Capitalism, The Fed and Economic Policy

Comments

-

I’d argue that people with college and graduate degrees aren’t the everyday workers. If I’m not mistaken, half of the student load debt was for grad school.tempo_n_groove said:

THE STUDENT LOAN RELIEF ONE GETS ME. So… We bail out the billionaires but continue to handcuff the every day worker and not bail them out…mickeyrat said:struck me as something to note and watch....Retailers, beware: Resumption of student loan payments could lead some buyers to pull backBy Paul WisemanYesterdayWASHINGTON (AP) — The reprieve is over. Just as the American economy is struggling with high inflation and interest rates, the coming resumption of student loan payments poses yet another potential challenge.

The suspension of federal student loan payments, which took effect at the height of the pandemic in 2020, expires late this summer. Interest will start accruing again in September. Payments will resume in October.

Though many hoped their loans might at least be lightened, the Supreme Court last week struck down a Biden administration plan that would have given millions of people some relief from the return of the loan payments. The Biden plan would have canceled up to $20,000 in federal student loans for 43 million borrowers; 20 million would have had their loans erased entirely. The court ruled that the plan exceeded the government’s authority.

The restart of those payments will force many people to start paying hundreds of dollars in loans each month — money they had been spending elsewhere for the past three years. Their pullback in spending on goods and services won't likely make a serious dent in the $26 trillion U.S. economy, the world's largest. Any pain instead will likely be concentrated in a few industries, notably e-commerce companies, bars and restaurants and some major retailers.

Even if all that won't be enough to weaken overall economic growth, the shift in spending by many young adults could inject further uncertainty into an economy already beset by uncertainties, from whether the Fed will manage to tame inflation and halt its interest rate hikes to whether a recession is destined to strike by next year, as many economists still fear.

Josh Bivens, chief economist at the Economic Policy Institute think tank, suggested that the likely hit to the economy might amount to perhaps one-third of a percentage point of gross domestic product — the nation's total output of goods and services — or about $85 billion or $90 billion a year.

It's “not trivial, but it’s not huge,’’ Bivens said. “At the macro level, my guess is that it won’t be a game-changer.’’

The continued willingness of consumers to spend has kept the economy humming despite more than a year of dramatically rising interest rates. Consumers have had the financial wherewithal to load up Amazon shopping carts, go out for dinner and buy everything from lawn furniture to new refrigerators, in part because the government spent around $5 trillion since 2020 to cushion the economic damage from COVID-19.

But those pandemic relief programs, including the student loan moratorium, are ending and adding to the obstacles the economy is facing.

The suspension of loan payments “had given people a bit more money in the pocket, and they’ve gone out and they’ve spent that money,’’ said Neil Saunders, managing director of the GlobalData Retail consultancy.

Deutsche Bank analysts who follow the retail industry estimate that the resumption of the loan payments could shrink consumer spending by $14 billion a month, or an average of $305 per borrower. The biggest blow, they say, will likely be absorbed by online commerce and mail-order companies and by restaurants and bars.

Among the individual companies that could be hurt, according to the Deutsche Bank analysis, are Macy’s, Target and Kohl’s. The largest retailer, Walmart, is thought to be insulated from major damage because of its grocery business. (Walmart is also the nation's largest grocer.)

Dollar stores and other discounters might even benefit if more financially squeezed consumers turn to bargain-hunting.

Jan Hatzius, chief economist at Goldman Sachs, and his colleagues say they expect the end of the student loan moratorium to impose a “modest drag’’ on the economy, shaving 0.2% off growth in consumer spending this year. The dent to spending would have been half as much, they say, if the Supreme Court had allowed the Biden debt forgiveness program to proceed.

The economy has endured a wild ride since COVID-19 hit in early 2020. A deep recession engulfed the economy in March and April that year. Massive government aid fueled a rebound of surprising speed, strength and resilience.

But it came at a price: Surging demand from consumers overwhelmed the world’s factories, ports and freight yards, resulting in delays, shortages — and much higher prices. Inflation surged last year to heights not seen since the early 1980s.

In response, the Fed began jacking up its benchmark short-term rate in March 2022. Since then, it’s raised its key rate 10 times. Higher borrowing costs have had the intended effect of slowing the economy and price acceleration. From a year-over-year peak of 9.1% in June 2022, consumer price inflation fell to 4% in May. Yet that’s still twice the Fed’s 2% target. So the central bank has signaled that more rate hike are likely this year.

At the same time, the government has been phasing out pandemic relief. Extended unemployment aid ended in September 2021. An expansion of the food stamps program ended this year.

The savings that Americans had socked away beginning at the peak of the pandemic — when they were receiving government relief checks and saving money while hunkered down at home — are evaporating. Fed researchers have reported that any “excess’’ pandemic savings probably dried up in the first three months of 2023.

Despite everything, the economy has proved surprisingly durable. The government last week sharply upgraded its estimate of January-through-March economic growth to a 2% annual rate and said consumers were spending at their fastest pace in nearly two years. Factor in a still-robust job market — employers keep hiring briskly, and unemployment, at 3.7%, is barely above a half-century low — and the economy has repeatedly outrun predictions, first sounded more than a year ago, that a recession was inevitable.

“The economy has really powered through it,’’ Bivens said. “So what is the straw that breaks the camel’s back? My guess is it’s not this. I don’t think it’s a big-enough thing.’’

Still, Bivens said, he worries about the Fed rate hikes and federal cutbacks, including the end of the student loan payment moratorium, “throwing more contractionary shocks’’ at an American economy that has defied the doubters — at least for now.

___

AP Retail Writer Anne D'Innocenzio contributed to this report from New York.

0 -

If you still or have a student loan that is haunting you then you are an everyday worker.mrussel1 said:

I’d argue that people with college and graduate degrees aren’t the everyday workers. If I’m not mistaken, half of the student load debt was for grad school.tempo_n_groove said:

THE STUDENT LOAN RELIEF ONE GETS ME. So… We bail out the billionaires but continue to handcuff the every day worker and not bail them out…mickeyrat said:struck me as something to note and watch....Retailers, beware: Resumption of student loan payments could lead some buyers to pull backBy Paul WisemanYesterdayWASHINGTON (AP) — The reprieve is over. Just as the American economy is struggling with high inflation and interest rates, the coming resumption of student loan payments poses yet another potential challenge.

The suspension of federal student loan payments, which took effect at the height of the pandemic in 2020, expires late this summer. Interest will start accruing again in September. Payments will resume in October.

Though many hoped their loans might at least be lightened, the Supreme Court last week struck down a Biden administration plan that would have given millions of people some relief from the return of the loan payments. The Biden plan would have canceled up to $20,000 in federal student loans for 43 million borrowers; 20 million would have had their loans erased entirely. The court ruled that the plan exceeded the government’s authority.

The restart of those payments will force many people to start paying hundreds of dollars in loans each month — money they had been spending elsewhere for the past three years. Their pullback in spending on goods and services won't likely make a serious dent in the $26 trillion U.S. economy, the world's largest. Any pain instead will likely be concentrated in a few industries, notably e-commerce companies, bars and restaurants and some major retailers.

Even if all that won't be enough to weaken overall economic growth, the shift in spending by many young adults could inject further uncertainty into an economy already beset by uncertainties, from whether the Fed will manage to tame inflation and halt its interest rate hikes to whether a recession is destined to strike by next year, as many economists still fear.

