Mayor Elect Zohran Mamdani and NYC

All in one place. Hopes, fears, scary stories, whatever related to the Bus Driver, Mayor-Elect, Zohran Mamdani and NYC.

Libtardaplorable©. And proud of it.

Brilliantati©

Comments

-

ew boy,

here we go..."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.gimmesometruth27 said:ew boy,

here we go...

Well, the "ew, boy" was spread over three or four threads, I believe, with one being closed for some reason. Better to keep it all in one thread. Let the melt down continue.09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

I overheard a woman at the hospital yesterday saying to my manager “ come spring we are putting our house up for sale I asked where do you live? Queens we are getting out because of the new Mayor, I said I’ll keep you in mind once my house values goes up I’ll sell you mine 👋jesus greets me looks just like me ....0

-

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

MOVED OR COPIED FROM THE ELON MUSK THREAD

Since we were discussing taxes, I figured you’d understand it was individual taxpayers/filers and not “individuals”. In 2022, there were 59,387 adult tax filers earning between $1M+ to $10M+.

Suggestion, stop using AI to form your opinion. Facts matter. Fact: The Bus Driver proposes a 2% additional tax on individual tax filers earning $1M+, per $M. Someone earning $1M pays an additional $20K. Someone earning $10M pays an additional $200K. How are either of those amounts $117K? Talk about “Simple logic. Start there.”

In 2022, there were 3,610 adults earning $10M+. Your simple math of dividing $4B by 34,000 to arrive at an impact is just that, simple. And lazy. How’s that US education system working for you?

To your paragraph that I bolded below regarding millionaires in NYC, further bunk and fuzzy maths. My AI tells me, “there are 390,000 millionaires in NYC, an increase of 45% from the decade prior”. Care to source the bunk numbers in the paragraph of yours I bolded?

Why so shrill?

Halifax2TheMax said:* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

The bold is bunk. You don't divide the $4B by number of households over $1M. Fuzzy maths. Again.

Without my abacus, it appears that you assume all 34,000 NY'ers that earn a million or more and will be taxed by raising the NYC income tax rate by 2%, earn $1M and not more, that there's not some percentage/number of NY'ers earning $2M, $5M, $10M, $20M, or $30M+ and some number in-between those amounts. 2% of $1M is $20K. Based on 2022 data, $3,045,440,000 could be raised by increasing the NYC tax rate by 2% and applying it to those earning $1M-$10M+ (33,765 individuals earning $1M+). So, I believe $4B is a realistic number given the 2022 data is 3 years old and the Bus Driver is working with newer data. 34,000 households do not an individual make, as some households probably have more than one individual that earns in that $1M-$10M+ range.

If they put $100,000 of their after tax income in the stock market and earn 8%, they can earn $8K of the tax charge back and forgo Starbucks and Dunkin' another $1,820 a year. How will they ever go on and NYC survive?

As for corporate taxes, CCOOTWH lowered corporate tax rates from 35% to 21%, a 14% decline. The Bus Driver wants to increase it 4.25% to 11.5%, same as Jeresy's and more in line with all neighboring states. That still leaves a net gain from CCOOTWH's tax cut of 9.75%. How will corporations ever survive and continue? Surely NYC will collapse as it did when the corporate rates were 10%-12% during the Ford fall down go boom years to the 1990's. But you knew that, eh?

I'm creating a Mamdani thread to keep it all in one place.

i said what you bolded, PER TAXPAYER. You changed that to per individual. That’s changing the meaning of what I said, and then you added some word salad almost completely devoid of meaning, with a range of various income levels meant to make a simple point appear confusing. So that could be a husband and wife. I’m sure they see their finances separately, I guess was your point?? . It’s almost impossible to comprehend the meaning of this, unless you think the children count separately. I’m saying per taxpayer simply because that’s the factual data available, not the income word salad you provided only to deceive.Zohran said he is raising $4 billion from one percent of personal taxpayers, that comes out to $117k per, despite whatever word salad you come up with to obfuscate the truth.

that does not count the $5 billion increase to corporate taxes he is proposing, which could impact the same wealthy individuals. That’s five million dollars per business. Or they can easily pass that along to their customers or employees, defeating the purpose of his agenda.

and that does not include the additional $50 billion increase to the city’s debt he is proposing, which will more than triple the debt service costs of the city. Citing trumps tax cuts is even more dishonesty, because NY needs to be competitive with other states to keep jobs and business, and these proposals will bring NYC corp taxes at triple the national average, and one third higher than NJ, despite his lies about them being the same, because of the tiny fact he ignored that city corps also pay state rates. If it’s a great movement, why is there so much lying?

from 2010 to 2022 NYC lost one third of its millionaires, and somehow the extreme left believe this will not continue nor accelerate.If You really want to continue to debate this, take one fact at a time. His baseline argument is it will not impact that many which literally means the impact is huge on a per taxpayer basis, so only a few leave and it all falls apart. That’s simple logic. Start there.09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

As it relates to “millionaires fleeing NYC”. Cue up the Aerosmith.

https://www.instagram.com/reel/DQxQUHokkNZ/?igsh=MTI3c2VrZWkzbDIzcg==09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Hal my pal, you made a huge mistake here, and explains why I could not comprehend your earlier points.

” there are 390,000 millionaires in NYC”

that’s true but false in this specific context. The tax plan levies taxpayers who “earn over one million dollars a year.” That’s why the relevant number of taxpayers is about 35k or 1% of nyc individual taxpayers (ZM promise) which is easy to google. $4B/35,000 = $120,000 per approx. and there are other ways to prove this #, and as stated many times, it doesn’t include the cost of debt service or corp taxes, both items zm has not been up front about.

Yes, I know there is a NYT article claiming a short term trend of increases in millionaires (not income millionaires that’s applicable here), but short term trends are more defined like events such as Covid. That’s why the long term trend made an impact in my reading. Plus in the data presented, millionaires were not targeted like they are by ZM, giving folks a huge incentive to leave, which is my point, and is clear once we possibly in the future examine the very high income taxpayers that will be funding a huge part of these programs. That’s where ZMs logic starts to fail spectacularly.

Next I will need to beg your forgiveness, as I left out the word “share.” The point of the quote remains NYC will be less competitive keeping and attracting millionaires. It’s from CBCNY, a proclaimed nonpartisan think tank whose purpose is city finances.“New York’s share of the nation’s millionaires fell from 12.7% in 2010 to 8.7% in 2022;”

That’s a 33% drop over twelve years, demonstrating NYCs success and competitiveness on a long term basis. The fact it’s over 12 years is a big deal.and you know this portion of your argument is silly, as it’s all happened before, well before PJ got started but around the time that great band from your country began.Social programs costing more and tax increases higher than promised, hiding budget deficits and misleading accounting leading to the city budget imploding. It all happened before in NYC but his voters did not study their history closely enough.0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.Lerxst1992 said:Hal my pal, you made a huge mistake here, and explains why I could not comprehend your earlier points.

” there are 390,000 millionaires in NYC”

that’s true but false in this specific context. The tax plan levies taxpayers who “earn over one million dollars a year.” That’s why the relevant number of taxpayers is about 35k or 1% of nyc individual taxpayers (ZM promise) which is easy to google. $4B/35,000 = $120,000 per approx. and there are other ways to prove this #, and as stated many times, it doesn’t include the cost of debt service or corp taxes, both items zm has not been up front about.

Yes, I know there is a NYT article claiming a short term trend of increases in millionaires (not income millionaires that’s applicable here), but short term trends are more defined like events such as Covid. That’s why the long term trend made an impact in my reading. Plus in the data presented, millionaires were not targeted like they are by ZM, giving folks a huge incentive to leave, which is my point, and is clear once we possibly in the future examine the very high income taxpayers that will be funding a huge part of these programs. That’s where ZMs logic starts to fail spectacularly.

Next I will need to beg your forgiveness, as I left out the word “share.” The point of the quote remains NYC will be less competitive keeping and attracting millionaires. It’s from CBCNY, a proclaimed nonpartisan think tank whose purpose is city finances.“New York’s share of the nation’s millionaires fell from 12.7% in 2010 to 8.7% in 2022;”

That’s a 33% drop over twelve years, demonstrating NYCs success and competitiveness on a long term basis. The fact it’s over 12 years is a big deal.and you know this portion of your argument is silly, as it’s all happened before, well before PJ got started but around the time that great band from your country began.Social programs costing more and tax increases higher than promised, hiding budget deficits and misleading accounting leading to the city budget imploding. It all happened before in NYC but his voters did not study their history closely enough.

My numbers are from the New York City Independent Budget Office (NYCIBO) as they relate to individual adult tax filers earning $1M+ to $10M+, probably outdated as they're from 2022, and I stand by them. You're comparing the number of New York State millionaires with New York City millionaires. We've been told for 16 years that if you raise taxes in NY/NYC, the millionaire/billionaire class will leave. Total bullshit.

From your source that you cited (CBCNY):- Statewide growth: The number of millionaires in New York State nearly doubled from 2010 to 2022, from 35,802 to 69,780, notes CBCNY.

