Why do people buy crap?

Comments

-

I love doing things and I love collecting things.0

-

gee, thanks.rgambs said:I don't shop, shopping as entertainment is just sad. Trying to fill the holes in your life by buying shit you don't even care about, convincing yourself you do care, its just pathetic.

Instead of going to buy something, GO DO SOMETHING!

Your boos mean nothing to me, for I have seen what makes you cheer0 -

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

Your boos mean nothing to me, for I have seen what makes you cheer0 -

Squirrels and pack rats!!!HughFreakingDillon said:

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

0 -

What really gets me is when all that is available (locally at least) is crap. I get leg cramps at night (old man shit-that-happens) and was told a heating pad helps. So I went out and bought one and the only brand I could find is Sunbeam but that's OK because Sunbean is a good brand, right? NO! It's a PIECE...OF...CRAP!!"It's a sad and beautiful world"-Roberto Benigni0

-

Did that few years ago and stopped.PJfanwillneverleave1 said:It's a strange feeling looking at your Pearl Jam collection of sort throughout the years and wonder do I really need this?

10-18-2000 Houston, 04-06-2003 Houston, 6-25-2003 Toronto, 10-8-2004 Kissimmee, 9-4-2005 Calgary, 12-3-05 Sao Paulo, 7-2-2006 Denver, 7-22-06 Gorge, 7-23-2006 Gorge, 9-13-2006 Bern, 6-22-2008 DC, 6-24-2008 MSG, 6-25-2008 MSG0 -

I'm thinking about putting on the breaks too.callen said:

Did that few years ago and stopped.PJfanwillneverleave1 said:It's a strange feeling looking at your Pearl Jam collection of sort throughout the years and wonder do I really need this?

0 -

I now collect just stickers and pins, and then posters of shows I go to. The stickers and pins don't take up much space and don't cost a lot for thr most part. Fun to trade.0

-

The comparison isn't valid imo. Human brains and squirrel brains are not equal. I mean personally, ive never met a pigeon with BPD, but no one's arguing that exists right?HughFreakingDillon said:

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

From what I've heard it's a coping mechanism. They hoard shit and hang on to everything as a distraction from some fucked up shit that happened to them, so like instead of grieving and moving on they fixate on some idea which somehow involves "rescuing" newspapers from the garbage. There's some kind of connection between hoarders being unable to throw anything out and the traumatic loss they experienced that triggered it.

I collect stickers and pins. What I've got now wouldn't even fill a shoebox. I've got a couple posters and t-shirts but i wouldn't call myself a collector.NYC 06/24/08-Auckland 11/27/09-Chch 11/29/09-Newark 05/18/10-Atlanta 09/22/12-Chicago 07/19/13-Brooklyn 10/18/13 & 10/19/13-Hartford 10/25/13-Baltimore 10/27/13-Auckland 1/17/14-GC 1/19/14-Melbourne 1/24/14-Sydney 1/26/14-Amsterdam 6/16/14 & 6/17/14-Milan 6/20/14-Berlin 6/26/14-Leeds 7/8/14-Milton Keynes 7/11/14-St. Louis 10/3/14-NYC 9/26/15

LIVEFOOTSTEPS.ORG/USER/?USR=4350 -

.for poetry through the ceiling. ISBN: 1 4241 8840 7

"Hear me, my chiefs!

I am tired; my heart is

sick and sad. From where

the sun stands I will fight

no more forever."

Chief Joseph - Nez Perce0 -

i know a few folks who have problems with spending money. it seems they can't stop. they don't buy junk, the stuff they buy is nice, it just never ends. it seems everyday is wide open for spending money.

boats, cars, trucks, off road vehicles, guns, stereos, tvs, other electronics, hunting trips all over the lands, stock piling food - 10 or 20 pounds of coffee at a time. a good idea if you're going to get snowed in some winter. i know a dude who has owned more than probably 500 cars. some vehicles he's owned for hrs & resold or traded them off. some folks are never content with a damn thing, this drives me absolutely fucking bananas

perpetually out of their damn minds in search of a deal

fuck thatPost edited by chadwick onfor poetry through the ceiling. ISBN: 1 4241 8840 7

"Hear me, my chiefs!

I am tired; my heart is

sick and sad. From where

the sun stands I will fight

no more forever."