Josh Bivens, chief economist at the Economic Policy Institute think tank, suggested that the likely hit to the economy might amount to perhaps one-third of a percentage point of gross domestic product — the nation's total output of goods and services — or about $85 billion or $90 billion a year.

It's “not trivial, but it’s not huge,’’ Bivens said. “At the macro level, my guess is that it won’t be a game-changer.’’

The continued willingness of consumers to spend has kept the economy humming despite more than a year of dramatically rising interest rates. Consumers have had the financial wherewithal to load up Amazon shopping carts, go out for dinner and buy everything from lawn furniture to new refrigerators, in part because the government spent around $5 trillion since 2020 to cushion the economic damage from COVID-19.

But those pandemic relief programs, including the student loan moratorium, are ending and adding to the obstacles the economy is facing.

The suspension of loan payments “had given people a bit more money in the pocket, and they’ve gone out and they’ve spent that money,’’ said Neil Saunders, managing director of the GlobalData Retail consultancy.

Deutsche Bank analysts who follow the retail industry estimate that the resumption of the loan payments could shrink consumer spending by $14 billion a month, or an average of $305 per borrower. The biggest blow, they say, will likely be absorbed by online commerce and mail-order companies and by restaurants and bars.

Among the individual companies that could be hurt, according to the Deutsche Bank analysis, are Macy’s, Target and Kohl’s. The largest retailer, Walmart, is thought to be insulated from major damage because of its grocery business. (Walmart is also the nation's largest grocer.)

Dollar stores and other discounters might even benefit if more financially squeezed consumers turn to bargain-hunting.

Jan Hatzius, chief economist at Goldman Sachs, and his colleagues say they expect the end of the student loan moratorium to impose a “modest drag’’ on the economy, shaving 0.2% off growth in consumer spending this year. The dent to spending would have been half as much, they say, if the Supreme Court had allowed the Biden debt forgiveness program to proceed.

The economy has endured a wild ride since COVID-19 hit in early 2020. A deep recession engulfed the economy in March and April that year. Massive government aid fueled a rebound of surprising speed, strength and resilience.

But it came at a price: Surging demand from consumers overwhelmed the world’s factories, ports and freight yards, resulting in delays, shortages — and much higher prices. Inflation surged last year to heights not seen since the early 1980s.

In response, the Fed began jacking up its benchmark short-term rate in March 2022. Since then, it’s raised its key rate 10 times. Higher borrowing costs have had the intended effect of slowing the economy and price acceleration. From a year-over-year peak of 9.1% in June 2022, consumer price inflation fell to 4% in May. Yet that’s still twice the Fed’s 2% target. So the central bank has signaled that more rate hike are likely this year.

At the same time, the government has been phasing out pandemic relief. Extended unemployment aid ended in September 2021. An expansion of the food stamps program ended this year.

The savings that Americans had socked away beginning at the peak of the pandemic — when they were receiving government relief checks and saving money while hunkered down at home — are evaporating. Fed researchers have reported that any “excess’’ pandemic savings probably dried up in the first three months of 2023.

Despite everything, the economy has proved surprisingly durable. The government last week sharply upgraded its estimate of January-through-March economic growth to a 2% annual rate and said consumers were spending at their fastest pace in nearly two years. Factor in a still-robust job market — employers keep hiring briskly, and unemployment, at 3.7%, is barely above a half-century low — and the economy has repeatedly outrun predictions, first sounded more than a year ago, that a recession was inevitable.

“The economy has really powered through it,’’ Bivens said. “So what is the straw that breaks the camel’s back? My guess is it’s not this. I don’t think it’s a big-enough thing.’’

Still, Bivens said, he worries about the Fed rate hikes and federal cutbacks, including the end of the student loan payment moratorium, “throwing more contractionary shocks’’ at an American economy that has defied the doubters — at least for now.

___

AP Retail Writer Anne D'Innocenzio contributed to this report from New York.

0 -

Purely anecdotal but I talk to regular people every day who have tens of thousands of student loan debt that they either have yet start paying on or have not made payments on in years. Most of these people are already struggling to pay their other bills.www.myspace.com0

-

I'm paying mine regularly. It never goes away and I only borrowed 15k for trade school. paid about 18k at this point with 10k still to go thanks to the interest freeze. I expect it to balloon back up once interest starts accruing again. These are federal loans not private. 6.5% interest. I'd hate to get some relief from that if it meant a slap in the face to people that went to school before costs went sideways and student loans became a money making enterprise.The Juggler said:Purely anecdotal but I talk to regular people every day who have tens of thousands of student loan debt that they either have yet start paying on or have not made payments on in years. Most of these people are already struggling to pay their other bills.Scio me nihil scire

There are no kings inside the gates of eden0 -

I don't know what "haunting" means. If you're making 200k a year but you still have 60k in student loan debt, are you really worse off than the person making $20 per hour? I don't think so. Remember that 46% of debt is held by graduate students, not undergrad.tempo_n_groove said:

If you still or have a student loan that is haunting you then you are an everyday worker.mrussel1 said:

I’d argue that people with college and graduate degrees aren’t the everyday workers. If I’m not mistaken, half of the student load debt was for grad school.tempo_n_groove said:

THE STUDENT LOAN RELIEF ONE GETS ME. So… We bail out the billionaires but continue to handcuff the every day worker and not bail them out…mickeyrat said:struck me as something to note and watch....Retailers, beware: Resumption of student loan payments could lead some buyers to pull backBy Paul WisemanYesterdayWASHINGTON (AP) — The reprieve is over. Just as the American economy is struggling with high inflation and interest rates, the coming resumption of student loan payments poses yet another potential challenge.

The suspension of federal student loan payments, which took effect at the height of the pandemic in 2020, expires late this summer. Interest will start accruing again in September. Payments will resume in October.

Though many hoped their loans might at least be lightened, the Supreme Court last week struck down a Biden administration plan that would have given millions of people some relief from the return of the loan payments. The Biden plan would have canceled up to $20,000 in federal student loans for 43 million borrowers; 20 million would have had their loans erased entirely. The court ruled that the plan exceeded the government’s authority.

The restart of those payments will force many people to start paying hundreds of dollars in loans each month — money they had been spending elsewhere for the past three years. Their pullback in spending on goods and services won't likely make a serious dent in the $26 trillion U.S. economy, the world's largest. Any pain instead will likely be concentrated in a few industries, notably e-commerce companies, bars and restaurants and some major retailers.

Even if all that won't be enough to weaken overall economic growth, the shift in spending by many young adults could inject further uncertainty into an economy already beset by uncertainties, from whether the Fed will manage to tame inflation and halt its interest rate hikes to whether a recession is destined to strike by next year, as many economists still fear.

Josh Bivens, chief economist at the Economic Policy Institute think tank, suggested that the likely hit to the economy might amount to perhaps one-third of a percentage point of gross domestic product — the nation's total output of goods and services — or about $85 billion or $90 billion a year.

It's “not trivial, but it’s not huge,’’ Bivens said. “At the macro level, my guess is that it won’t be a game-changer.’’