I looked up the tax rate in NYS/NYC/Fed for someone earning $25M+ and its a combined 14.776% and The Bus Driver wants to increase that 2%. That means the combined NYS/NYC tax rate is 16.776% resulting in a tax liability (without deductions, tax loop holes, etc, we can agree no one pays the full rate, right?) of $4,194,000. Add the Federal tax liability of 37% on the taxable amount of the $25M and they owe a combined Fed/NYS/NYC amount of $13,218,540, leaving them with $11,781,460. Again, we know ultra wealthy taxpayers don't pay the full rate of 37% due to loopholes/accounting/deductions, etc. How will they go on? How will they ever afford NYC? Guess they'll have to move out of the city or the state? Poor, poor things. We've heard this for 16 years from the right wing media and pundits. Someone who makes $1M and has to pay $20K more in taxes isn't leaving the city. And if they do? Maybe the rents will come down? For context, the average income in NYC is $41,482.

I chose the $25M threshold as an example because I found it interesting that NYS/NYC have a tax bracket for that amount which indicates that there are tax payers in that bracket in NYS/NYC, which further reinforces my contention of the $4B being raised by increasing the taxes on those making $1M+ to $10M+ and backed by the 2022 NYCIBO number of adult tax filers in those income ranges.

To my bold in your first paragraph, why is that there? It has no relevancy to the issue of a 2% tax increase on those earning $1M+. Talk about discussing "one topic at a time". Also, what relevance is NYS's share of millionaires, as a percentage, compared to other states as it relates to NYC? Is it possible that more millionaires were created in CA, Silicon Valley, Tejas with SpaceX, oil/gas, fracking or Flo Rida, where old folks go to retire? It doesn't mean they left NYS/NYC, just that more have been created in other places and there's a larger pool of millionaires nationwide.

Silly? Are you going back to the Ford fall down go boom administration for some veiled comparison of tax policy and it being the reason NYC collapsed, despite the tax history of both NYS/NYC raising the rates, dems and repubs both? Now, that's silly.

Your concern of budget deficits is a smoke screen considering what CCOOTWH's Big, Ugly Bill has done to deficits and debt. But you do you.

Trickle down works, the rich freely invest and create jobs and without them, society would collapse. But I'm getting on the bus.09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

If people will give the guy a chance, I think he will work out well. The voters are happy, that's for sure."It's a sad and beautiful world"-Roberto Benigni0

-

if millionaires want to leave, fuck em. let them fly themselves to texas. as long as we don't have to fucking pay for it."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

brianlux said:If people will give the guy a chance, I think he will work out well. The voters are happy, that's for sure.gimmesometruth27 said:if millionaires want to leave, fuck em. let them fly themselves to texas. as long as we don't have to fucking pay for it.Fuck em? We need them to pay for this. Why comment on a political forum if we ignore fundamental facts? MAGA left?Before I get back to numbers with H, my point is this has already happened, and the young voters who was the base of ZM support, did not do a good enough job learning from OUR history. Cuomo won with voters over 45.

when a locality targets very few individuals to fund massive programs, if just a few leave, it all falls apart and it’s obvious how risky these plans are. Maybe we can get Eric T to tariff Canada in 20 years to bail us out, because the modern R states will not help in any way shape or form, 0

0 -

Halifax2TheMax said:

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.Lerxst1992 said:Hal my pal, you made a huge mistake here, and explains why I could not comprehend your earlier points.

” there are 390,000 millionaires in NYC”

that’s true but false in this specific context. The tax plan levies taxpayers who “earn over one million dollars a year.” That’s why the relevant number of taxpayers is about 35k or 1% of nyc individual taxpayers (ZM promise) which is easy to google. $4B/35,000 = $120,000 per approx. and there are other ways to prove this #, and as stated many times, it doesn’t include the cost of debt service or corp taxes, both items zm has not been up front about.

Yes, I know there is a NYT article claiming a short term trend of increases in millionaires (not income millionaires that’s applicable here), but short term trends are more defined like events such as Covid. That’s why the long term trend made an impact in my reading. Plus in the data presented, millionaires were not targeted like they are by ZM, giving folks a huge incentive to leave, which is my point, and is clear once we possibly in the future examine the very high income taxpayers that will be funding a huge part of these programs. That’s where ZMs logic starts to fail spectacularly.

Next I will need to beg your forgiveness, as I left out the word “share.” The point of the quote remains NYC will be less competitive keeping and attracting millionaires. It’s from CBCNY, a proclaimed nonpartisan think tank whose purpose is city finances.“New York’s share of the nation’s millionaires fell from 12.7% in 2010 to 8.7% in 2022;”

That’s a 33% drop over twelve years, demonstrating NYCs success and competitiveness on a long term basis. The fact it’s over 12 years is a big deal.and you know this portion of your argument is silly, as it’s all happened before, well before PJ got started but around the time that great band from your country began.Social programs costing more and tax increases higher than promised, hiding budget deficits and misleading accounting leading to the city budget imploding. It all happened before in NYC but his voters did not study their history closely enough.

My numbers are from the New York City Independent Budget Office (NYCIBO) as they relate to individual adult tax filers earning $1M+ to $10M+, probably outdated as they're from 2022, and I stand by them. You're comparing the number of New York State millionaires with New York City millionaires. We've been told for 16 years that if you raise taxes in NY/NYC, the millionaire/billionaire class will leave. Total bullshit.

From your source that you cited (CBCNY):- Statewide growth: The number of millionaires in New York State nearly doubled from 2010 to 2022, from 35,802 to 69,780, notes CBCNY.

I looked up the tax rate in NYS/NYC/Fed for someone earning $25M+ and its a combined 14.776% and The Bus Driver wants to increase that 2%. That means the combined NYS/NYC tax rate is 16.776% resulting in a tax liability (without deductions, tax loop holes, etc, we can agree no one pays the full rate, right?) of $4,194,000. Add the Federal tax liability of 37% on the taxable amount of the $25M and they owe a combined Fed/NYS/NYC amount of $13,218,540, leaving them with $11,781,460. Again, we know ultra wealthy taxpayers don't pay the full rate of 37% due to loopholes/accounting/deductions, etc. How will they go on? How will they ever afford NYC? Guess they'll have to move out of the city or the state? Poor, poor things. We've heard this for 16 years from the right wing media and pundits. Someone who makes $1M and has to pay $20K more in taxes isn't leaving the city. And if they do? Maybe the rents will come down? For context, the average income in NYC is $41,482.

I chose the $25M threshold as an example because I found it interesting that NYS/NYC have a tax bracket for that amount which indicates that there are tax payers in that bracket in NYS/NYC, which further reinforces my contention of the $4B being raised by increasing the taxes on those making $1M+ to $10M+ and backed by the 2022 NYCIBO number of adult tax filers in those income ranges.

To my bold in your first paragraph, why is that there? It has no relevancy to the issue of a 2% tax increase on those earning $1M+. Talk about discussing "one topic at a time". Also, what relevance is NYS's share of millionaires, as a percentage, compared to other states as it relates to NYC? Is it possible that more millionaires were created in CA, Silicon Valley, Tejas with SpaceX, oil/gas, fracking or Flo Rida, where old folks go to retire? It doesn't mean they left NYS/NYC, just that more have been created in other places and there's a larger pool of millionaires nationwide.

Silly? Are you going back to the Ford fall down go boom administration for some veiled comparison of tax policy and it being the reason NYC collapsed, despite the tax history of both NYS/NYC raising the rates, dems and repubs both? Now, that's silly.

Your concern of budget deficits is a smoke screen considering what CCOOTWH's Big, Ugly Bill has done to deficits and debt. But you do you.

Trickle down works, the rich freely invest and create jobs and without them, society would collapse. But I'm getting on the bus.Hal, your comment is loaded with inaccuracies, please don’t make me dissect them one by one.

The math is simple. ZM own numbers indicate the individual tax raise of $4B will be funded by 1% of the @ 3.8M city taxpayers. Is he lying about this also? $4B charged to 38,000 taxpayers is about $120,000 per filer.

