Stock market

Comments

-

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.hippiemom = goodness0 -

Unions and minimum wage are defined as class warfare? Just trying to confirm this

Rate hikes are basically the Fed's only weapon against inflation. Should see stocks take a hit as well, and people with any credit card debt will see it come their way, too.

Of note: we're not in a recession, at least not yet.0 -

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!0 -

A recession isn;t necessarily bad...but how low do you think it will go and how long will it last?mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!hippiemom = goodness0 -

Just to challenge you on this - why would you think it's time? If anything this is like worst case scenario right now. We needed the Fed to start hiking rates a loooonnnng time ago and now they're going to be in uncharted territory because of it. At least they're finally doing it. But unless they start hiking very high very soon, and very quickly, then there's no runway left to drop the rate when you're actually in a recession.mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!

Note: ironic, also, because we may go into a recession because of the rate hikes.

IMO I don't think there will be a recession though, but that's just me.Post edited by Jearlpam0925 on0 -

Why do you not think there will be a recession?Jearlpam0925 said:

Just to challenge you on this - why would you think it's time? If anything this is like worst case scenario right now. We needed the Fed to start hiking rates a loooonnnng time ago and now they're going to be in uncharted territory because of it. At least they're finally doing it. But unless they start hiking very high very soon, and very quickly, then there's no runway left to drop the rate when you're actually in a recession.mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!

IMO I don't think there will be a recession though, but that's just me.hippiemom = goodness0 -

I love the dropping of accusations or is it claims or maybe "statements," and when asked for details or facts to back said accusations, claims, or statements, its crickets. But the buzz words sure are plentiful. Or maybe thoughts haven't been thought through?

And damn do I not want to "assume" what anyone "means" around these here parts.09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Well I'm not sure I can predict those, but I think unemployment creeping to 5.5% would not be a bad thing. It is extraordinarily difficult to hire right now, I can tell you that. We hire people and they never show. I've never seen anything like this in 25 years.cincybearcat said:

A recession isn;t necessarily bad...but how low do you think it will go and how long will it last?mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!

The market is in bear territory now, so we're there. I think the Fed can manage the landing softly. Between quantitative easing, interest rates and other monetary tools, I think they can manage a recession better than inflation.0 -

I edited my response above, but I just don't see it. Though I could see the very tool to fight inflation to end up causing a recession. If Covid blows up again massively then I think there will be a recession, or if Russia plans to go to war with the world and China goes after Taiwan, that kind of stuff. But outside of that, the labor market is too hot, all the fundamentals that were pointing in the wrong direction last time (housing) are strong this time and not in that territory. I just don't see it. The only thing that could do is if things like credit card debt and student loans all of a sudden are so far out of swing that they bankrupt people. And at least I don't think that's currently the issue.cincybearcat said:

Why do you not think there will be a recession?Jearlpam0925 said:

Just to challenge you on this - why would you think it's time? If anything this is like worst case scenario right now. We needed the Fed to start hiking rates a loooonnnng time ago and now they're going to be in uncharted territory because of it. At least they're finally doing it. But unless they start hiking very high very soon, and very quickly, then there's no runway left to drop the rate when you're actually in a recession.mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!

IMO I don't think there will be a recession though, but that's just me.

And I think once China gets humming again with shipping, since edit: sorry Shaghai opened back up, that's a plus.Post edited by Jearlpam0925 on0 -

I can tell you affirmatively that banks are increasing reserves and preparing for higher delinquencies and faster roll rates. Higher interest rates are coming thru the LIBOR and prime + terms.Jearlpam0925 said:

I edited my response above, but I just don't see it. Though I could see the very tool to fight inflation to end up causing a recession. If Covid blows up again massively then I think there will be a recession, or if Russia plans to go to war with the world and China goes after Taiwan, that kind of stuff. But outside of that, the labor market is too hot, all the fundamentals that were pointing in the wrong direction last time (housing) are strong this time and not in that territory. I just don't see it. The only thing that could do is if things like credit card debt and student loans all of a sudden are so far out of swing that they bankrupt people. And at least I don't think that's currently the issue.cincybearcat said:

Why do you not think there will be a recession?Jearlpam0925 said:

Just to challenge you on this - why would you think it's time? If anything this is like worst case scenario right now. We needed the Fed to start hiking rates a loooonnnng time ago and now they're going to be in uncharted territory because of it. At least they're finally doing it. But unless they start hiking very high very soon, and very quickly, then there's no runway left to drop the rate when you're actually in a recession.mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!