The continued willingness of consumers to spend has kept the economy humming despite more than a year of dramatically rising interest rates. Consumers have had the financial wherewithal to load up Amazon shopping carts, go out for dinner and buy everything from lawn furniture to new refrigerators, in part because the government spent around $5 trillion since 2020 to cushion the economic damage from COVID-19.

But those pandemic relief programs, including the student loan moratorium, are ending and adding to the obstacles the economy is facing.

The suspension of loan payments “had given people a bit more money in the pocket, and they’ve gone out and they’ve spent that money,’’ said Neil Saunders, managing director of the GlobalData Retail consultancy.

Deutsche Bank analysts who follow the retail industry estimate that the resumption of the loan payments could shrink consumer spending by $14 billion a month, or an average of $305 per borrower. The biggest blow, they say, will likely be absorbed by online commerce and mail-order companies and by restaurants and bars.

Among the individual companies that could be hurt, according to the Deutsche Bank analysis, are Macy’s, Target and Kohl’s. The largest retailer, Walmart, is thought to be insulated from major damage because of its grocery business. (Walmart is also the nation's largest grocer.)

Dollar stores and other discounters might even benefit if more financially squeezed consumers turn to bargain-hunting.

Jan Hatzius, chief economist at Goldman Sachs, and his colleagues say they expect the end of the student loan moratorium to impose a “modest drag’’ on the economy, shaving 0.2% off growth in consumer spending this year. The dent to spending would have been half as much, they say, if the Supreme Court had allowed the Biden debt forgiveness program to proceed.

The economy has endured a wild ride since COVID-19 hit in early 2020. A deep recession engulfed the economy in March and April that year. Massive government aid fueled a rebound of surprising speed, strength and resilience.

But it came at a price: Surging demand from consumers overwhelmed the world’s factories, ports and freight yards, resulting in delays, shortages — and much higher prices. Inflation surged last year to heights not seen since the early 1980s.

In response, the Fed began jacking up its benchmark short-term rate in March 2022. Since then, it’s raised its key rate 10 times. Higher borrowing costs have had the intended effect of slowing the economy and price acceleration. From a year-over-year peak of 9.1% in June 2022, consumer price inflation fell to 4% in May. Yet that’s still twice the Fed’s 2% target. So the central bank has signaled that more rate hike are likely this year.

At the same time, the government has been phasing out pandemic relief. Extended unemployment aid ended in September 2021. An expansion of the food stamps program ended this year.

The savings that Americans had socked away beginning at the peak of the pandemic — when they were receiving government relief checks and saving money while hunkered down at home — are evaporating. Fed researchers have reported that any “excess’’ pandemic savings probably dried up in the first three months of 2023.

Despite everything, the economy has proved surprisingly durable. The government last week sharply upgraded its estimate of January-through-March economic growth to a 2% annual rate and said consumers were spending at their fastest pace in nearly two years. Factor in a still-robust job market — employers keep hiring briskly, and unemployment, at 3.7%, is barely above a half-century low — and the economy has repeatedly outrun predictions, first sounded more than a year ago, that a recession was inevitable.

“The economy has really powered through it,’’ Bivens said. “So what is the straw that breaks the camel’s back? My guess is it’s not this. I don’t think it’s a big-enough thing.’’

Still, Bivens said, he worries about the Fed rate hikes and federal cutbacks, including the end of the student loan payment moratorium, “throwing more contractionary shocks’’ at an American economy that has defied the doubters — at least for now.

___

AP Retail Writer Anne D'Innocenzio contributed to this report from New York.

I think you could do things like freeze interest or tie it to the discount rate and that would be very helpful. But waiving student loan debt is a benefit to the class of Americans most likely to have high incomes. It's regressive in nature, in my opinion, not progressive.0 -

I'll park this here.._____________________________________SIGNATURE________________________________________________

Not today Sir, Probably not tomorrow.............................................. bayfront arena st. pete '94

you're finally here and I'm a mess................................................... nationwide arena columbus '10

memories like fingerprints are slowly raising.................................... first niagara center buffalo '13

another man ..... moved by sleight of hand...................................... joe louis arena detroit '140 -

So that means 54% of people are not grad students. I talk to people making less than 100k who have roughly that same amount of student loan debt you mention all the time.mrussel1 said:

I don't know what "haunting" means. If you're making 200k a year but you still have 60k in student loan debt, are you really worse off than the person making $20 per hour? I don't think so. Remember that 46% of debt is held by graduate students, not undergrad.tempo_n_groove said:

If you still or have a student loan that is haunting you then you are an everyday worker.mrussel1 said:

I’d argue that people with college and graduate degrees aren’t the everyday workers. If I’m not mistaken, half of the student load debt was for grad school.tempo_n_groove said:

THE STUDENT LOAN RELIEF ONE GETS ME. So… We bail out the billionaires but continue to handcuff the every day worker and not bail them out…mickeyrat said:struck me as something to note and watch....Retailers, beware: Resumption of student loan payments could lead some buyers to pull backBy Paul WisemanYesterdayWASHINGTON (AP) — The reprieve is over. Just as the American economy is struggling with high inflation and interest rates, the coming resumption of student loan payments poses yet another potential challenge.

The suspension of federal student loan payments, which took effect at the height of the pandemic in 2020, expires late this summer. Interest will start accruing again in September. Payments will resume in October.

Though many hoped their loans might at least be lightened, the Supreme Court last week struck down a Biden administration plan that would have given millions of people some relief from the return of the loan payments. The Biden plan would have canceled up to $20,000 in federal student loans for 43 million borrowers; 20 million would have had their loans erased entirely. The court ruled that the plan exceeded the government’s authority.

The restart of those payments will force many people to start paying hundreds of dollars in loans each month — money they had been spending elsewhere for the past three years. Their pullback in spending on goods and services won't likely make a serious dent in the $26 trillion U.S. economy, the world's largest. Any pain instead will likely be concentrated in a few industries, notably e-commerce companies, bars and restaurants and some major retailers.

Even if all that won't be enough to weaken overall economic growth, the shift in spending by many young adults could inject further uncertainty into an economy already beset by uncertainties, from whether the Fed will manage to tame inflation and halt its interest rate hikes to whether a recession is destined to strike by next year, as many economists still fear.

Josh Bivens, chief economist at the Economic Policy Institute think tank, suggested that the likely hit to the economy might amount to perhaps one-third of a percentage point of gross domestic product — the nation's total output of goods and services — or about $85 billion or $90 billion a year.

It's “not trivial, but it’s not huge,’’ Bivens said. “At the macro level, my guess is that it won’t be a game-changer.’’

The continued willingness of consumers to spend has kept the economy humming despite more than a year of dramatically rising interest rates. Consumers have had the financial wherewithal to load up Amazon shopping carts, go out for dinner and buy everything from lawn furniture to new refrigerators, in part because the government spent around $5 trillion since 2020 to cushion the economic damage from COVID-19.

But those pandemic relief programs, including the student loan moratorium, are ending and adding to the obstacles the economy is facing.

The suspension of loan payments “had given people a bit more money in the pocket, and they’ve gone out and they’ve spent that money,’’ said Neil Saunders, managing director of the GlobalData Retail consultancy.

Deutsche Bank analysts who follow the retail industry estimate that the resumption of the loan payments could shrink consumer spending by $14 billion a month, or an average of $305 per borrower. The biggest blow, they say, will likely be absorbed by online commerce and mail-order companies and by restaurants and bars.