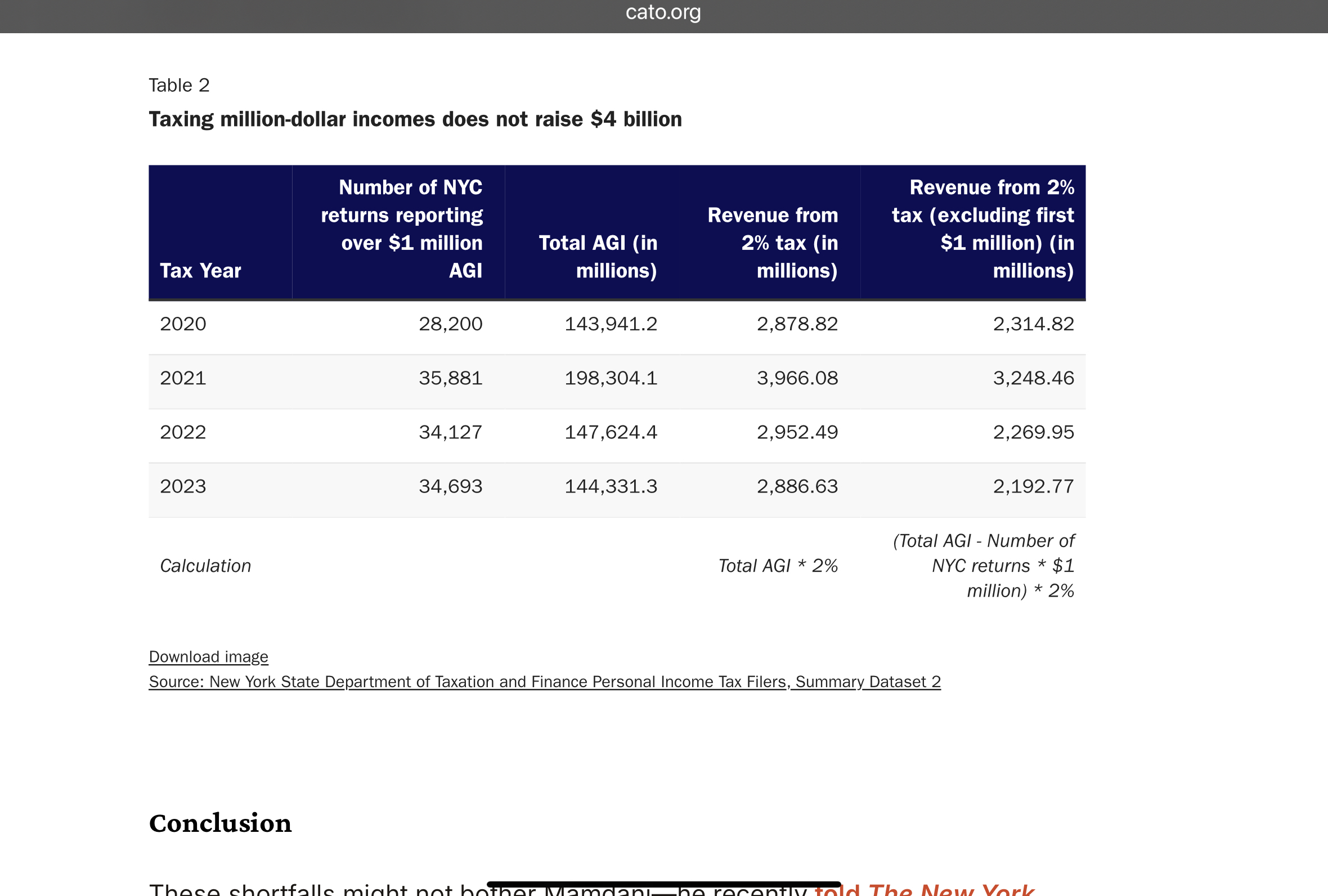

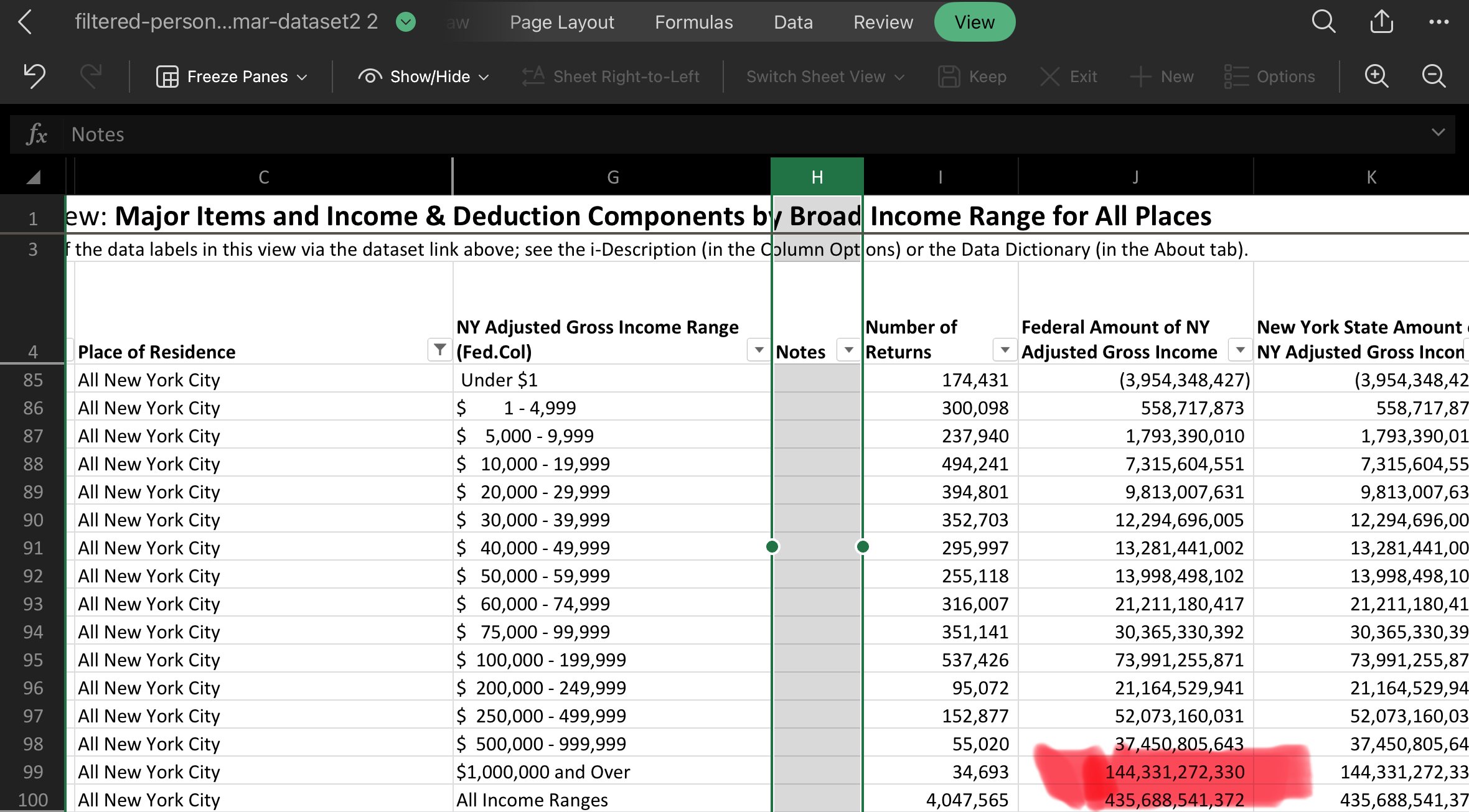

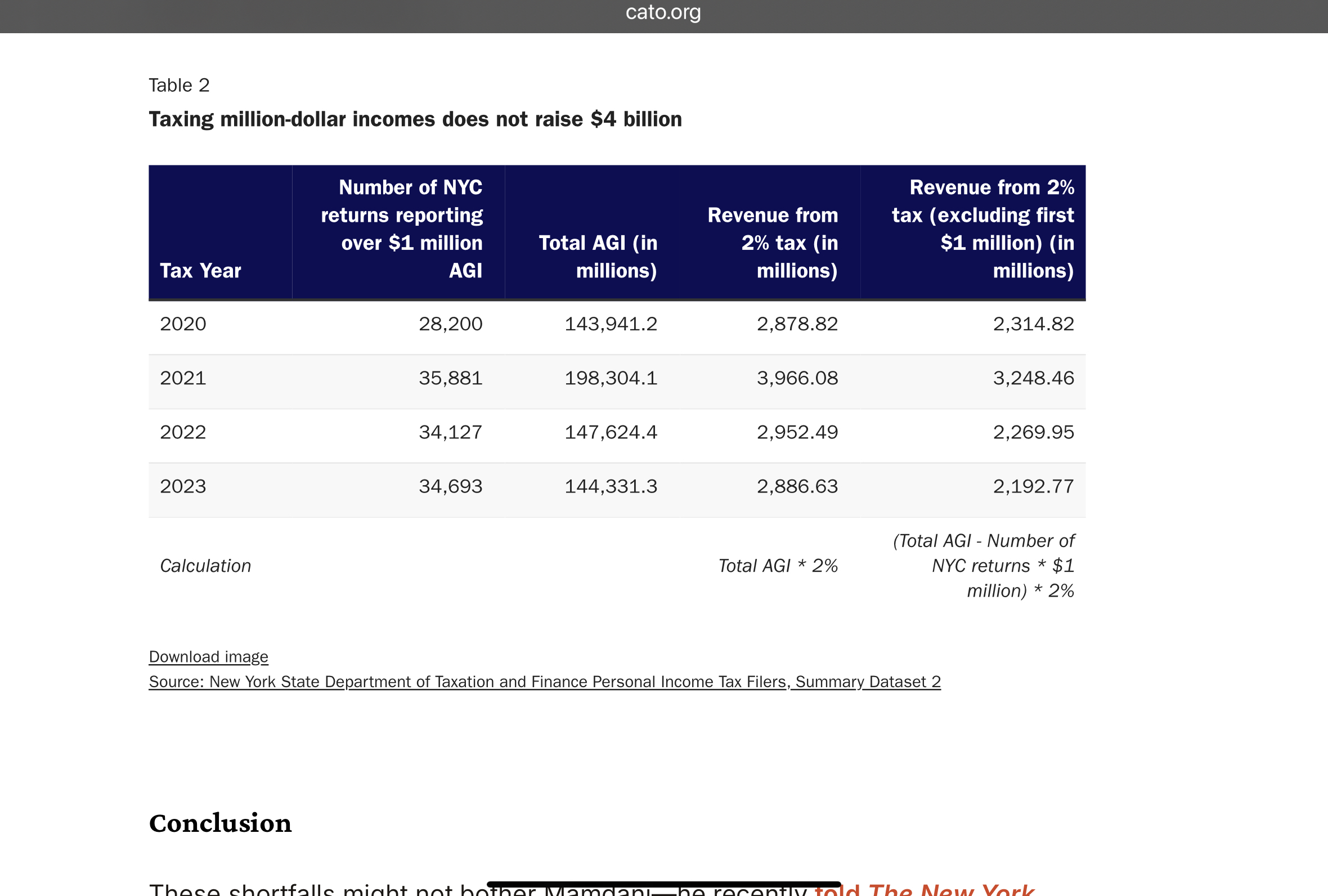

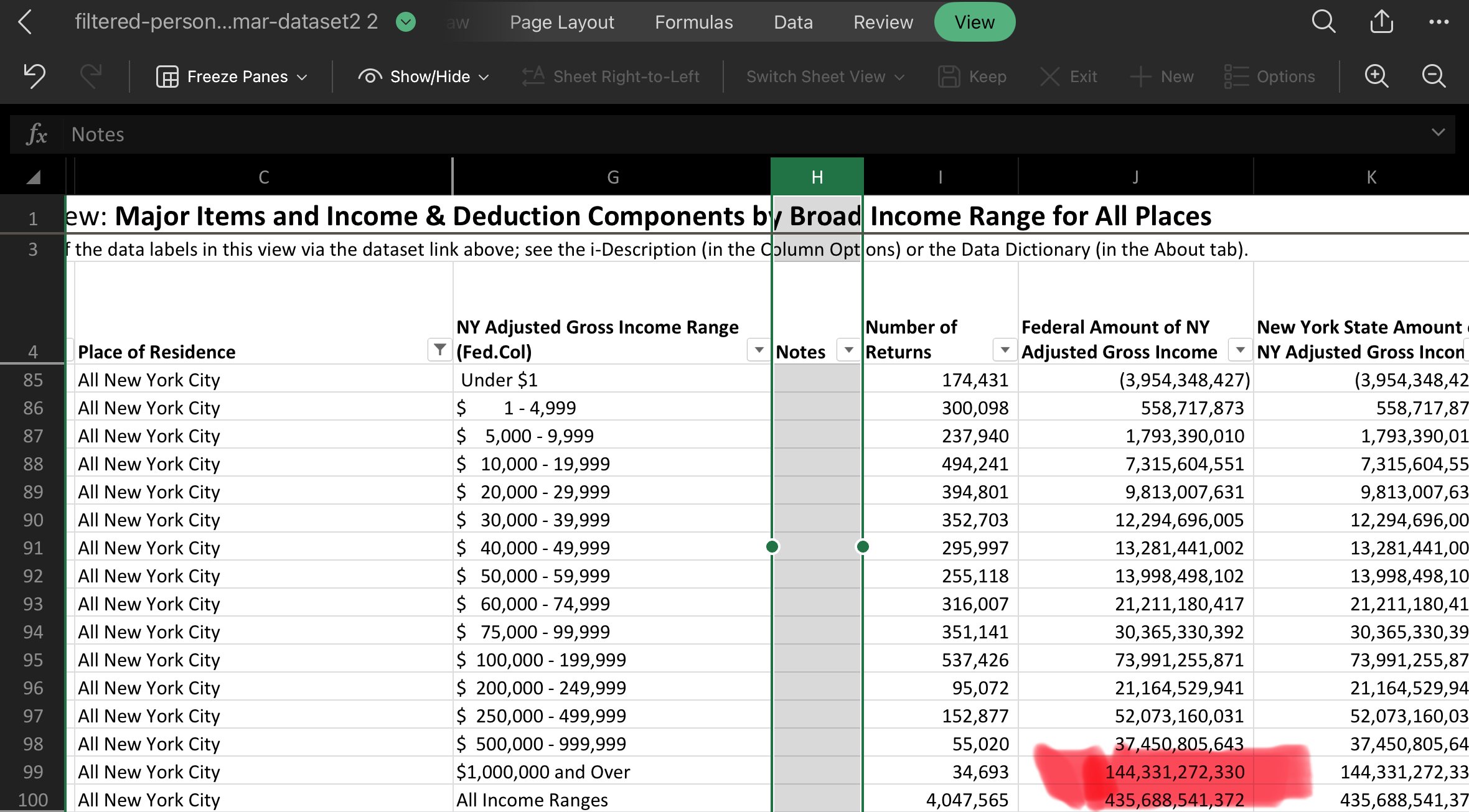

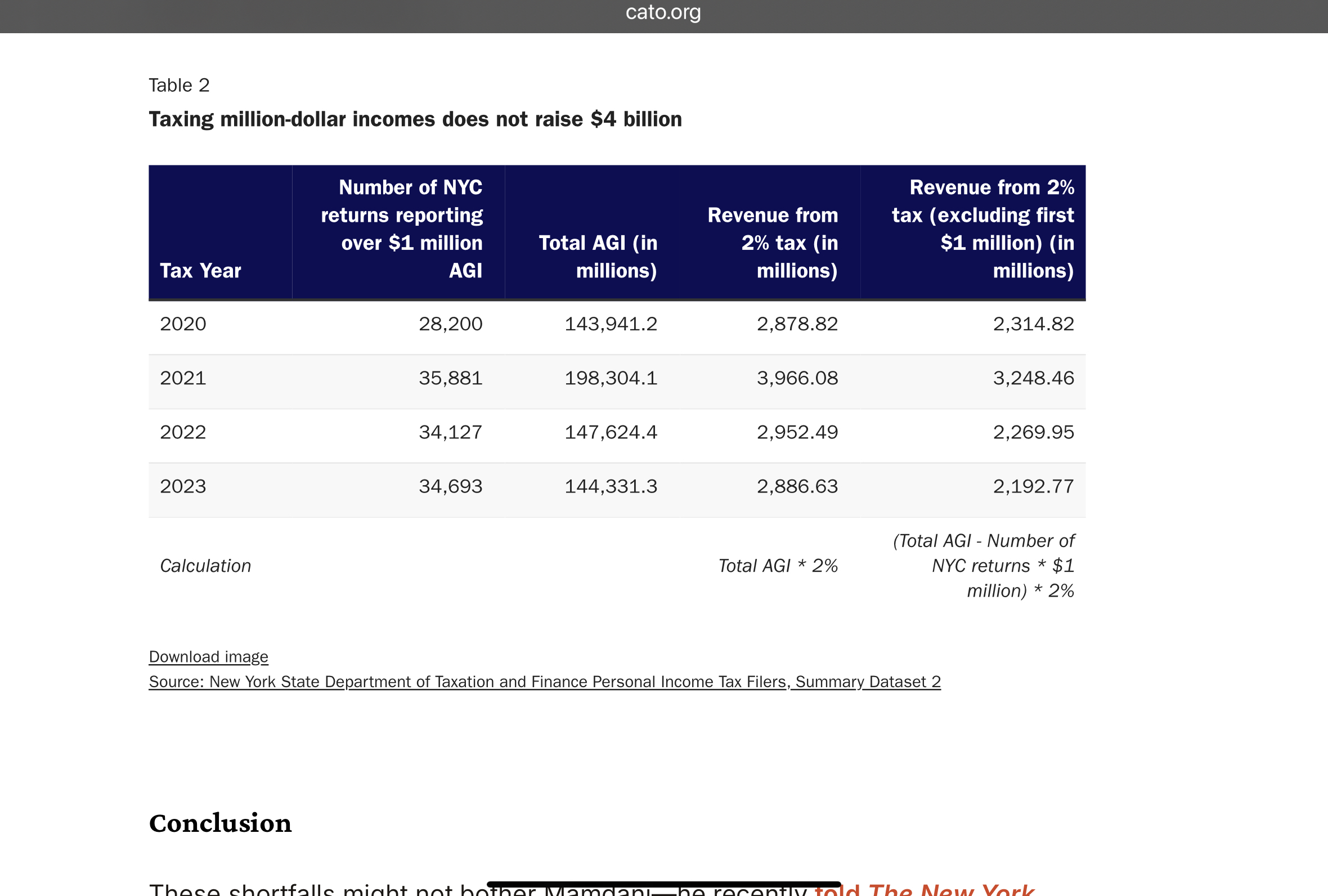

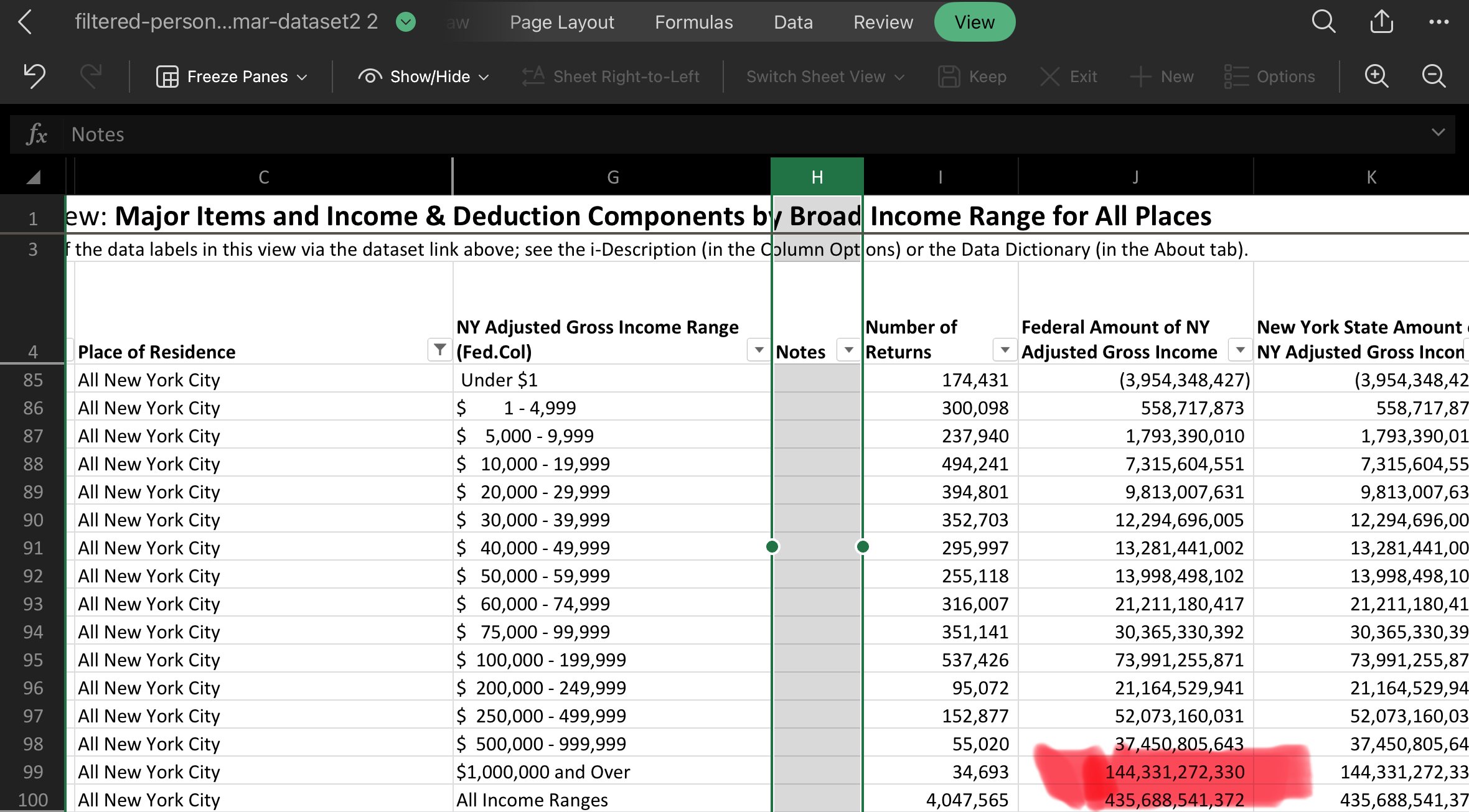