IMO I don't think there will be a recession though, but that's just me.

And I think once China gets humming again with shipping, since edit: sorry Shaghai opened back up, that's a plus.

I think we're a lock for a technical recession. How painful it will be is TBD. And you're right, the tool of 3/4 pt is such a blunt instrument, I think it will cause a recession.0 -

YesJearlpam0925 said:

I'd say the board definitely falls under the realm of social media. And if your perception is what's said here then I'd say that's even much more narrowed and myopic than one would even get on many platforms. And, man, I can't think of anything more direct than addressing you by name. Shall I DM you next time?nicknyr15 said:

I’m not on social media. I’d appreciate if you’d keep me out of your posts or address me directly.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

and it couldn’t be more indirect. Unless you @ me or dm then there’s a chance I’ll never see it.Post edited by nicknyr15 on0 -

So I hear you on the job market but with things getting more expensive people have to tighten their belts and less gets spent, less things get bought, less things get built, companies make less than expected and start laying off. The spiral begins...Jearlpam0925 said:

I edited my response above, but I just don't see it. Though I could see the very tool to fight inflation to end up causing a recession. If Covid blows up again massively then I think there will be a recession, or if Russia plans to go to war with the world and China goes after Taiwan, that kind of stuff. But outside of that, the labor market is too hot, all the fundamentals that were pointing in the wrong direction last time (housing) are strong this time and not in that territory. I just don't see it. The only thing that could do is if things like credit card debt and student loans all of a sudden are so far out of swing that they bankrupt people. And at least I don't think that's currently the issue.cincybearcat said:

Why do you not think there will be a recession?Jearlpam0925 said:

Just to challenge you on this - why would you think it's time? If anything this is like worst case scenario right now. We needed the Fed to start hiking rates a loooonnnng time ago and now they're going to be in uncharted territory because of it. At least they're finally doing it. But unless they start hiking very high very soon, and very quickly, then there's no runway left to drop the rate when you're actually in a recession.mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!

IMO I don't think there will be a recession though, but that's just me.

And I think once China gets humming again with shipping, since edit: sorry Shaghai opened back up, that's a plus.0 -

In a hot job market wages should be increasing. Also, that's what the Fed rate hike is for - to tamp down inflation by tamping down demand. And also this is predicated on my opinion that inflation is a short-term problem, which I believe it is. So, technically, I can very well see a recession happening but nothing close to what we've seen the past 2 or 3 times. Again, I preface all of that goes out the window if war or Covid heats up.tempo_n_groove said:

So I hear you on the job market but with things getting more expensive people have to tighten their belts and less gets spent, less things get bought, less things get built, companies make less than expected and start laying off. The spiral begins...Jearlpam0925 said:

I edited my response above, but I just don't see it. Though I could see the very tool to fight inflation to end up causing a recession. If Covid blows up again massively then I think there will be a recession, or if Russia plans to go to war with the world and China goes after Taiwan, that kind of stuff. But outside of that, the labor market is too hot, all the fundamentals that were pointing in the wrong direction last time (housing) are strong this time and not in that territory. I just don't see it. The only thing that could do is if things like credit card debt and student loans all of a sudden are so far out of swing that they bankrupt people. And at least I don't think that's currently the issue.cincybearcat said:

Why do you not think there will be a recession?Jearlpam0925 said:

Just to challenge you on this - why would you think it's time? If anything this is like worst case scenario right now. We needed the Fed to start hiking rates a loooonnnng time ago and now they're going to be in uncharted territory because of it. At least they're finally doing it. But unless they start hiking very high very soon, and very quickly, then there's no runway left to drop the rate when you're actually in a recession.mrussel1 said:

Bring on the recession. It's time.cincybearcat said:

Well I mean it fits the definition...but it's cuter to just say stuff like "I mean if you said so so it must be true".Jearlpam0925 said:

I mean you said so so it must be true. I know they've been trying to increase minimum wage, very much class warfare I guess. I saw ol Joe tweeted about unions today and the minimum wage. Is that the class warfare you're referring?cincybearcat said:

It's become the Dems platform. Surprised you didn't know that already.Jearlpam0925 said:

OK more than anything I'm here for the class warfare and I'm still shocked to hear he's the one carrying it out. Good ol' middle of the road Joe is now a leading revolutionary of class warfare. Again, news to me.cincybearcat said:

Yup and he is tweeting about it all day today again. He is nothing but a politician, always looking who else to blame for their issues. Joe was never the solution to our real problems, he is part of it. Just was a solution to the bat shit crazy GOP of today.Jearlpam0925 said:T what? Biden wants a class war? That's news to me!