Among the individual companies that could be hurt, according to the Deutsche Bank analysis, are Macy’s, Target and Kohl’s. The largest retailer, Walmart, is thought to be insulated from major damage because of its grocery business. (Walmart is also the nation's largest grocer.)

Dollar stores and other discounters might even benefit if more financially squeezed consumers turn to bargain-hunting.

Jan Hatzius, chief economist at Goldman Sachs, and his colleagues say they expect the end of the student loan moratorium to impose a “modest drag’’ on the economy, shaving 0.2% off growth in consumer spending this year. The dent to spending would have been half as much, they say, if the Supreme Court had allowed the Biden debt forgiveness program to proceed.

The economy has endured a wild ride since COVID-19 hit in early 2020. A deep recession engulfed the economy in March and April that year. Massive government aid fueled a rebound of surprising speed, strength and resilience.

But it came at a price: Surging demand from consumers overwhelmed the world’s factories, ports and freight yards, resulting in delays, shortages — and much higher prices. Inflation surged last year to heights not seen since the early 1980s.

In response, the Fed began jacking up its benchmark short-term rate in March 2022. Since then, it’s raised its key rate 10 times. Higher borrowing costs have had the intended effect of slowing the economy and price acceleration. From a year-over-year peak of 9.1% in June 2022, consumer price inflation fell to 4% in May. Yet that’s still twice the Fed’s 2% target. So the central bank has signaled that more rate hike are likely this year.

At the same time, the government has been phasing out pandemic relief. Extended unemployment aid ended in September 2021. An expansion of the food stamps program ended this year.

The savings that Americans had socked away beginning at the peak of the pandemic — when they were receiving government relief checks and saving money while hunkered down at home — are evaporating. Fed researchers have reported that any “excess’’ pandemic savings probably dried up in the first three months of 2023.

Despite everything, the economy has proved surprisingly durable. The government last week sharply upgraded its estimate of January-through-March economic growth to a 2% annual rate and said consumers were spending at their fastest pace in nearly two years. Factor in a still-robust job market — employers keep hiring briskly, and unemployment, at 3.7%, is barely above a half-century low — and the economy has repeatedly outrun predictions, first sounded more than a year ago, that a recession was inevitable.

“The economy has really powered through it,’’ Bivens said. “So what is the straw that breaks the camel’s back? My guess is it’s not this. I don’t think it’s a big-enough thing.’’

Still, Bivens said, he worries about the Fed rate hikes and federal cutbacks, including the end of the student loan payment moratorium, “throwing more contractionary shocks’’ at an American economy that has defied the doubters — at least for now.

___

AP Retail Writer Anne D'Innocenzio contributed to this report from New York.

I think you could do things like freeze interest or tie it to the discount rate and that would be very helpful. But waiving student loan debt is a benefit to the class of Americans most likely to have high incomes. It's regressive in nature, in my opinion, not progressive.www.myspace.com0 -

Yeah this is insanemickeyrat said:

https://www.cnbc.com/2023/07/06/adp-jobs-report-private-sector-added-497000-workers-in-june.html

Really interested to see what the gov's number looks like tomorrow. Interest rates are shooting up again....www.myspace.com0 -

Well what it means to me is that a solid minority of students are holding half the debt. But it also means to me that if your angle is right, that graduates making less than 100k are holding a 100k+ in debt, that just screams of bad choices in my opinion. Now the gov't rewards bad decisions all the time, and I get that. But if you believe that we do actually have to pay our federal debt one day, then there isn't a good reason to provide such a significant financial benefit to the class of people who are most likely to be top earners.The Juggler said:

So that means 54% of people are not grad students. I talk to people making less than 100k who have roughly that same amount of student loan debt you mention all the time.mrussel1 said:

I don't know what "haunting" means. If you're making 200k a year but you still have 60k in student loan debt, are you really worse off than the person making $20 per hour? I don't think so. Remember that 46% of debt is held by graduate students, not undergrad.tempo_n_groove said:

If you still or have a student loan that is haunting you then you are an everyday worker.mrussel1 said:

I’d argue that people with college and graduate degrees aren’t the everyday workers. If I’m not mistaken, half of the student load debt was for grad school.tempo_n_groove said:

THE STUDENT LOAN RELIEF ONE GETS ME. So… We bail out the billionaires but continue to handcuff the every day worker and not bail them out…mickeyrat said:struck me as something to note and watch....Retailers, beware: Resumption of student loan payments could lead some buyers to pull backBy Paul WisemanYesterdayWASHINGTON (AP) — The reprieve is over. Just as the American economy is struggling with high inflation and interest rates, the coming resumption of student loan payments poses yet another potential challenge.

The suspension of federal student loan payments, which took effect at the height of the pandemic in 2020, expires late this summer. Interest will start accruing again in September. Payments will resume in October.

Though many hoped their loans might at least be lightened, the Supreme Court last week struck down a Biden administration plan that would have given millions of people some relief from the return of the loan payments. The Biden plan would have canceled up to $20,000 in federal student loans for 43 million borrowers; 20 million would have had their loans erased entirely. The court ruled that the plan exceeded the government’s authority.

The restart of those payments will force many people to start paying hundreds of dollars in loans each month — money they had been spending elsewhere for the past three years. Their pullback in spending on goods and services won't likely make a serious dent in the $26 trillion U.S. economy, the world's largest. Any pain instead will likely be concentrated in a few industries, notably e-commerce companies, bars and restaurants and some major retailers.

Even if all that won't be enough to weaken overall economic growth, the shift in spending by many young adults could inject further uncertainty into an economy already beset by uncertainties, from whether the Fed will manage to tame inflation and halt its interest rate hikes to whether a recession is destined to strike by next year, as many economists still fear.

Josh Bivens, chief economist at the Economic Policy Institute think tank, suggested that the likely hit to the economy might amount to perhaps one-third of a percentage point of gross domestic product — the nation's total output of goods and services — or about $85 billion or $90 billion a year.

It's “not trivial, but it’s not huge,’’ Bivens said. “At the macro level, my guess is that it won’t be a game-changer.’’

The continued willingness of consumers to spend has kept the economy humming despite more than a year of dramatically rising interest rates. Consumers have had the financial wherewithal to load up Amazon shopping carts, go out for dinner and buy everything from lawn furniture to new refrigerators, in part because the government spent around $5 trillion since 2020 to cushion the economic damage from COVID-19.

But those pandemic relief programs, including the student loan moratorium, are ending and adding to the obstacles the economy is facing.

The suspension of loan payments “had given people a bit more money in the pocket, and they’ve gone out and they’ve spent that money,’’ said Neil Saunders, managing director of the GlobalData Retail consultancy.

Deutsche Bank analysts who follow the retail industry estimate that the resumption of the loan payments could shrink consumer spending by $14 billion a month, or an average of $305 per borrower. The biggest blow, they say, will likely be absorbed by online commerce and mail-order companies and by restaurants and bars.

Among the individual companies that could be hurt, according to the Deutsche Bank analysis, are Macy’s, Target and Kohl’s. The largest retailer, Walmart, is thought to be insulated from major damage because of its grocery business. (Walmart is also the nation's largest grocer.)

Dollar stores and other discounters might even benefit if more financially squeezed consumers turn to bargain-hunting.