Chief Joseph - Nez Perce0 -

Well you don't understand because you don't have the condition. People deal with emotions in different ways. My FIL was married to a lady that had a room dedicated to her doll...one of those dolls that looks real. The room had a crib, toys, the closet was filled with clothes. she changed its diaper. I whispered to Mr. RK ' she must have always wanted a girl' since she had 3 adult sons. She came back from changing the doll's diaper and said, "I always wamted a girl, now I have one and I don't have to watch it grow up and leave me". Kinda sad, but she isn't harming anybody.HughFreakingDillon said:

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

I realize it's not exactly like hoarders, but I get the emotional attachment to inanimate objects. Ever read the article about lab monkeys that live alone cages and when a fake stuffed monkey is put in the cage, the monkeys cling to and hug the fake monkey? I assume it's like that, the objects provide some sort of comfort.The joy of life comes from our encounters with new experiences, and hence there is no greater joy than to have an endlessly changing horizon, for each day to have a new and different sun.

- Christopher McCandless0 -

I wasn't trying to diminish the condition. I believe it's real; I was just (poorly) trying to articulate that I'm personally ignorant on how it works. that's all I meant.RKCNDY said:

Well you don't understand because you don't have the condition. People deal with emotions in different ways. My FIL was married to a lady that had a room dedicated to her doll...one of those dolls that looks real. The room had a crib, toys, the closet was filled with clothes. she changed its diaper. I whispered to Mr. RK ' she must have always wanted a girl' since she had 3 adult sons. She came back from changing the doll's diaper and said, "I always wamted a girl, now I have one and I don't have to watch it grow up and leave me". Kinda sad, but she isn't harming anybody.HughFreakingDillon said:

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

I realize it's not exactly like hoarders, but I get the emotional attachment to inanimate objects. Ever read the article about lab monkeys that live alone cages and when a fake stuffed monkey is put in the cage, the monkeys cling to and hug the fake monkey? I assume it's like that, the objects provide some sort of comfort.

Your boos mean nothing to me, for I have seen what makes you cheer0 -

I didn't make the squirrel comparison, Tempo did. Either way, what you say makes sense. I mean, in a small sense, I guess my buying shit on ebay was a coping mechanism, so it's really the same, just taken to the extreme.ldent42 said:

The comparison isn't valid imo. Human brains and squirrel brains are not equal. I mean personally, ive never met a pigeon with BPD, but no one's arguing that exists right?HughFreakingDillon said:

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

From what I've heard it's a coping mechanism. They hoard shit and hang on to everything as a distraction from some fucked up shit that happened to them, so like instead of grieving and moving on they fixate on some idea which somehow involves "rescuing" newspapers from the garbage. There's some kind of connection between hoarders being unable to throw anything out and the traumatic loss they experienced that triggered it.

I collect stickers and pins. What I've got now wouldn't even fill a shoebox. I've got a couple posters and t-shirts but i wouldn't call myself a collector.

Your boos mean nothing to me, for I have seen what makes you cheer0 -

I didn't quite catch the whole conversation but I heard someone mention today that there are something like 50 million (it was a huge number) Americans who could not, if need be, come up with $500 cash. Over spending a bit are we, fellow Americans??"It's a sad and beautiful world"-Roberto Benigni0

-

i saw that doll thing on an episode of SVU once. saddest fucking shit ever. Woman loses her baby and gets a doll made and she takes the doll to the park and shit like in a pram and everything. It's scary cuz you know shit like that happens IRL.RKCNDY said:

Well you don't understand because you don't have the condition. People deal with emotions in different ways. My FIL was married to a lady that had a room dedicated to her doll...one of those dolls that looks real. The room had a crib, toys, the closet was filled with clothes. she changed its diaper. I whispered to Mr. RK ' she must have always wanted a girl' since she had 3 adult sons. She came back from changing the doll's diaper and said, "I always wamted a girl, now I have one and I don't have to watch it grow up and leave me". Kinda sad, but she isn't harming anybody.HughFreakingDillon said:

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

I realize it's not exactly like hoarders, but I get the emotional attachment to inanimate objects. Ever read the article about lab monkeys that live alone cages and when a fake stuffed monkey is put in the cage, the monkeys cling to and hug the fake monkey? I assume it's like that, the objects provide some sort of comfort.NYC 06/24/08-Auckland 11/27/09-Chch 11/29/09-Newark 05/18/10-Atlanta 09/22/12-Chicago 07/19/13-Brooklyn 10/18/13 & 10/19/13-Hartford 10/25/13-Baltimore 10/27/13-Auckland 1/17/14-GC 1/19/14-Melbourne 1/24/14-Sydney 1/26/14-Amsterdam 6/16/14 & 6/17/14-Milan 6/20/14-Berlin 6/26/14-Leeds 7/8/14-Milton Keynes 7/11/14-St. Louis 10/3/14-NYC 9/26/15

LIVEFOOTSTEPS.ORG/USER/?USR=4350 -

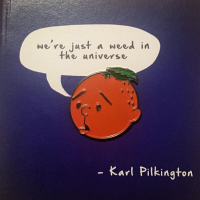

I would buy this

0

0 -

My sister and I have often thought about calling up A&E and getting our dad on that show. He's not nearly as bad as the folks I've seen on there, but he's definitely a hoarder. It's bad enough that I really don't like going to his house. And goodness, if I ever do get a girlfriend, I'm surely not taking her there.PJfanwillneverleave1 said:^^^

This is all good advice.

I regularly de-clutter, sometimes six months is too long.

Any dollar store stuff I buy only last a few days anyway so I am good there.

I enjoy throwing garbage out of the house.

HFD - To your earlier comment about not being able to watch the Hoarders show. It is very hard to watch because you can't believe that it is real. Once you watch one episode you will forever be scanning your home for shit to throw out, ha.Star Lake 00 / Pittsburgh 03 / State College 03 / Bristow 03 / Cleveland 06 / Camden II 06 / DC 08 / Pittsburgh 13 / Baltimore 13 / Charlottesville 13 / Cincinnati 14 / St. Paul 14 / Hampton 16 / Wrigley I 16 / Wrigley II 16 / Baltimore 20 / Camden 22 / Baltimore 24 / Raleigh I 25 / Raleigh II 25 / Pittsburgh I 250 -

Fair enough...thank you for clarifying.HughFreakingDillon said:

I wasn't trying to diminish the condition. I believe it's real; I was just (poorly) trying to articulate that I'm personally ignorant on how it works. that's all I meant.RKCNDY said:

Well you don't understand because you don't have the condition. People deal with emotions in different ways. My FIL was married to a lady that had a room dedicated to her doll...one of those dolls that looks real. The room had a crib, toys, the closet was filled with clothes. she changed its diaper. I whispered to Mr. RK ' she must have always wanted a girl' since she had 3 adult sons. She came back from changing the doll's diaper and said, "I always wamted a girl, now I have one and I don't have to watch it grow up and leave me". Kinda sad, but she isn't harming anybody.HughFreakingDillon said:

I don't get how it can be a psychological condition, when these things aren't real. I mean, how do I say this properly? how can humans have a condition in their brain that involves things that are outside of the natural world? do any other mammals hoard things?ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

I realize it's not exactly like hoarders, but I get the emotional attachment to inanimate objects. Ever read the article about lab monkeys that live alone cages and when a fake stuffed monkey is put in the cage, the monkeys cling to and hug the fake monkey? I assume it's like that, the objects provide some sort of comfort.The joy of life comes from our encounters with new experiences, and hence there is no greater joy than to have an endlessly changing horizon, for each day to have a new and different sun.

- Christopher McCandless0 -

I get most of it. I understand it's a psychological condition, and I get the whole thing behind not being able to control behaviour when it's a psychological condition or mental illness. I just don't get the refusal to clean anything part. That doesn't seem to have anything to do with a problem with attachment to what is hoarded or anything. I don't understand the connection between hoarding and complete filth and a refusal to wipe a counter or clear a cobweb, yet it seems to be so common with severe hoarders.ldent42 said:I mean it's a psychological condition. I'm not so sure why that's hard to understand, but then again I have seen the show.

Post edited by PJ_Soul onWith all its sham, drudgery, and broken dreams, it is still a beautiful world. Be careful. Strive to be happy. ~ Desiderata0

Categories

- All Categories

- 149.2K Pearl Jam's Music and Activism

- 110.3K The Porch

- 287 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help