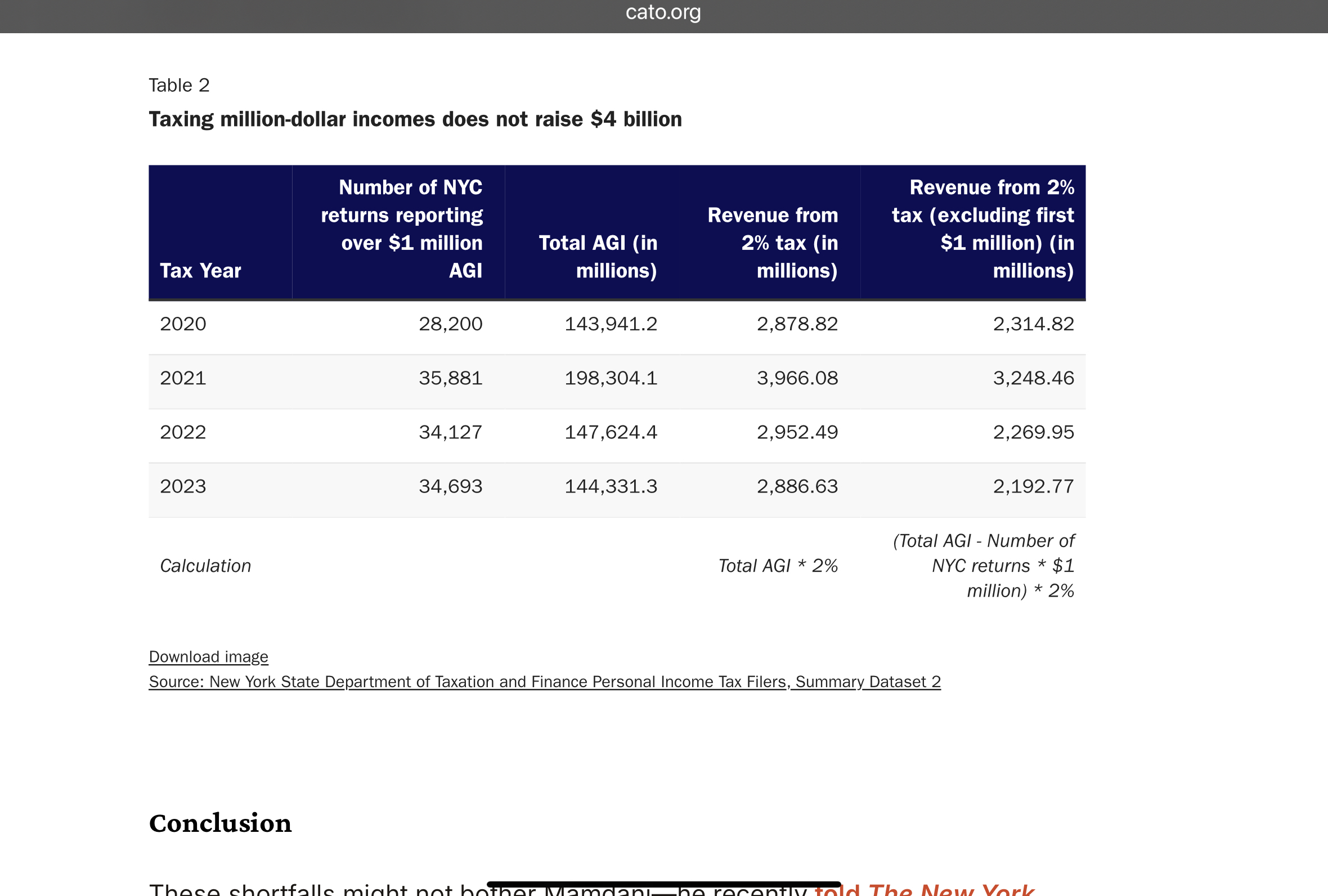

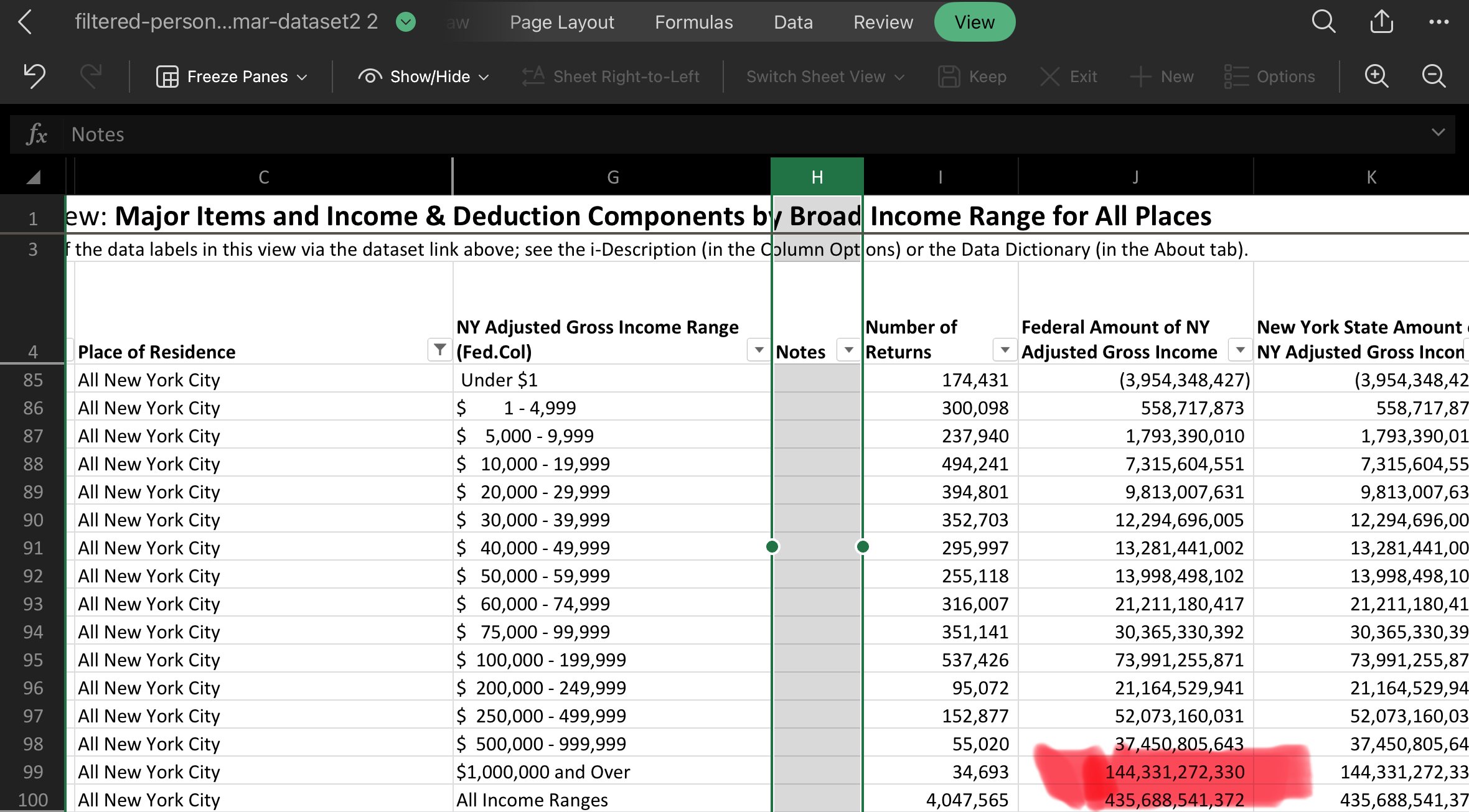

and I can prove this math by calculating it differently based on total city personal income earned. According to NYS own data for city, found in a Cato analysis, and I even downloaded the NYS tax dept spreadsheet (because I KNOW you’d complain about Cato), in 2023 the total income generated by income millionaires was $144B in 2023, and that income varies widely further adding risk to these plans.