Also, if our boy nicky got out of his social media hole they'd see that - surprisingly, if you can believe this - inflation isn't just happening in the United States. But politics!

In more related news, Fed hike coming of 75 bp. That's a big deal.

And yes the rate hike is a huge deal. As I have been reading, many feel the fed has been acting too slow to avoid a recession from their now actions to curb inflation. They mentioned expecting another point over the course of the year. Seems like many think this will certainly curb inflation and just wondering how low and how long the recession it triggers goes/lasts.

Hey @EdsonNascimento remind me again what I think a recession is please!

IMO I don't think there will be a recession though, but that's just me.

And I think once China gets humming again with shipping, since edit: sorry Shaghai opened back up, that's a plus.0 -

I go to this guy a lot for overall feedback on what's going on, and this is what I was feeling and much better articulates my thoughts (he's threaded within the tweet):

"It is premature for the Fed to become resigned to a recession to get inflation back in the box."Post edited by Jearlpam0925 on0 -

Jearlpam0925 said:I go to this guy a lot for overall feedback on what's going on, and this is what I was feeling and much better articulates my thoughts (he's threaded within the tweet):

"It is premature for the Fed to become resigned to a recession to get inflation back in the box."mostly caused by Russia etc..umm what about the 2021 4q inflation?_____________________________________SIGNATURE________________________________________________

Not today Sir, Probably not tomorrow.............................................. bayfront arena st. pete '94

you're finally here and I'm a mess................................................... nationwide arena columbus '10

memories like fingerprints are slowly raising.................................... first niagara center buffalo '13

another man ..... moved by sleight of hand...................................... joe louis arena detroit '140 -

That thing called Covid that went especially wild in 2021.

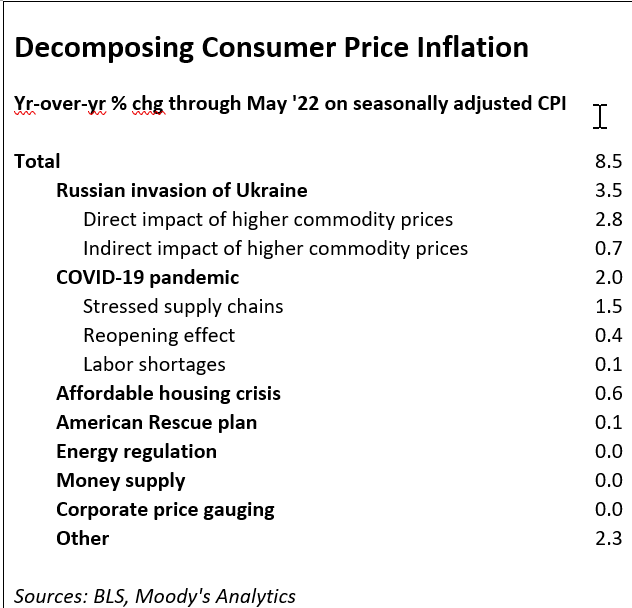

They also released this breakdown, which I mostly agree with:

0 -

lol that chart looks pretty sketchy. How did they arrive at those numbers. How do they know increased money supply didn't indirectly impact them. It looks more like a wishlist.. .lol.In regards to the 75bps increase. Isn't anything below a 2% overnight rate considered expansionary? Ergo if you don't want to be pour gas on a hot fire, you need to at least get it over 2% so it's neutral, and no longer expansionary?I think it's also going to be hard. I'm not going to feel the brunt of those interest rate increases for about 3.5 years when my mortgage comes up for renewal. Lots of other people are in similar boats. The US (I wish we had this here) even has 30 year mortgages where the rate is locked in the whole time, so all the people on those would be uneffected by rates.IE I think it takes a while to see the impact of increased rates because only a percentage of the population is in variable rate mortgages... it takes years to see the impact on fixed mortgages. Ergo having people spend more money on debt, and less on goods, to quiet down economy probably isn't going to be seen much at the short intervals between fed/boc meetings?0

-

Their stuff is subscription-based so I'm not paying for it atm. But you could also dig up BLS data if you wish.

Are you one of those "printing money is stupid" people that thinks it causes, or is one of the greatest causes, of inflation? Because this has been disproven time and time again, look into papers re: velocity of money.

