take Romney at his word: If he wins, Roe v. Wade will be overturned, leaving it up to the states to decide whether abortion remains legal.

Romney and other establishment Republicans tout states rights as the way to resolve a contentious issue in a divided country. "I would love the Supreme Court to say, 'Let’s send this back to the states,'" he said in an interview with Diane Sawyer. "Rather than having a federal mandate through Roe v. Wade, let the states again consider this issue state by state." Republicans would prefer you not look too closely at their platform, which calls for outlawing all abortions, without exception.

But isn't Romney just pandering to the religious right? Isn't he, at heart, a moderate on this and other issues? Romney’s record as governor of Massachusetts – that is, in his relatively "liberal" incarnation – suggests otherwise. In 2005, Gov. Romney vetoed a bill requiring hospitals to provide emergency contraception to rape victims. He justified the move by citing the anti-birth control claptrap of the rightwing fringe that the morning after pill is a form of abortion. (It isn’t – it prevents conception.) The liberal Massachusetts legislature overrode Romney’s veto, ensuring that rape victims in that state would not be forced against their will to bear the child of their rapist. Women who live in the Red States of the Bible Belt won’t be so blessed.

The recent wave of state Personhood amendments and laws suggests this is not a far-fetched scenario. Personhood measures endow fertilized eggs with full legal rights, typically ban abortion in all cases, including rape and incest, and open the door to bans on in-vitro fertilization, the IUD, and hormonal contraception. Granted, Personhood initiatives have been rejected by the voters by large margins in Colorado and even in staunchly pro-life Mississippi. But with Roe overturned, all that will be needed to enact a Personhood law is a conservative majority in the state legislature and a willing governor. Note, too, that Romney has assured the antiabortion right that he "absolutely" supports state and federal constitutional amendments defining life as beginning at conception, a position that puts him to the right of the Mormon Church.

The best that can be hoped for post-Roe is that legislators in the nearly two dozen states where abortion will likely be banned show some humanity and write rape, incest, and life exceptions into legislation.

Contraception

In January, when Romney was cruising to the nomination, he ridiculed George Stephanopoulus for asking him, during a presidential debate, if he thought states had a right to ban contraception. "George, this is an unusual topic that you’re raising," he huffed.

Six weeks later Romney had endorsed the Blunt-Rubio Amendment, which would have allowed any employer to claim a "moral objection" and exclude potentially millions of women from getting birth control under their insurance coverage.

As you'll recall, the simmering war on women boiled over last February when Congressional Republicans convened an almost all-male hearing on the Obama administration’s mandate that insurers cover birth control with no co-pay under the Affordable Care Act. Romney joined the chorus of outraged conservatives and attacked the birth-control regulation as a heinous attack on religious liberty, even though the administration had already revised the initial regulation to insure that no religious institution would have to pay for contraception. He dogwhistled to the far-right repeatedly with statements that the mandate covered "abortive pills." Even after Romney had wrapped up the nomination and the Blunt Amendment had been defeated, the presumptive Republican nominee was still campaigning against the contraception mandate. "As President, I will abolish it," he told the National Rifle Association.

Romney wasn’t just defensively tacking right to fend off Rick Santorum and his hard-right legions. Before the controversy erupted, Romney had already signaled his intent to chip away at access to birth control, vowing to defund Planned Parenthood and eliminate Title X, the federal family planning program that provides family planning and screenings for breast and ovarian cancer, high blood pressure, and the like for five million women. Killing the program would deprive many of these women of their only source of health care. Romney had also pledged to restore George W. Bush’s so-called "conscience clause" allowing anyone in the health care delivery chain, say a clerk in a pharmacy, the right to refuse to sell contraceptives.

As long as Republicans retain control of the House – a near certainty if the GOP wins the presidency – Romney would have the power to deliver on these promises, and the substantial advances in women’s reproductive rights made under Obama will be reversed.

But wouldn’t victory release Romney from his promissory notes to the rightwing of the Republican Party? After all, isn’t this what Etch-a-Sketch candidates do?

Again Romney’s record as Massachusetts governor, so often cited in favor of his essentially moderate outlook, points to the opposite conclusion. As well as attempting to deny rape victims the morning after pill, Romney withdrew his previous support for legal abortion, embryonic stem cell research, comprehensive sex education, and gay civil rights. On social issues he flip-flops in only one direction: to the right.

Ten days ago Romney campaigned in the crucial swing state of Virginia alongside Michele Bachmann and Governor Bob McDonnell. Bachmann praised Romney as the man who could "take the country back."

Back to what? Bachmann didn’t say. Now you know.

_____________

I'd also like to know "back to what?" You and the TP have been saying that since President Obama took office.Shows: 6.27.08 Hartford, CT/5.15.10 Hartford, CT/6.18.2011 Hartford, CT (EV Solo)/10.19.13 Brooklyn/10.25.13 Hartford

"Becoming a Bruce fan is like hitting puberty as a musical fan. It's inevitable." - dcfaithful0 -

Newch91 wrote:BinauralJam wrote:

Dukat had more personality. Is that from Star Trek?

Is that from Star Trek?

Yup DS9, the simularities aren't just psychical.0 -

BinauralJam wrote:Newch91 wrote:BinauralJam wrote:

Dukat had more personality. Is that from Star Trek?

Is that from Star Trek?