ZM is estimating this number to be closer to $200b in 2026 and beyond. Divide that total income by one percent of city taxpayers, and ZMs 2% rate, and again, you are in the neighborhood of $120,000 per taxpayer. Obvious math proven two ways, and it’s only a FRACTION of his desired total budget hikes.

so this math is proven both by using both his $4B targeted individual tax raise and also by using the total AGI of city filers that earn over $1M. “Examples” of cherry picked data and federal taxes “how we define what is an individual filer” have no bearing on this specific calculation. Math doesn’t lie, only folks that want to hide the truth by cherry picking irrelevant data to the specific calculation to make simplicity appear confusing, which is very trumpian.please don’t go back to that federal data. Let’s stick to ZMs city numbers, 1% of filers, and a desired take of $4B from individuals. Simple. Stick with his numbers, and the state data that backs it up two separate ways.

Prove your integrity and agree with Mamdanis math.

0

0 -

Isn’t Hal’s point that a 1M taxpayer would pay a different amount than a 20M taxpayer and that not every millionaire taxpayer will pay a flat rate of 120k per?Lerxst1992 said:Halifax2TheMax said:

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.Lerxst1992 said:Hal my pal, you made a huge mistake here, and explains why I could not comprehend your earlier points.

” there are 390,000 millionaires in NYC”

that’s true but false in this specific context. The tax plan levies taxpayers who “earn over one million dollars a year.” That’s why the relevant number of taxpayers is about 35k or 1% of nyc individual taxpayers (ZM promise) which is easy to google. $4B/35,000 = $120,000 per approx. and there are other ways to prove this #, and as stated many times, it doesn’t include the cost of debt service or corp taxes, both items zm has not been up front about.

Yes, I know there is a NYT article claiming a short term trend of increases in millionaires (not income millionaires that’s applicable here), but short term trends are more defined like events such as Covid. That’s why the long term trend made an impact in my reading. Plus in the data presented, millionaires were not targeted like they are by ZM, giving folks a huge incentive to leave, which is my point, and is clear once we possibly in the future examine the very high income taxpayers that will be funding a huge part of these programs. That’s where ZMs logic starts to fail spectacularly.

Next I will need to beg your forgiveness, as I left out the word “share.” The point of the quote remains NYC will be less competitive keeping and attracting millionaires. It’s from CBCNY, a proclaimed nonpartisan think tank whose purpose is city finances.“New York’s share of the nation’s millionaires fell from 12.7% in 2010 to 8.7% in 2022;”

That’s a 33% drop over twelve years, demonstrating NYCs success and competitiveness on a long term basis. The fact it’s over 12 years is a big deal.and you know this portion of your argument is silly, as it’s all happened before, well before PJ got started but around the time that great band from your country began.Social programs costing more and tax increases higher than promised, hiding budget deficits and misleading accounting leading to the city budget imploding. It all happened before in NYC but his voters did not study their history closely enough.

My numbers are from the New York City Independent Budget Office (NYCIBO) as they relate to individual adult tax filers earning $1M+ to $10M+, probably outdated as they're from 2022, and I stand by them. You're comparing the number of New York State millionaires with New York City millionaires. We've been told for 16 years that if you raise taxes in NY/NYC, the millionaire/billionaire class will leave. Total bullshit.

From your source that you cited (CBCNY):- Statewide growth: The number of millionaires in New York State nearly doubled from 2010 to 2022, from 35,802 to 69,780, notes CBCNY.

I looked up the tax rate in NYS/NYC/Fed for someone earning $25M+ and its a combined 14.776% and The Bus Driver wants to increase that 2%. That means the combined NYS/NYC tax rate is 16.776% resulting in a tax liability (without deductions, tax loop holes, etc, we can agree no one pays the full rate, right?) of $4,194,000. Add the Federal tax liability of 37% on the taxable amount of the $25M and they owe a combined Fed/NYS/NYC amount of $13,218,540, leaving them with $11,781,460. Again, we know ultra wealthy taxpayers don't pay the full rate of 37% due to loopholes/accounting/deductions, etc. How will they go on? How will they ever afford NYC? Guess they'll have to move out of the city or the state? Poor, poor things. We've heard this for 16 years from the right wing media and pundits. Someone who makes $1M and has to pay $20K more in taxes isn't leaving the city. And if they do? Maybe the rents will come down? For context, the average income in NYC is $41,482.

I chose the $25M threshold as an example because I found it interesting that NYS/NYC have a tax bracket for that amount which indicates that there are tax payers in that bracket in NYS/NYC, which further reinforces my contention of the $4B being raised by increasing the taxes on those making $1M+ to $10M+ and backed by the 2022 NYCIBO number of adult tax filers in those income ranges.

To my bold in your first paragraph, why is that there? It has no relevancy to the issue of a 2% tax increase on those earning $1M+. Talk about discussing "one topic at a time". Also, what relevance is NYS's share of millionaires, as a percentage, compared to other states as it relates to NYC? Is it possible that more millionaires were created in CA, Silicon Valley, Tejas with SpaceX, oil/gas, fracking or Flo Rida, where old folks go to retire? It doesn't mean they left NYS/NYC, just that more have been created in other places and there's a larger pool of millionaires nationwide.

Silly? Are you going back to the Ford fall down go boom administration for some veiled comparison of tax policy and it being the reason NYC collapsed, despite the tax history of both NYS/NYC raising the rates, dems and repubs both? Now, that's silly.

Your concern of budget deficits is a smoke screen considering what CCOOTWH's Big, Ugly Bill has done to deficits and debt. But you do you.

Trickle down works, the rich freely invest and create jobs and without them, society would collapse. But I'm getting on the bus.Hal, your comment is loaded with inaccuracies, please don’t make me dissect them one by one.

The math is simple. ZM own numbers indicate the individual tax raise of $4B will be funded by 1% of the @ 3.8M city taxpayers. Is he lying about this also? $4B charged to 38,000 taxpayers is about $120,000 per filer.

and I can prove this math by calculating it differently based on total city personal income earned. According to NYS own data for city, found in a Cato analysis, and I even downloaded the NYS tax dept spreadsheet (because I KNOW you’d complain about Cato), in 2023 the total income generated by income millionaires was $144B in 2023, and that income varies widely further adding risk to these plans.

ZM is estimating this number to be closer to $200b in 2026 and beyond. Divide that total income by one percent of city taxpayers, and ZMs 2% rate, and again, you are in the neighborhood of $120,000 per taxpayer. Obvious math proven two ways, and it’s only a FRACTION of his desired total budget hikes.

so this math is proven both by using both his $4B targeted individual tax raise and also by using the total AGI of city filers that earn over $1M. “Examples” of cherry picked data and federal taxes “how we define what is an individual filer” have no bearing on this specific calculation. Math doesn’t lie, only folks that want to hide the truth by cherry picking irrelevant data to the specific calculation to make simplicity appear confusing, which is very trumpian.please don’t go back to that federal data. Let’s stick to ZMs city numbers, 1% of filers, and a desired take of $4B from individuals. Simple. Stick with his numbers, and the state data that backs it up two separate ways.

Prove your integrity and agree with Mamdanis math.

Scio me nihil scire

Scio me nihil scire

There are no kings inside the gates of eden0 -

static111 said:

Isn’t Hal’s point that a 1M taxpayer would pay a different amount than a 20M taxpayer and that not every millionaire taxpayer will pay a flat rate of 120k per?Lerxst1992 said:Halifax2TheMax said:

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.Lerxst1992 said:Hal my pal, you made a huge mistake here, and explains why I could not comprehend your earlier points.

” there are 390,000 millionaires in NYC”

that’s true but false in this specific context. The tax plan levies taxpayers who “earn over one million dollars a year.” That’s why the relevant number of taxpayers is about 35k or 1% of nyc individual taxpayers (ZM promise) which is easy to google. $4B/35,000 = $120,000 per approx. and there are other ways to prove this #, and as stated many times, it doesn’t include the cost of debt service or corp taxes, both items zm has not been up front about.

Yes, I know there is a NYT article claiming a short term trend of increases in millionaires (not income millionaires that’s applicable here), but short term trends are more defined like events such as Covid. That’s why the long term trend made an impact in my reading. Plus in the data presented, millionaires were not targeted like they are by ZM, giving folks a huge incentive to leave, which is my point, and is clear once we possibly in the future examine the very high income taxpayers that will be funding a huge part of these programs. That’s where ZMs logic starts to fail spectacularly.

Next I will need to beg your forgiveness, as I left out the word “share.” The point of the quote remains NYC will be less competitive keeping and attracting millionaires. It’s from CBCNY, a proclaimed nonpartisan think tank whose purpose is city finances.“New York’s share of the nation’s millionaires fell from 12.7% in 2010 to 8.7% in 2022;”

That’s a 33% drop over twelve years, demonstrating NYCs success and competitiveness on a long term basis. The fact it’s over 12 years is a big deal.and you know this portion of your argument is silly, as it’s all happened before, well before PJ got started but around the time that great band from your country began.Social programs costing more and tax increases higher than promised, hiding budget deficits and misleading accounting leading to the city budget imploding. It all happened before in NYC but his voters did not study their history closely enough.