Jan Hatzius, chief economist at Goldman Sachs, and his colleagues say they expect the end of the student loan moratorium to impose a “modest drag’’ on the economy, shaving 0.2% off growth in consumer spending this year. The dent to spending would have been half as much, they say, if the Supreme Court had allowed the Biden debt forgiveness program to proceed.

The economy has endured a wild ride since COVID-19 hit in early 2020. A deep recession engulfed the economy in March and April that year. Massive government aid fueled a rebound of surprising speed, strength and resilience.

But it came at a price: Surging demand from consumers overwhelmed the world’s factories, ports and freight yards, resulting in delays, shortages — and much higher prices. Inflation surged last year to heights not seen since the early 1980s.

In response, the Fed began jacking up its benchmark short-term rate in March 2022. Since then, it’s raised its key rate 10 times. Higher borrowing costs have had the intended effect of slowing the economy and price acceleration. From a year-over-year peak of 9.1% in June 2022, consumer price inflation fell to 4% in May. Yet that’s still twice the Fed’s 2% target. So the central bank has signaled that more rate hike are likely this year.

At the same time, the government has been phasing out pandemic relief. Extended unemployment aid ended in September 2021. An expansion of the food stamps program ended this year.

The savings that Americans had socked away beginning at the peak of the pandemic — when they were receiving government relief checks and saving money while hunkered down at home — are evaporating. Fed researchers have reported that any “excess’’ pandemic savings probably dried up in the first three months of 2023.

Despite everything, the economy has proved surprisingly durable. The government last week sharply upgraded its estimate of January-through-March economic growth to a 2% annual rate and said consumers were spending at their fastest pace in nearly two years. Factor in a still-robust job market — employers keep hiring briskly, and unemployment, at 3.7%, is barely above a half-century low — and the economy has repeatedly outrun predictions, first sounded more than a year ago, that a recession was inevitable.

“The economy has really powered through it,’’ Bivens said. “So what is the straw that breaks the camel’s back? My guess is it’s not this. I don’t think it’s a big-enough thing.’’

Still, Bivens said, he worries about the Fed rate hikes and federal cutbacks, including the end of the student loan payment moratorium, “throwing more contractionary shocks’’ at an American economy that has defied the doubters — at least for now.

___

AP Retail Writer Anne D'Innocenzio contributed to this report from New York.

I think you could do things like freeze interest or tie it to the discount rate and that would be very helpful. But waiving student loan debt is a benefit to the class of Americans most likely to have high incomes. It's regressive in nature, in my opinion, not progressive.0 -

I remember a roommate of my daughter who couldn't even pay her rent until her student loan came through. Kids were borrowing $20K/year to cover tuition, room and board.

I can't imagine telling my kids to get a degree knowing that they will have at least $80K in debt when they graduate (assuming they graduate in four years.)

It may have seemed like a good idea to keep student loan debt from being dischargeable in bankruptcy to encourage lenders to make funds available...but it wasn't. Fucking horrible idea.

When the parents are ignorant enough to encourage that shit how do we blame the student?

That girl should have gone to college closer to home and skipped the room and board costs at a minimum.Remember the Thomas Nine !! (10/02/2018)

The Golden Age is 2 months away. And guess what….. you’re gonna love it! (teskeinc 11.19.24)

1998: Noblesville; 2003: Noblesville; 2009: EV Nashville, Chicago, Chicago

2010: St Louis, Columbus, Noblesville; 2011: EV Chicago, East Troy, East Troy

2013: London ON, Wrigley; 2014: Cincy, St Louis, Moline (NO CODE)

2016: Lexington, Wrigley #1; 2018: Wrigley, Wrigley, Boston, Boston

2020: Oakland, Oakland: 2021: EV Ohana, Ohana, Ohana, Ohana

2022: Oakland, Oakland, Nashville, Louisville; 2023: Chicago, Chicago, Noblesville

2024: Noblesville, Wrigley, Wrigley, Ohana, Ohana; 2025: Pitt1, Pitt20 -

Not saying they made correct choices. I am just saying there are likely millions of regular people (not just mostly grad students making 200k plus) drowning in debt while their student loans have been in deferment. Toss in an extra few hundred dollars a month for those loan payments and they're going to be in even worse shape.Post edited by The Juggler onwww.myspace.com0

-

But are these people poor, or are they just not advancing at the rate they expected, economically? In other words, is the problem that they can't buy a house, have kids? Or are they literally moving into section 8 housing like the real poor people in this country? My guess is the latter. But their perspective is different. Because they were educated enough to know to go to college and take loans (and needed full tuition, not reduced like a real disadvantaged person would receive), I'm guessing most came from middle to upper middle class families. So what they expect out of life is very different than what someone growing up in East Baltimore or Camden expects. I don't have data to back up these statements, but I do know that colleges have funds for the truly disadvantaged and are generous with them.The Juggler said:Not saying they made correct choices. I am just saying there are likely millions of regular people (not just mostly grad students making 200k plus) drowning in debt while their student loans have been in deferment. Toss in an extra few hundred dollars a month for those loan payments and they're going to be in even worse shape.0 -

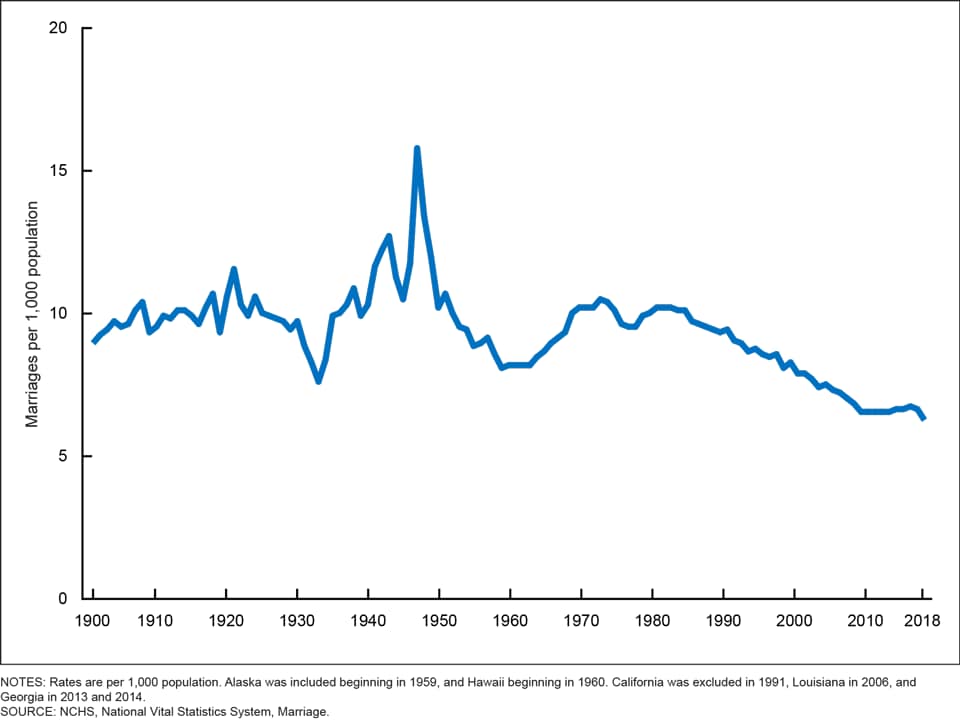

One other thing that I think really negatively affects these people in their 20's and early 30's that would benefit from the waiver, is the reduced marriage rate. Marriage has many problems, particularly divorce of course. But marriage, where finances become intertwined, is how you achieve scale and are able to buy homes. I bought my first house at 27 right after marrying. For the same home, I would have had to work almost another decade to be able to do that by myself. It would have been untenable. And cohabitating is not the same unless you mix finances. Otherwise you won't make that type of joint purchase. But look at the tanking marriage rates in this country, from 10.x to 6.x from our generation to today. It's hard to get ahead on one income.

