America’s March to Facism

Comments

-

yay democracy....Trump calls for jailing Democratic leaders as troops prepare for Chicago deployment - https://www.reuters.com/world/us/trump-calls-chicago-mayor-illinois-governor-be-jailed-2025-10-08/_____________________________________SIGNATURE________________________________________________

Not today Sir, Probably not tomorrow.............................................. bayfront arena st. pete '94

you're finally here and I'm a mess................................................... nationwide arena columbus '10

memories like fingerprints are slowly raising.................................... first niagara center buffalo '13

another man ..... moved by sleight of hand...................................... joe louis arena detroit '140 -

In my generation, my few peers owning homes in urban environments talk about being "house poor" - meaning that they are forgoing most (if not all) discretionary pleasures for a decent amount of time, in order to own a house, because their mortgage payments are high enough to consume discretionary funds, and the down payment requirements up-front are quite large. This isn't new - that's been the case for a long time.static111 said:

What does 40 years have to do with anything. The price of entry is higher than it has ever been. What once a construction worker and waitress could afford at 12% is out of reach of dual income degrees households at 6% because the starting costs are sky fucking high. I don't know where to take the conversation from there. When home costs out paced wage growth and renting became cheaper than buying the system became fucked. No matter how good the stock market is housing in America is fucked and if people can't afford to own the same quality of home that their dead beat parents bought people stop giving a shit.Lerxst1992 said:Halifax2TheMax said:Lerxst1992 said:

Lying? Where does your ai excerpt say that?Are you capable of reasoned debate and discussion?Halifax2TheMax said:Lerxst1992 said:Tim Simmons said:Bari Weiss is a grifter. Was severely dunked on for bad takes, got butthurt about it, and failed upward. Congrats on her new job of making news for olds

She is lying about why she left the times? I mean, you don’t see what she says happened to her right here on this forum?It’s not a joke that you can watch your budget and come up with $48 per week and use the tax tools currently available to solve the affordability problem and build wealth without resorting to socialism in nyc? Or that housing costs now are actually very comparable to the 80s and 90s? We can’t even have a reasonable discussion about that on this forum without centrists being ridiculed.

But it’s the conservatives that are stupid.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

AI tells me that you’re lying.U.S. housing costs have increased dramatically by decade, with prices rising faster than wages, leading to greater unaffordability. For example, the median U.S. home price rose from $47,200 in 1980 to $119,600 in 2000 and $416,900 by 2025, while the median household income grew at a slower rate. This trend is reflected in the rising price-to-income ratio, which measures how many years of median income it takes to buy a home.Historical Home Prices and Income Trends- 1980s:The median home price was $47,200 in 1980 and rose to $82,800 by the mid-1980s, with a price-to-income ratio of 3.51 in 1985.

- 1990s:The median sales price increased to $119,600 by 2000, after reaching $79,100 in 1990.

- 2000s:A significant increase occurred, with the median home price in 2005 reaching $232,500, followed by a decline in the latter half of the decade.

- 2010s:Prices began to rebound after hitting a low in 2012, eventually increasing by about 5% annually over the decade.

- 2020s:Prices saw substantial growth, with the median home price reaching approximately $416,900 by 2025, an increase of about 25% in just three years (2020-2023).

after going back and forth multiple times, and I point out repeatedly how important mortgage rates are in the determination of housing cost, is this comment of yours honest? AI disagrees…

…

” It's a massive omission to ignore interest rates in the calculation of total housing costs, potentially leading to an extremely inaccurate and misleading figure. For most homeowners who use a mortgage, interest payments make up a substantial portion—often the largest single component—of their total expense over the life of the loan.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

You used the interest rate from 1985 on the housing cost of 2025, while using the interest rate of today on today’s housing cost, and a 40 year mortgage. This comparison somehow shows that millennials can afford a $400K+ house for only $200K+. Bunk.

Your math is fuzzy. Got a stock tip?