My numbers are from the New York City Independent Budget Office (NYCIBO) as they relate to individual adult tax filers earning $1M+ to $10M+, probably outdated as they're from 2022, and I stand by them. You're comparing the number of New York State millionaires with New York City millionaires. We've been told for 16 years that if you raise taxes in NY/NYC, the millionaire/billionaire class will leave. Total bullshit.

From your source that you cited (CBCNY):- Statewide growth: The number of millionaires in New York State nearly doubled from 2010 to 2022, from 35,802 to 69,780, notes CBCNY.

I looked up the tax rate in NYS/NYC/Fed for someone earning $25M+ and its a combined 14.776% and The Bus Driver wants to increase that 2%. That means the combined NYS/NYC tax rate is 16.776% resulting in a tax liability (without deductions, tax loop holes, etc, we can agree no one pays the full rate, right?) of $4,194,000. Add the Federal tax liability of 37% on the taxable amount of the $25M and they owe a combined Fed/NYS/NYC amount of $13,218,540, leaving them with $11,781,460. Again, we know ultra wealthy taxpayers don't pay the full rate of 37% due to loopholes/accounting/deductions, etc. How will they go on? How will they ever afford NYC? Guess they'll have to move out of the city or the state? Poor, poor things. We've heard this for 16 years from the right wing media and pundits. Someone who makes $1M and has to pay $20K more in taxes isn't leaving the city. And if they do? Maybe the rents will come down? For context, the average income in NYC is $41,482.

I chose the $25M threshold as an example because I found it interesting that NYS/NYC have a tax bracket for that amount which indicates that there are tax payers in that bracket in NYS/NYC, which further reinforces my contention of the $4B being raised by increasing the taxes on those making $1M+ to $10M+ and backed by the 2022 NYCIBO number of adult tax filers in those income ranges.

To my bold in your first paragraph, why is that there? It has no relevancy to the issue of a 2% tax increase on those earning $1M+. Talk about discussing "one topic at a time". Also, what relevance is NYS's share of millionaires, as a percentage, compared to other states as it relates to NYC? Is it possible that more millionaires were created in CA, Silicon Valley, Tejas with SpaceX, oil/gas, fracking or Flo Rida, where old folks go to retire? It doesn't mean they left NYS/NYC, just that more have been created in other places and there's a larger pool of millionaires nationwide.

Silly? Are you going back to the Ford fall down go boom administration for some veiled comparison of tax policy and it being the reason NYC collapsed, despite the tax history of both NYS/NYC raising the rates, dems and repubs both? Now, that's silly.

Your concern of budget deficits is a smoke screen considering what CCOOTWH's Big, Ugly Bill has done to deficits and debt. But you do you.

Trickle down works, the rich freely invest and create jobs and without them, society would collapse. But I'm getting on the bus.Hal, your comment is loaded with inaccuracies, please don’t make me dissect them one by one.

The math is simple. ZM own numbers indicate the individual tax raise of $4B will be funded by 1% of the @ 3.8M city taxpayers. Is he lying about this also? $4B charged to 38,000 taxpayers is about $120,000 per filer.

and I can prove this math by calculating it differently based on total city personal income earned. According to NYS own data for city, found in a Cato analysis, and I even downloaded the NYS tax dept spreadsheet (because I KNOW you’d complain about Cato), in 2023 the total income generated by income millionaires was $144B in 2023, and that income varies widely further adding risk to these plans.

ZM is estimating this number to be closer to $200b in 2026 and beyond. Divide that total income by one percent of city taxpayers, and ZMs 2% rate, and again, you are in the neighborhood of $120,000 per taxpayer. Obvious math proven two ways, and it’s only a FRACTION of his desired total budget hikes.

so this math is proven both by using both his $4B targeted individual tax raise and also by using the total AGI of city filers that earn over $1M. “Examples” of cherry picked data and federal taxes “how we define what is an individual filer” have no bearing on this specific calculation. Math doesn’t lie, only folks that want to hide the truth by cherry picking irrelevant data to the specific calculation to make simplicity appear confusing, which is very trumpian.please don’t go back to that federal data. Let’s stick to ZMs city numbers, 1% of filers, and a desired take of $4B from individuals. Simple. Stick with his numbers, and the state data that backs it up two separate ways.

Prove your integrity and agree with Mamdanis math.

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

Exactly. Fuzzy math and US education systems. And Gerald Ford fall down go boom administrations.

I look forward to witnessing the collapse of NYC when the millionaires and billionaires flee and the rents plummet.

I’m done reading the simplicity of AI logic.

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Lerxst1992 said:brianlux said:If people will give the guy a chance, I think he will work out well. The voters are happy, that's for sure.gimmesometruth27 said:if millionaires want to leave, fuck em. let them fly themselves to texas. as long as we don't have to fucking pay for it.Fuck em? We need them to pay for this. Why comment on a political forum if we ignore fundamental facts? MAGA left?Before I get back to numbers with H, my point is this has already happened, and the young voters who was the base of ZM support, did not do a good enough job learning from OUR history. Cuomo won with voters over 45.

when a locality targets very few individuals to fund massive programs, if just a few leave, it all falls apart and it’s obvious how risky these plans are. Maybe we can get Eric T to tariff Canada in 20 years to bail us out, because the modern R states will not help in any way shape or form,

Huh?"It's a sad and beautiful world"-Roberto Benigni0 -

brianlux said:Lerxst1992 said:brianlux said:If people will give the guy a chance, I think he will work out well. The voters are happy, that's for sure.gimmesometruth27 said:if millionaires want to leave, fuck em. let them fly themselves to texas. as long as we don't have to fucking pay for it.Fuck em? We need them to pay for this. Why comment on a political forum if we ignore fundamental facts? MAGA left?Before I get back to numbers with H, my point is this has already happened, and the young voters who was the base of ZM support, did not do a good enough job learning from OUR history. Cuomo won with voters over 45.

when a locality targets very few individuals to fund massive programs, if just a few leave, it all falls apart and it’s obvious how risky these plans are. Maybe we can get Eric T to tariff Canada in 20 years to bail us out, because the modern R states will not help in any way shape or form,

Huh?Gimme said let them move, fuck em. Which is absurd because they’re the ones ZM wants to pay for this. And you said you think it will work, which I really, we’ve been down this path before. The reason I’m trying to get the people here to agree on an average impact, we can drill down further on how this works.

but I can get simple math by H, directly from the ZM campaign and amounts provided by the NYS dept of taxation.0 -

static111 said:

Isn’t Hal’s point that a 1M taxpayer would pay a different amount than a 20M taxpayer and that not every millionaire taxpayer will pay a flat rate of 120k per?Lerxst1992 said:Halifax2TheMax said:

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.Lerxst1992 said:Hal my pal, you made a huge mistake here, and explains why I could not comprehend your earlier points.

” there are 390,000 millionaires in NYC”

that’s true but false in this specific context. The tax plan levies taxpayers who “earn over one million dollars a year.” That’s why the relevant number of taxpayers is about 35k or 1% of nyc individual taxpayers (ZM promise) which is easy to google. $4B/35,000 = $120,000 per approx. and there are other ways to prove this #, and as stated many times, it doesn’t include the cost of debt service or corp taxes, both items zm has not been up front about.

Yes, I know there is a NYT article claiming a short term trend of increases in millionaires (not income millionaires that’s applicable here), but short term trends are more defined like events such as Covid. That’s why the long term trend made an impact in my reading. Plus in the data presented, millionaires were not targeted like they are by ZM, giving folks a huge incentive to leave, which is my point, and is clear once we possibly in the future examine the very high income taxpayers that will be funding a huge part of these programs. That’s where ZMs logic starts to fail spectacularly.

Next I will need to beg your forgiveness, as I left out the word “share.” The point of the quote remains NYC will be less competitive keeping and attracting millionaires. It’s from CBCNY, a proclaimed nonpartisan think tank whose purpose is city finances.“New York’s share of the nation’s millionaires fell from 12.7% in 2010 to 8.7% in 2022;”

That’s a 33% drop over twelve years, demonstrating NYCs success and competitiveness on a long term basis. The fact it’s over 12 years is a big deal.and you know this portion of your argument is silly, as it’s all happened before, well before PJ got started but around the time that great band from your country began.Social programs costing more and tax increases higher than promised, hiding budget deficits and misleading accounting leading to the city budget imploding. It all happened before in NYC but his voters did not study their history closely enough.

My numbers are from the New York City Independent Budget Office (NYCIBO) as they relate to individual adult tax filers earning $1M+ to $10M+, probably outdated as they're from 2022, and I stand by them. You're comparing the number of New York State millionaires with New York City millionaires. We've been told for 16 years that if you raise taxes in NY/NYC, the millionaire/billionaire class will leave. Total bullshit.

From your source that you cited (CBCNY):- Statewide growth: The number of millionaires in New York State nearly doubled from 2010 to 2022, from 35,802 to 69,780, notes CBCNY.