0 -

I don't know man. I just disagreed with your original point that they're not "everyday workers." Everyone of them I talk to owns a house and most are drowning in debt and do not make over 200k/year. I suspect I will be starting to include their student loans in their cashout refi applications in the near future when they have to start paying them back again.mrussel1 said:

But are these people poor, or are they just not advancing at the rate they expected, economically? In other words, is the problem that they can't buy a house, have kids? Or are they literally moving into section 8 housing like the real poor people in this country? My guess is the latter. But their perspective is different. Because they were educated enough to know to go to college and take loans (and needed full tuition, not reduced like a real disadvantaged person would receive), I'm guessing most came from middle to upper middle class families. So what they expect out of life is very different than what someone growing up in East Baltimore or Camden expects. I don't have data to back up these statements, but I do know that colleges have funds for the truly disadvantaged and are generous with them.The Juggler said:Not saying they made correct choices. I am just saying there are likely millions of regular people (not just mostly grad students making 200k plus) drowning in debt while their student loans have been in deferment. Toss in an extra few hundred dollars a month for those loan payments and they're going to be in even worse shape.www.myspace.com0 -

"I don't know what haunting means"mrussel1 said:

I don't know what "haunting" means. If you're making 200k a year but you still have 60k in student loan debt, are you really worse off than the person making $20 per hour? I don't think so. Remember that 46% of debt is held by graduate students, not undergrad.tempo_n_groove said:

If you still or have a student loan that is haunting you then you are an everyday worker.mrussel1 said:

I’d argue that people with college and graduate degrees aren’t the everyday workers. If I’m not mistaken, half of the student load debt was for grad school.tempo_n_groove said:

THE STUDENT LOAN RELIEF ONE GETS ME. So… We bail out the billionaires but continue to handcuff the every day worker and not bail them out…mickeyrat said:struck me as something to note and watch....Retailers, beware: Resumption of student loan payments could lead some buyers to pull backBy Paul WisemanYesterdayWASHINGTON (AP) — The reprieve is over. Just as the American economy is struggling with high inflation and interest rates, the coming resumption of student loan payments poses yet another potential challenge.

The suspension of federal student loan payments, which took effect at the height of the pandemic in 2020, expires late this summer. Interest will start accruing again in September. Payments will resume in October.

Though many hoped their loans might at least be lightened, the Supreme Court last week struck down a Biden administration plan that would have given millions of people some relief from the return of the loan payments. The Biden plan would have canceled up to $20,000 in federal student loans for 43 million borrowers; 20 million would have had their loans erased entirely. The court ruled that the plan exceeded the government’s authority.

The restart of those payments will force many people to start paying hundreds of dollars in loans each month — money they had been spending elsewhere for the past three years. Their pullback in spending on goods and services won't likely make a serious dent in the $26 trillion U.S. economy, the world's largest. Any pain instead will likely be concentrated in a few industries, notably e-commerce companies, bars and restaurants and some major retailers.

Even if all that won't be enough to weaken overall economic growth, the shift in spending by many young adults could inject further uncertainty into an economy already beset by uncertainties, from whether the Fed will manage to tame inflation and halt its interest rate hikes to whether a recession is destined to strike by next year, as many economists still fear.

Josh Bivens, chief economist at the Economic Policy Institute think tank, suggested that the likely hit to the economy might amount to perhaps one-third of a percentage point of gross domestic product — the nation's total output of goods and services — or about $85 billion or $90 billion a year.

It's “not trivial, but it’s not huge,’’ Bivens said. “At the macro level, my guess is that it won’t be a game-changer.’’

The continued willingness of consumers to spend has kept the economy humming despite more than a year of dramatically rising interest rates. Consumers have had the financial wherewithal to load up Amazon shopping carts, go out for dinner and buy everything from lawn furniture to new refrigerators, in part because the government spent around $5 trillion since 2020 to cushion the economic damage from COVID-19.

But those pandemic relief programs, including the student loan moratorium, are ending and adding to the obstacles the economy is facing.

The suspension of loan payments “had given people a bit more money in the pocket, and they’ve gone out and they’ve spent that money,’’ said Neil Saunders, managing director of the GlobalData Retail consultancy.

Deutsche Bank analysts who follow the retail industry estimate that the resumption of the loan payments could shrink consumer spending by $14 billion a month, or an average of $305 per borrower. The biggest blow, they say, will likely be absorbed by online commerce and mail-order companies and by restaurants and bars.

Among the individual companies that could be hurt, according to the Deutsche Bank analysis, are Macy’s, Target and Kohl’s. The largest retailer, Walmart, is thought to be insulated from major damage because of its grocery business. (Walmart is also the nation's largest grocer.)

Dollar stores and other discounters might even benefit if more financially squeezed consumers turn to bargain-hunting.

Jan Hatzius, chief economist at Goldman Sachs, and his colleagues say they expect the end of the student loan moratorium to impose a “modest drag’’ on the economy, shaving 0.2% off growth in consumer spending this year. The dent to spending would have been half as much, they say, if the Supreme Court had allowed the Biden debt forgiveness program to proceed.

The economy has endured a wild ride since COVID-19 hit in early 2020. A deep recession engulfed the economy in March and April that year. Massive government aid fueled a rebound of surprising speed, strength and resilience.

But it came at a price: Surging demand from consumers overwhelmed the world’s factories, ports and freight yards, resulting in delays, shortages — and much higher prices. Inflation surged last year to heights not seen since the early 1980s.

In response, the Fed began jacking up its benchmark short-term rate in March 2022. Since then, it’s raised its key rate 10 times. Higher borrowing costs have had the intended effect of slowing the economy and price acceleration. From a year-over-year peak of 9.1% in June 2022, consumer price inflation fell to 4% in May. Yet that’s still twice the Fed’s 2% target. So the central bank has signaled that more rate hike are likely this year.

At the same time, the government has been phasing out pandemic relief. Extended unemployment aid ended in September 2021. An expansion of the food stamps program ended this year.

The savings that Americans had socked away beginning at the peak of the pandemic — when they were receiving government relief checks and saving money while hunkered down at home — are evaporating. Fed researchers have reported that any “excess’’ pandemic savings probably dried up in the first three months of 2023.

Despite everything, the economy has proved surprisingly durable. The government last week sharply upgraded its estimate of January-through-March economic growth to a 2% annual rate and said consumers were spending at their fastest pace in nearly two years. Factor in a still-robust job market — employers keep hiring briskly, and unemployment, at 3.7%, is barely above a half-century low — and the economy has repeatedly outrun predictions, first sounded more than a year ago, that a recession was inevitable.

“The economy has really powered through it,’’ Bivens said. “So what is the straw that breaks the camel’s back? My guess is it’s not this. I don’t think it’s a big-enough thing.’’