I never said that bit about the 200k, you are twisting words to feed your lame jokes and put downs. What I was likely talking about was the time value of money which apparently is not a concept understood on this forum, unless Matt ever comes back

Static at least had the courage to provide their own mathematics ( which was almost perfect) calculating total mortgage costs for the average price of a home 1985 versus 2025 using the applicable interest rate for each year, applied against the home price for each, the one thing they did not do was account for the 40 years time difference. Of course they refused to continue the discussion once I pointed out what it was missing. Once doing that the present value of both mortgage streams are extremely similar.

Tip?

I knew all about Larry Ellison before Matt Cameron joined this band. There's your tip.

But, when real estate prices are disproportionately higher compared to wages, a huge chunk of an urban population is priced out of purchases (i.e. the majority of my peers), so let's say they pursue a rental so as to have funds left to invest. Well, wait a minute - additional demand for rentals raises the prices of renting, which consume much of that 'discretionary' or investable money. Now, due to these new realities, many aren't able to both rent and invest, let alone buy and invest.

I understand this is anecdotal, but is this not a typical story these days?

'05 - TO, '06 - TO 1, '08 - NYC 1 & 2, '09 - TO, Chi 1 & 2, '10 - Buffalo, NYC 1 & 2, '11 - TO 1 & 2, Hamilton, '13 - Buffalo, Brooklyn 1 & 2, '15 - Global Citizen, '16 - TO 1 & 2, Chi 2

EV

Toronto Film Festival 9/11/2007, '08 - Toronto 1 & 2, '09 - Albany 1, '11 - Chicago 10 -

Trump calls for jailing Democratic leaders as troops prepare for Chicago deployment - https://www.reuters.com/world/us/trump-calls-chicago-mayor-illinois-governor-be-jailed-2025-10-08/

so onto incarceration of elected officialsjesus greets me looks just like me ....0 -

I apologize the result of this debate has evolved to different threads. Maybe discussing economics from a “textbook” or “industry” point of view adds value to a political forum??static111 said:

What does 40 years have to do with anything. The price of entry is higher than it has ever been. What once a construction worker and waitress could afford at 12% is out of reach of dual income degrees households at 6% because the starting costs are sky fucking high. I don't know where to take the conversation from there. When home costs out paced wage growth and renting became cheaper than buying the system became fucked. No matter how good the stock market is housing in America is fucked and if people can't afford to own the same quality of home that their dead beat parents bought people stop giving a shit.Lerxst1992 said:Halifax2TheMax said:Lerxst1992 said:

Lying? Where does your ai excerpt say that?Are you capable of reasoned debate and discussion?Halifax2TheMax said:Lerxst1992 said:Tim Simmons said:Bari Weiss is a grifter. Was severely dunked on for bad takes, got butthurt about it, and failed upward. Congrats on her new job of making news for olds

She is lying about why she left the times? I mean, you don’t see what she says happened to her right here on this forum?It’s not a joke that you can watch your budget and come up with $48 per week and use the tax tools currently available to solve the affordability problem and build wealth without resorting to socialism in nyc? Or that housing costs now are actually very comparable to the 80s and 90s? We can’t even have a reasonable discussion about that on this forum without centrists being ridiculed.

But it’s the conservatives that are stupid.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

AI tells me that you’re lying.U.S. housing costs have increased dramatically by decade, with prices rising faster than wages, leading to greater unaffordability. For example, the median U.S. home price rose from $47,200 in 1980 to $119,600 in 2000 and $416,900 by 2025, while the median household income grew at a slower rate. This trend is reflected in the rising price-to-income ratio, which measures how many years of median income it takes to buy a home.Historical Home Prices and Income Trends- 1980s:The median home price was $47,200 in 1980 and rose to $82,800 by the mid-1980s, with a price-to-income ratio of 3.51 in 1985.

- 1990s:The median sales price increased to $119,600 by 2000, after reaching $79,100 in 1990.

- 2000s:A significant increase occurred, with the median home price in 2005 reaching $232,500, followed by a decline in the latter half of the decade.

- 2010s:Prices began to rebound after hitting a low in 2012, eventually increasing by about 5% annually over the decade.