I looked up the tax rate in NYS/NYC/Fed for someone earning $25M+ and its a combined 14.776% and The Bus Driver wants to increase that 2%. That means the combined NYS/NYC tax rate is 16.776% resulting in a tax liability (without deductions, tax loop holes, etc, we can agree no one pays the full rate, right?) of $4,194,000. Add the Federal tax liability of 37% on the taxable amount of the $25M and they owe a combined Fed/NYS/NYC amount of $13,218,540, leaving them with $11,781,460. Again, we know ultra wealthy taxpayers don't pay the full rate of 37% due to loopholes/accounting/deductions, etc. How will they go on? How will they ever afford NYC? Guess they'll have to move out of the city or the state? Poor, poor things. We've heard this for 16 years from the right wing media and pundits. Someone who makes $1M and has to pay $20K more in taxes isn't leaving the city. And if they do? Maybe the rents will come down? For context, the average income in NYC is $41,482.

I chose the $25M threshold as an example because I found it interesting that NYS/NYC have a tax bracket for that amount which indicates that there are tax payers in that bracket in NYS/NYC, which further reinforces my contention of the $4B being raised by increasing the taxes on those making $1M+ to $10M+ and backed by the 2022 NYCIBO number of adult tax filers in those income ranges.

To my bold in your first paragraph, why is that there? It has no relevancy to the issue of a 2% tax increase on those earning $1M+. Talk about discussing "one topic at a time". Also, what relevance is NYS's share of millionaires, as a percentage, compared to other states as it relates to NYC? Is it possible that more millionaires were created in CA, Silicon Valley, Tejas with SpaceX, oil/gas, fracking or Flo Rida, where old folks go to retire? It doesn't mean they left NYS/NYC, just that more have been created in other places and there's a larger pool of millionaires nationwide.

Silly? Are you going back to the Ford fall down go boom administration for some veiled comparison of tax policy and it being the reason NYC collapsed, despite the tax history of both NYS/NYC raising the rates, dems and repubs both? Now, that's silly.

Your concern of budget deficits is a smoke screen considering what CCOOTWH's Big, Ugly Bill has done to deficits and debt. But you do you.

Trickle down works, the rich freely invest and create jobs and without them, society would collapse. But I'm getting on the bus.Hal, your comment is loaded with inaccuracies, please don’t make me dissect them one by one.

The math is simple. ZM own numbers indicate the individual tax raise of $4B will be funded by 1% of the @ 3.8M city taxpayers. Is he lying about this also? $4B charged to 38,000 taxpayers is about $120,000 per filer.

and I can prove this math by calculating it differently based on total city personal income earned. According to NYS own data for city, found in a Cato analysis, and I even downloaded the NYS tax dept spreadsheet (because I KNOW you’d complain about Cato), in 2023 the total income generated by income millionaires was $144B in 2023, and that income varies widely further adding risk to these plans.

ZM is estimating this number to be closer to $200b in 2026 and beyond. Divide that total income by one percent of city taxpayers, and ZMs 2% rate, and again, you are in the neighborhood of $120,000 per taxpayer. Obvious math proven two ways, and it’s only a FRACTION of his desired total budget hikes.

so this math is proven both by using both his $4B targeted individual tax raise and also by using the total AGI of city filers that earn over $1M. “Examples” of cherry picked data and federal taxes “how we define what is an individual filer” have no bearing on this specific calculation. Math doesn’t lie, only folks that want to hide the truth by cherry picking irrelevant data to the specific calculation to make simplicity appear confusing, which is very trumpian.please don’t go back to that federal data. Let’s stick to ZMs city numbers, 1% of filers, and a desired take of $4B from individuals. Simple. Stick with his numbers, and the state data that backs it up two separate ways.

Prove your integrity and agree with Mamdanis math.

My attempt is to simplify the math to further drill down on the impact, but I can’t get to the next step because I can’t get him to agree on the number of taxpayers that ZM says this will impact and how much he is promising it will raise.

My attempt is to simplify the math to further drill down on the impact, but I can’t get to the next step because I can’t get him to agree on the number of taxpayers that ZM says this will impact and how much he is promising it will raise.

The $120k is an average to demonstrate how much, but the real average number is much much greater than $120k because we are only looking at one third of what ZM wants to raise and the majority of tax collection will come from far fewer than 1%, which is his argument, which only makes mine stronger.

yes we can claim those that make barely over $1m will not be impacted as much, which I wholeheartedly agree with and proves my point further, because the real impact is on a much smaller target than 1% of taxpayers. But I can’t explain that because he and the dems in general are hiding behind hysterics, jokes, extremism , hating Trump and celebrating moral victories rather than a party of fair and earnest help to craft successful American policies to provide for those in need.0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.OMG! Somebody check on Montgomery County, MD! It’s been two plus years and decades and I think it looks like 1975 Ford administration fall down go boom NYC years, a devastated wasteland where elected government seized the means of production! Damn socialists ruin everything! It can’t be done! Only capitalism and free markets can save us! People need to get better educated! Oh no!

I know, just another media anecdote with no facts, links or proof of it working in the real world. Can’t possibly be accomplished.

https://www.nytimes.com/2023/08/25/business/affordable-housing-montgomery-county.html09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

Halifax2TheMax said:* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.OMG! Somebody check on Montgomery County, MD! It’s been two plus years and decades and I think it looks like 1975 Ford administration fall down go boom NYC years, a devastated wasteland where elected government seized the means of production! Damn socialists ruin everything! It can’t be done! Only capitalism and free markets can save us! People need to get better educated! Oh no!

I know, just another media anecdote with no facts, links or proof of it working in the real world. Can’t possibly be accomplished.

https://www.nytimes.com/2023/08/25/business/affordable-housing-montgomery-county.htmlThanks for being a pal and providing a link proving my analysis is correct. Dems claim to want affordable housing as long as it’s nimby. Hence the comment you mocked about red hook $8000 rent tenants voting in socialism, instead of understanding what the point was.

” Montgomery County still has a housing shortage and suffers from the same not-in-my-backyard politics that have exacerbated it. And some of the housing, like the Laureate, serves middle-class tenants, not someone earning, say, the minimum wage.”

And it’s not funded anything like what the ny socialist king wants. This actually sounds somewhat like capitalism…

” When a developer builds a project, it typically teams up with a private equity firm that puts up about a third of the cost. (The rest comes from a bank loan.) They want a return, however, and the money isn’t cheap. The going annual rate in private equity is in the mid- to high teens, Mr. Quinn said. A $50 million investment, for example, is expected to return about $90 million after four years — money that is made up for with rent.”“So in 2021, the Montgomery County Council voted to create the $100 million Housing Production Fund. The fund allows H.O.C. to replace private equity as developers’ main source of investment, and charge a 5 percent return. The discount saves the developer tens of millions of dollars off the project’s effective cost.”

All from your article…thanks…lol. You even read the entire thing?

0 -

And again the point is states need to be competitive to keep and add jobs.

Socialist king wants to tax city residents SEVENTY PERCENT MORE THAN MONTGOMERY MD

perhaps our resident cpa can chime in with the state rate some upper middle class ny dude pays, because that’s relevant to what the socialist king wants to do.0 -

Lerxst1992 said:Halifax2TheMax said:* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.OMG! Somebody check on Montgomery County, MD! It’s been two plus years and decades and I think it looks like 1975 Ford administration fall down go boom NYC years, a devastated wasteland where elected government seized the means of production! Damn socialists ruin everything! It can’t be done! Only capitalism and free markets can save us! People need to get better educated! Oh no!

I know, just another media anecdote with no facts, links or proof of it working in the real world. Can’t possibly be accomplished.

https://www.nytimes.com/2023/08/25/business/affordable-housing-montgomery-county.htmlThanks for being a pal and providing a link proving my analysis is correct. Dems claim to want affordable housing as long as it’s nimby. Hence the comment you mocked about red hook $8000 rent tenants voting in socialism, instead of understanding what the point was.

” Montgomery County still has a housing shortage and suffers from the same not-in-my-backyard politics that have exacerbated it. And some of the housing, like the Laureate, serves middle-class tenants, not someone earning, say, the minimum wage.”

And it’s not funded anything like what the ny socialist king wants. This actually sounds somewhat like capitalism…

” When a developer builds a project, it typically teams up with a private equity firm that puts up about a third of the cost. (The rest comes from a bank loan.) They want a return, however, and the money isn’t cheap. The going annual rate in private equity is in the mid- to high teens, Mr. Quinn said. A $50 million investment, for example, is expected to return about $90 million after four years — money that is made up for with rent.”“So in 2021, the Montgomery County Council voted to create the $100 million Housing Production Fund. The fund allows H.O.C. to replace private equity as developers’ main source of investment, and charge a 5 percent return. The discount saves the developer tens of millions of dollars off the project’s effective cost.”

All from your article…thanks…lol. You even read the entire thing?

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

Fuck the people in those 2,000 units, eh? 4M unit shortfall nationwide, NYC included, and nothing can be done. Yes, I did read the whole thing. You left out that private equity wants a 15% return, increasing the costs, the rent, or the payback, discouraging below market rent units. That’s why the county/city steps in as they get a 5% return and own an asset. But yea, keep shilling for corporations. Dem my ass, more like a corporate elitist will the defenses of corporate greed.

You also seem to have missed the part where every neighborhood in Montgomery County, inclusive of the “rich” neighborhoods, like Rockville, Chevy Chase, etc, have received a project such as this. So much for your NIMBY argument and “seizing the means of production”. Re-read the whole article in context. Connect the dots. Or did AI break that ability?

Did you read the whole article, LOL?Post edited by Halifax2TheMax on09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0

Categories

- All Categories

- 149K Pearl Jam's Music and Activism

- 110.2K The Porch

- 280 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.3K Flea Market

- 39.3K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help