Yup DS9, the simularities aren't just psychical. I've never seen a movie or any show of Star Trek. I've seen Star Wars and knew that character wasn't from it. Shows: 6.27.08 Hartford, CT/5.15.10 Hartford, CT/6.18.2011 Hartford, CT (EV Solo)/10.19.13 Brooklyn/10.25.13 Hartford

I've never seen a movie or any show of Star Trek. I've seen Star Wars and knew that character wasn't from it. Shows: 6.27.08 Hartford, CT/5.15.10 Hartford, CT/6.18.2011 Hartford, CT (EV Solo)/10.19.13 Brooklyn/10.25.13 Hartford

"Becoming a Bruce fan is like hitting puberty as a musical fan. It's inevitable." - dcfaithful0 -

DAY ONE

can't wait. It's gonna be tyt.

http://www.youtube.com/watch?feature=pl ... zK3ZX7hvzg

Believe in America!

WOOT0 -

0

0 -

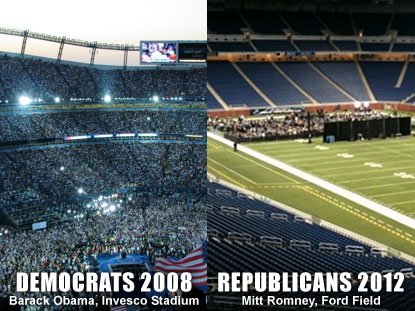

the Republicans were probably at work.

Like I said, Obama is cool but Romney is pretty cool too. 50 percent approval rating in the latest Gallup poll. Polls are weak but Romeny is still a swell guy.Post edited by usamamasan1 on0 -

usamamasan1 wrote:the Republicans were probably at work.

Like I said, Obama is cool.

I agree, white people have all the jobs0 -

BinauralJam wrote:usamamasan1 wrote:the Republicans were probably at work.

Like I said, Obama is cool.

I agree, white people have all the jobs 0

0 -

-

hmmm, he said he stands by what he said. I guess his position has not "evolved".0

-

0

-

"I am not familiar, precisely, with exactly what I said, but I stand by what I said, whatever it was." — Mitt Romney, May 2012.BinauralJam wrote: That's something The Onion would write. Even better, he actually said it.

That's something The Onion would write. Even better, he actually said it.  Shows: 6.27.08 Hartford, CT/5.15.10 Hartford, CT/6.18.2011 Hartford, CT (EV Solo)/10.19.13 Brooklyn/10.25.13 Hartford

Shows: 6.27.08 Hartford, CT/5.15.10 Hartford, CT/6.18.2011 Hartford, CT (EV Solo)/10.19.13 Brooklyn/10.25.13 Hartford

"Becoming a Bruce fan is like hitting puberty as a musical fan. It's inevitable." - dcfaithful0 -

Asked Monday if he is "comfortable" with Trump's statements on the birther issue, Romney stiffened. "You know, I don't agree with all the people who support me, and my guess is that they don't all agree with everything I believe in," Romney said, an air of irritation in his voice. "But I need to get to 50.1 percent or more, and I'm appreciative to have the help of a lot of good people."

Romney then turned to make his way back toward the front of the plane—his mood a little darker than before. But the presumptive Republican nominee seemed to catch himself, almost as if he didn't want to exit on a tense note.

Squeezing the top of one of the airplane's seats, Romney turned back to reporters.

"This is an upgrade, you know. You notice this?" he said to no one in particular, a hint of a smile on his face. "This is leather. It's not Naugahyde."

Romney appeared to be making fun of himself. Campaigning in the early primary states, Romney often mentioned the "old Naugahyde chairs" he and his partners at Bain Capital had used during the early days of the company, an anecdote that was meant to exhibit the firm's less than fancy beginnings.

Romney declared in a deadpan voice, "Killed a lot of naugas for this."

As reporters giggled, Romney noted that his last plane "was not as nice as this one."

"Gets us there," he added. "I hope."

Woot1144

Believe in America

Mitt is it!

Jeb0 -

usamamasan1 wrote:Asked Monday if he is "comfortable" with Trump's statements on the birther issue, Romney stiffened. "You know, I don't agree with all the people who support me, and my guess is that they don't all agree with everything I believe in," Romney said, an air of irritation in his voice. "But I need to get to 50.1 percent or more, and I'm appreciative to have the help of a lot of good people."

Romney then turned to make his way back toward the front of the plane—his mood a little darker than before. But the presumptive Republican nominee seemed to catch himself, almost as if he didn't want to exit on a tense note.

Squeezing the top of one of the airplane's seats, Romney turned back to reporters.

"This is an upgrade, you know. You notice this?" he said to no one in particular, a hint of a smile on his face. "This is leather. It's not Naugahyde."

Romney appeared to be making fun of himself. Campaigning in the early primary states, Romney often mentioned the "old Naugahyde chairs" he and his partners at Bain Capital had used during the early days of the company, an anecdote that was meant to exhibit the firm's less than fancy beginnings.

Romney declared in a deadpan voice, "Killed a lot of naugas for this."

As reporters giggled, Romney noted that his last plane "was not as nice as this one."

"Gets us there," he added. "I hope."

Woot1144

Believe in America

Mitt is it!

Jeb

He came off as kind of an ass to me there... Not that I didn't expect it0 -

usamamasan1 wrote:the Republicans were probably at work.

Like I said, Obama is cool but Romney is pretty cool too. 50 percent approval rating in the latest Gallup poll. Polls are weak but Romeny is still a swell guy.

at work.... or their klan rally0 -

BinauralJam wrote:usamamasan1 wrote:the Republicans were probably at work.

Like I said, Obama is cool.

I agree, white people have all the jobs

:wtf: Dude...really ? I can't believe you you said that.

Godfather.0 -

Political Expediency on Same-Sex Marriage Earns President Obama $15 Million in One Night. .....

now for the right money as we all know this clown will tell you just what you want to hear.

Godfather.0

This discussion has been closed.

Categories

- All Categories

- 149.2K Pearl Jam's Music and Activism

- 110.3K The Porch

- 286 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help