No quarter over quarter rate hike has been over 2%, at least not in a long long time. That is a shock to the system. You go from calming demand with the effect of lowering the rate of inflation increases, to antagonizing - and basically wanting to cause - a recession.

I contend they should have raised rates much quicker coming out of the prior recession (like between 2012 and 2017). And that Trump shgould have never directed the Fed to drop the rate in 2018.

And we're talking about the US-strictly here. Most people in this country do have 30, or 15, year mortgages. Not sure how your country works, but I first assumed that you did live here and when you said you mortgage is up for renewal you were talking about an ARM mortgage. Which, for those people especially, it will be very very bad. Those mortgages started to bubble up again but are no where near where they were ala 2007. But for those people it will be bad. People here really took advantage of extremely low mortgage rates within the past couple years and re-fi'ed their mortgages.

My main concern is personal debt, followed by housing. It looks like people overall have been flush with savings during this expansion (which is weird in itself to say we've been in during a global pandemic), but those are now starting to be tapped into. And with the Fed going with such a large increase so quickly that is going to affect the banks and credit card companies, which will then in turn affect the people with that debt. That and student loans, or any debt with a variable rate, is my greatest concern.

Then housing supply is already historically scarce and only getting worse. And now, yes, housing prices SHOULD come down with higher rates, but with supply so low I'm not sure if that's actually going to happen. Plus getting that mortgage will only cost more now. Those are my longer-term concerns.Post edited by Jearlpam0925 on0 -

I like Zandi a lot. When I worked for a large Corp, he would come and advise us on macro issues which would drive our loss forecasting strategies. Very smart and easy to understand.Jearlpam0925 said:I go to this guy a lot for overall feedback on what's going on, and this is what I was feeling and much better articulates my thoughts (he's threaded within the tweet):

"It is premature for the Fed to become resigned to a recession to get inflation back in the box."

I am resigned to a recession, but it doesn't need to be steep. He certainly could be right that a half point was enough.

0 -

Jearlpam0925 said:Their stuff is subscription-based so I'm not paying for it atm. But you could also dig up BLS data if you wish.

Are you one of those "printing money is stupid" people that thinks it causes, or is one of the greatest causes, of inflation? Because this has been disproven time and time again, look into papers re: velocity of money.

No quarter over quarter rate hike has been over 2%, at least not in a long long time. That is a shock to the system. You go from calming demand with the effect of lowering the rate of inflation increases, to antagonizing - and basically wanting to cause - a recession.

I contend they should have raised rates much quicker coming out of the prior recession (like between 2012 and 2017). And that Trump shgould have never directed the Fed to drop the rate in 2018.

And we're talking about the US-strictly here. Most people in this country do have 30, or 15, year mortgages. Not sure how your country works, but I first assumed that you did live here and when you said you mortgage is up for renewal you were talking about an ARM mortgage. Which, for those people especially, it will be very very bad. Those mortgages started to bubble up again but are no where near where they were ala 2007. But for those people it will be bad. People here really took advantage of extremely low mortgage rates within the past couple years and re-fi'ed their mortgages.

My main concern is personal debt, followed by housing. It looks like people overall have been flush with savings during this expansion (which is weird in itself to say we've been in during a global pandemic), but those are now starting to be tapped into. And with the Fed going with such a large increase so quickly that is going to affect the banks and credit card companies, which will then in turn affect the people with that debt. That and student loans, or any debt with a variable rate, is my greatest concern.

Then housing supply is already historically scarce and only getting worse. And now, yes, housing prices SHOULD come down with higher rates, but with supply so low I'm not sure if that's actually going to happen. Plus getting that mortgage will only cost more now. Those are my longer-term concerns.Yah here in Canada we don't really get mortgages the length of a mortgage. The common practice is to renew 5 years a time, so whatever you chose, variable or fixed, really only makes a difference until the next time we renew.The advantage (I suppose because of less risk to the banks when it resets every 5 years) is I believe our rates are a bit lower than the US, but the drawback is your exposed to interest rate increases when you renew. So up here where everyone has a 5 year mortgage, anyone who has a fixed rate mortgage will feel the pain as they renew over the next 4 to 5 years.It's definitely a shame you can't get 30 years mortgages here. It would completely remove the risk of people defaulting on their homes if there was no risk of the payments ever going up from where you started.0

Categories

- All Categories

- 149.2K Pearl Jam's Music and Activism

- 110.3K The Porch

- 286 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help