Still, Bivens said, he worries about the Fed rate hikes and federal cutbacks, including the end of the student loan payment moratorium, “throwing more contractionary shocks’’ at an American economy that has defied the doubters — at least for now.

___

AP Retail Writer Anne D'Innocenzio contributed to this report from New York.

I think you could do things like freeze interest or tie it to the discount rate and that would be very helpful. But waiving student loan debt is a benefit to the class of Americans most likely to have high incomes. It's regressive in nature, in my opinion, not progressive.

It's something that a bunch of people are going through and on the outside it doesn't make sense but when you know so many people that are going through this it makes more sense.

Read about the people it is effecting. The debt is actually crippling their efforts to grow financially. When you pay into something for years and the amount owed doesn't move that is predatory lending. It's leeches sucking people dry.0 -

I guess it depends on your definition of everyday workers. I think of non college grads as an everyday worker, not necessarily white collar professionals. But that distinction doesn't really matter in the grand scheme of the discussion. I'm not saying they aren't drowning in debt. I'm sure they are. But that was driven by bad decisions and they are still the most likely to be gainfully employed. I would much prefer equity programs that help the disadvantaged. I don't consider someone employed, with a home, as disadvantaged.The Juggler said:

I don't know man. I just disagreed with your original point that they're not "everyday workers." Everyone of them I talk to owns a house and most are drowning in debt and do not make over 200k/year. I suspect I will be starting to include their student loans in their cashout refi applications in the near future when they have to start paying them back again.mrussel1 said:

But are these people poor, or are they just not advancing at the rate they expected, economically? In other words, is the problem that they can't buy a house, have kids? Or are they literally moving into section 8 housing like the real poor people in this country? My guess is the latter. But their perspective is different. Because they were educated enough to know to go to college and take loans (and needed full tuition, not reduced like a real disadvantaged person would receive), I'm guessing most came from middle to upper middle class families. So what they expect out of life is very different than what someone growing up in East Baltimore or Camden expects. I don't have data to back up these statements, but I do know that colleges have funds for the truly disadvantaged and are generous with them.The Juggler said:Not saying they made correct choices. I am just saying there are likely millions of regular people (not just mostly grad students making 200k plus) drowning in debt while their student loans have been in deferment. Toss in an extra few hundred dollars a month for those loan payments and they're going to be in even worse shape.0 -

Most of these people can't afford homes. Why? Because of the ton of student debt...mrussel1 said:

I guess it depends on your definition of everyday workers. I think of non college grads as an everyday worker, not necessarily white collar professionals. But that distinction doesn't really matter in the grand scheme of the discussion. I'm not saying they aren't drowning in debt. I'm sure they are. But that was driven by bad decisions and they are still the most likely to be gainfully employed. I would much prefer equity programs that help the disadvantaged. I don't consider someone employed, with a home, as disadvantaged.The Juggler said:

I don't know man. I just disagreed with your original point that they're not "everyday workers." Everyone of them I talk to owns a house and most are drowning in debt and do not make over 200k/year. I suspect I will be starting to include their student loans in their cashout refi applications in the near future when they have to start paying them back again.mrussel1 said:

But are these people poor, or are they just not advancing at the rate they expected, economically? In other words, is the problem that they can't buy a house, have kids? Or are they literally moving into section 8 housing like the real poor people in this country? My guess is the latter. But their perspective is different. Because they were educated enough to know to go to college and take loans (and needed full tuition, not reduced like a real disadvantaged person would receive), I'm guessing most came from middle to upper middle class families. So what they expect out of life is very different than what someone growing up in East Baltimore or Camden expects. I don't have data to back up these statements, but I do know that colleges have funds for the truly disadvantaged and are generous with them.The Juggler said:Not saying they made correct choices. I am just saying there are likely millions of regular people (not just mostly grad students making 200k plus) drowning in debt while their student loans have been in deferment. Toss in an extra few hundred dollars a month for those loan payments and they're going to be in even worse shape.

You're not going to get it so I'll move along.0 -

Remember that only federal loans were eligible. In those cases, the interest today is 5% for undergrad and 6.5% for grad. How is that predatory? You can't make payments for years and not make a dent into loans with that interest. Plus the interest has not been accruing for over three years.tempo_n_groove said:

"I don't know what haunting means"mrussel1 said:

I don't know what "haunting" means. If you're making 200k a year but you still have 60k in student loan debt, are you really worse off than the person making $20 per hour? I don't think so. Remember that 46% of debt is held by graduate students, not undergrad.tempo_n_groove said:

If you still or have a student loan that is haunting you then you are an everyday worker.mrussel1 said:

I’d argue that people with college and graduate degrees aren’t the everyday workers. If I’m not mistaken, half of the student load debt was for grad school.tempo_n_groove said:

THE STUDENT LOAN RELIEF ONE GETS ME. So… We bail out the billionaires but continue to handcuff the every day worker and not bail them out…mickeyrat said:struck me as something to note and watch....Retailers, beware: Resumption of student loan payments could lead some buyers to pull backBy Paul WisemanYesterdayWASHINGTON (AP) — The reprieve is over. Just as the American economy is struggling with high inflation and interest rates, the coming resumption of student loan payments poses yet another potential challenge.

The suspension of federal student loan payments, which took effect at the height of the pandemic in 2020, expires late this summer. Interest will start accruing again in September. Payments will resume in October.

Though many hoped their loans might at least be lightened, the Supreme Court last week struck down a Biden administration plan that would have given millions of people some relief from the return of the loan payments. The Biden plan would have canceled up to $20,000 in federal student loans for 43 million borrowers; 20 million would have had their loans erased entirely. The court ruled that the plan exceeded the government’s authority.

The restart of those payments will force many people to start paying hundreds of dollars in loans each month — money they had been spending elsewhere for the past three years. Their pullback in spending on goods and services won't likely make a serious dent in the $26 trillion U.S. economy, the world's largest. Any pain instead will likely be concentrated in a few industries, notably e-commerce companies, bars and restaurants and some major retailers.

Even if all that won't be enough to weaken overall economic growth, the shift in spending by many young adults could inject further uncertainty into an economy already beset by uncertainties, from whether the Fed will manage to tame inflation and halt its interest rate hikes to whether a recession is destined to strike by next year, as many economists still fear.

Josh Bivens, chief economist at the Economic Policy Institute think tank, suggested that the likely hit to the economy might amount to perhaps one-third of a percentage point of gross domestic product — the nation's total output of goods and services — or about $85 billion or $90 billion a year.

It's “not trivial, but it’s not huge,’’ Bivens said. “At the macro level, my guess is that it won’t be a game-changer.’’

The continued willingness of consumers to spend has kept the economy humming despite more than a year of dramatically rising interest rates. Consumers have had the financial wherewithal to load up Amazon shopping carts, go out for dinner and buy everything from lawn furniture to new refrigerators, in part because the government spent around $5 trillion since 2020 to cushion the economic damage from COVID-19.

But those pandemic relief programs, including the student loan moratorium, are ending and adding to the obstacles the economy is facing.

The suspension of loan payments “had given people a bit more money in the pocket, and they’ve gone out and they’ve spent that money,’’ said Neil Saunders, managing director of the GlobalData Retail consultancy.