- 2020s:Prices saw substantial growth, with the median home price reaching approximately $416,900 by 2025, an increase of about 25% in just three years (2020-2023).

after going back and forth multiple times, and I point out repeatedly how important mortgage rates are in the determination of housing cost, is this comment of yours honest? AI disagrees…

…

” It's a massive omission to ignore interest rates in the calculation of total housing costs, potentially leading to an extremely inaccurate and misleading figure. For most homeowners who use a mortgage, interest payments make up a substantial portion—often the largest single component—of their total expense over the life of the loan.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

You used the interest rate from 1985 on the housing cost of 2025, while using the interest rate of today on today’s housing cost, and a 40 year mortgage. This comparison somehow shows that millennials can afford a $400K+ house for only $200K+. Bunk.

Your math is fuzzy. Got a stock tip?

I never said that bit about the 200k, you are twisting words to feed your lame jokes and put downs. What I was likely talking about was the time value of money which apparently is not a concept understood on this forum, unless Matt ever comes back

Static at least had the courage to provide their own mathematics ( which was almost perfect) calculating total mortgage costs for the average price of a home 1985 versus 2025 using the applicable interest rate for each year, applied against the home price for each, the one thing they did not do was account for the 40 years time difference. Of course they refused to continue the discussion once I pointed out what it was missing. Once doing that the present value of both mortgage streams are extremely similar.

Tip?

I knew all about Larry Ellison before Matt Cameron joined this band. There's your tip.

The total costs of the two examples for the math you provided are 40 years apart. $100 from 40 years ago is worth more than it is today. Hopefully we can agree to understand how those two costs relate to each other we need to account for the difference in time? It’s an expansive topic in both finance and economics. Per google…

…

” The Time Value of Money (TVM) compares costs from different years by discounting future costs back to their present value to account for the lost earning potential (opportunity cost) and inflation that reduces future money's purchasing power. Using a formula, TVM calculates how much a future sum of money would be worth in today's dollars, allowing for a direct comparison of costs across different time periods.How TVM Works- Opportunity Cost:Money received today can be invested to earn a return. By delaying receiving money, you lose the potential to earn interest or investment gains, which is the opportunity cost.

Inflation:The cost of goods and services increases over time due to inflation, meaning that a specific amount of money in the future will buy less than it does today. This erosion of purchasing power is a key reason why future money is worth less than present money.Discounting:To compare costs from different years, you "discount" a future cost to its present value. This means you calculate what that future cost is equivalent to in today's terms, using a discount rate (often related to inflation or investment returns).ExampleImagine you're comparing a cost from last year to an estimated cost for next year.The concept of the Time Value of Money recognizes that receiving $100 today is more valuable than receiving $100 next year because you could have invested it and earned interest. Conversely, if a future cost is $100, its present value will be less than $100 because of this lost earning potential and reduced purchasing power.- A product that cost $100 last year might cost $103 next year due to a 3% inflation rate.

In PracticeWhen comparing costs from different years, you would use the TVM to:- , where FV is the future value, r is the discount rate, and n is the number of periods.Find the Present Value (PV):This is the value of a future amount of money in today's dollars. The formula is often expressed as

PV=FV/(1+r)n

Account for inflation:The discount rate (r) often reflects the expected rate of inflation and potential returns on investment, giving a realistic measure of what money will be worth in the future.Make Informed Decisions:By converting all costs to their present values, you can make more informed financial decisions, such as budgeting for future expenses or evaluating investment opportunities.