Deutsche Bank analysts who follow the retail industry estimate that the resumption of the loan payments could shrink consumer spending by $14 billion a month, or an average of $305 per borrower. The biggest blow, they say, will likely be absorbed by online commerce and mail-order companies and by restaurants and bars.

Among the individual companies that could be hurt, according to the Deutsche Bank analysis, are Macy’s, Target and Kohl’s. The largest retailer, Walmart, is thought to be insulated from major damage because of its grocery business. (Walmart is also the nation's largest grocer.)

Dollar stores and other discounters might even benefit if more financially squeezed consumers turn to bargain-hunting.

Jan Hatzius, chief economist at Goldman Sachs, and his colleagues say they expect the end of the student loan moratorium to impose a “modest drag’’ on the economy, shaving 0.2% off growth in consumer spending this year. The dent to spending would have been half as much, they say, if the Supreme Court had allowed the Biden debt forgiveness program to proceed.

The economy has endured a wild ride since COVID-19 hit in early 2020. A deep recession engulfed the economy in March and April that year. Massive government aid fueled a rebound of surprising speed, strength and resilience.

But it came at a price: Surging demand from consumers overwhelmed the world’s factories, ports and freight yards, resulting in delays, shortages — and much higher prices. Inflation surged last year to heights not seen since the early 1980s.

In response, the Fed began jacking up its benchmark short-term rate in March 2022. Since then, it’s raised its key rate 10 times. Higher borrowing costs have had the intended effect of slowing the economy and price acceleration. From a year-over-year peak of 9.1% in June 2022, consumer price inflation fell to 4% in May. Yet that’s still twice the Fed’s 2% target. So the central bank has signaled that more rate hike are likely this year.

At the same time, the government has been phasing out pandemic relief. Extended unemployment aid ended in September 2021. An expansion of the food stamps program ended this year.

The savings that Americans had socked away beginning at the peak of the pandemic — when they were receiving government relief checks and saving money while hunkered down at home — are evaporating. Fed researchers have reported that any “excess’’ pandemic savings probably dried up in the first three months of 2023.

Despite everything, the economy has proved surprisingly durable. The government last week sharply upgraded its estimate of January-through-March economic growth to a 2% annual rate and said consumers were spending at their fastest pace in nearly two years. Factor in a still-robust job market — employers keep hiring briskly, and unemployment, at 3.7%, is barely above a half-century low — and the economy has repeatedly outrun predictions, first sounded more than a year ago, that a recession was inevitable.

“The economy has really powered through it,’’ Bivens said. “So what is the straw that breaks the camel’s back? My guess is it’s not this. I don’t think it’s a big-enough thing.’’

Still, Bivens said, he worries about the Fed rate hikes and federal cutbacks, including the end of the student loan payment moratorium, “throwing more contractionary shocks’’ at an American economy that has defied the doubters — at least for now.

___

AP Retail Writer Anne D'Innocenzio contributed to this report from New York.

I think you could do things like freeze interest or tie it to the discount rate and that would be very helpful. But waiving student loan debt is a benefit to the class of Americans most likely to have high incomes. It's regressive in nature, in my opinion, not progressive.

It's something that a bunch of people are going through and on the outside it doesn't make sense but when you know so many people that are going through this it makes more sense.

Read about the people it is effecting. The debt is actually crippling their efforts to grow financially. When you pay into something for years and the amount owed doesn't move that is predatory lending. It's leeches sucking people dry.

Also, I do think the fed could link the interest to the discount rate, which is currently 5.25% for the grad students. But that has been like 1% for the last decade, up until the rate hikes over the last year+0 -

dont' get frustrated. That's why we debate. What do you mean I'm not going to get it? It's not like it's a complicated argument. It's about perspective. Do Americans have a right to a home? Does a person that's gainfully employed deserve a significant debt reduction and a poor person in Baltimore doesn't? That's the question for me. Why do the bad choices by college grads deserve a break when bad choices (or disadvantage) don't?tempo_n_groove said:

Most of these people can't afford homes. Why? Because of the ton of student debt...mrussel1 said:

I guess it depends on your definition of everyday workers. I think of non college grads as an everyday worker, not necessarily white collar professionals. But that distinction doesn't really matter in the grand scheme of the discussion. I'm not saying they aren't drowning in debt. I'm sure they are. But that was driven by bad decisions and they are still the most likely to be gainfully employed. I would much prefer equity programs that help the disadvantaged. I don't consider someone employed, with a home, as disadvantaged.The Juggler said:

I don't know man. I just disagreed with your original point that they're not "everyday workers." Everyone of them I talk to owns a house and most are drowning in debt and do not make over 200k/year. I suspect I will be starting to include their student loans in their cashout refi applications in the near future when they have to start paying them back again.mrussel1 said:

But are these people poor, or are they just not advancing at the rate they expected, economically? In other words, is the problem that they can't buy a house, have kids? Or are they literally moving into section 8 housing like the real poor people in this country? My guess is the latter. But their perspective is different. Because they were educated enough to know to go to college and take loans (and needed full tuition, not reduced like a real disadvantaged person would receive), I'm guessing most came from middle to upper middle class families. So what they expect out of life is very different than what someone growing up in East Baltimore or Camden expects. I don't have data to back up these statements, but I do know that colleges have funds for the truly disadvantaged and are generous with them.The Juggler said:Not saying they made correct choices. I am just saying there are likely millions of regular people (not just mostly grad students making 200k plus) drowning in debt while their student loans have been in deferment. Toss in an extra few hundred dollars a month for those loan payments and they're going to be in even worse shape.

You're not going to get it so I'll move along.0 -

I guess we agree. That was my main point. Things are going to get a lot tougher for them once they have start paying again.mrussel1 said:

I guess it depends on your definition of everyday workers. I think of non college grads as an everyday worker, not necessarily white collar professionals. But that distinction doesn't really matter in the grand scheme of the discussion. I'm not saying they aren't drowning in debt. I'm sure they are. But that was driven by bad decisions and they are still the most likely to be gainfully employed. I would much prefer equity programs that help the disadvantaged. I don't consider someone employed, with a home, as disadvantaged.The Juggler said:

I don't know man. I just disagreed with your original point that they're not "everyday workers." Everyone of them I talk to owns a house and most are drowning in debt and do not make over 200k/year. I suspect I will be starting to include their student loans in their cashout refi applications in the near future when they have to start paying them back again.mrussel1 said:

But are these people poor, or are they just not advancing at the rate they expected, economically? In other words, is the problem that they can't buy a house, have kids? Or are they literally moving into section 8 housing like the real poor people in this country? My guess is the latter. But their perspective is different. Because they were educated enough to know to go to college and take loans (and needed full tuition, not reduced like a real disadvantaged person would receive), I'm guessing most came from middle to upper middle class families. So what they expect out of life is very different than what someone growing up in East Baltimore or Camden expects. I don't have data to back up these statements, but I do know that colleges have funds for the truly disadvantaged and are generous with them.The Juggler said:Not saying they made correct choices. I am just saying there are likely millions of regular people (not just mostly grad students making 200k plus) drowning in debt while their student loans have been in deferment. Toss in an extra few hundred dollars a month for those loan payments and they're going to be in even worse shape.www.myspace.com0

Categories

- All Categories

- 149.2K Pearl Jam's Music and Activism

- 110.3K The Porch

- 288 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help