0 -

Housing costs are brutal. The history of this forum disagreement is someone a week or so ago posted an article that said “look at how much more expensive housing is today than 1985.” But the article also pointed out that interest rates are nearly half now vs then.benjs said:

In my generation, my few peers owning homes in urban environments talk about being "house poor" - meaning that they are forgoing most (if not all) discretionary pleasures for a decent amount of time, in order to own a house, because their mortgage payments are high enough to consume discretionary funds, and the down payment requirements up-front are quite large. This isn't new - that's been the case for a long time.static111 said:

What does 40 years have to do with anything. The price of entry is higher than it has ever been. What once a construction worker and waitress could afford at 12% is out of reach of dual income degrees households at 6% because the starting costs are sky fucking high. I don't know where to take the conversation from there. When home costs out paced wage growth and renting became cheaper than buying the system became fucked. No matter how good the stock market is housing in America is fucked and if people can't afford to own the same quality of home that their dead beat parents bought people stop giving a shit.Lerxst1992 said:Halifax2TheMax said:Lerxst1992 said:

Lying? Where does your ai excerpt say that?Are you capable of reasoned debate and discussion?Halifax2TheMax said:Lerxst1992 said:Tim Simmons said:Bari Weiss is a grifter. Was severely dunked on for bad takes, got butthurt about it, and failed upward. Congrats on her new job of making news for olds

She is lying about why she left the times? I mean, you don’t see what she says happened to her right here on this forum?It’s not a joke that you can watch your budget and come up with $48 per week and use the tax tools currently available to solve the affordability problem and build wealth without resorting to socialism in nyc? Or that housing costs now are actually very comparable to the 80s and 90s? We can’t even have a reasonable discussion about that on this forum without centrists being ridiculed.

But it’s the conservatives that are stupid.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

AI tells me that you’re lying.U.S. housing costs have increased dramatically by decade, with prices rising faster than wages, leading to greater unaffordability. For example, the median U.S. home price rose from $47,200 in 1980 to $119,600 in 2000 and $416,900 by 2025, while the median household income grew at a slower rate. This trend is reflected in the rising price-to-income ratio, which measures how many years of median income it takes to buy a home.Historical Home Prices and Income Trends- 1980s:The median home price was $47,200 in 1980 and rose to $82,800 by the mid-1980s, with a price-to-income ratio of 3.51 in 1985.

- 1990s:The median sales price increased to $119,600 by 2000, after reaching $79,100 in 1990.

- 2000s:A significant increase occurred, with the median home price in 2005 reaching $232,500, followed by a decline in the latter half of the decade.

- 2010s:Prices began to rebound after hitting a low in 2012, eventually increasing by about 5% annually over the decade.

- 2020s:Prices saw substantial growth, with the median home price reaching approximately $416,900 by 2025, an increase of about 25% in just three years (2020-2023).

after going back and forth multiple times, and I point out repeatedly how important mortgage rates are in the determination of housing cost, is this comment of yours honest? AI disagrees…

…

” It's a massive omission to ignore interest rates in the calculation of total housing costs, potentially leading to an extremely inaccurate and misleading figure. For most homeowners who use a mortgage, interest payments make up a substantial portion—often the largest single component—of their total expense over the life of the loan.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

You used the interest rate from 1985 on the housing cost of 2025, while using the interest rate of today on today’s housing cost, and a 40 year mortgage. This comparison somehow shows that millennials can afford a $400K+ house for only $200K+. Bunk.

Your math is fuzzy. Got a stock tip?

I never said that bit about the 200k, you are twisting words to feed your lame jokes and put downs. What I was likely talking about was the time value of money which apparently is not a concept understood on this forum, unless Matt ever comes back

Static at least had the courage to provide their own mathematics ( which was almost perfect) calculating total mortgage costs for the average price of a home 1985 versus 2025 using the applicable interest rate for each year, applied against the home price for each, the one thing they did not do was account for the 40 years time difference. Of course they refused to continue the discussion once I pointed out what it was missing. Once doing that the present value of both mortgage streams are extremely similar.

Tip?

I knew all about Larry Ellison before Matt Cameron joined this band. There's your tip.

But, when real estate prices are disproportionately higher compared to wages, a huge chunk of an urban population is priced out of purchases (i.e. the majority of my peers), so let's say they pursue a rental so as to have funds left to invest. Well, wait a minute - additional demand for rentals raises the prices of renting, which consume much of that 'discretionary' or investable money. Now, due to these new realities, many aren't able to both rent and invest, let alone buy and invest.

I understand this is anecdotal, but is this not a typical story these days?

For a week or so, we (left vs center) can’t agree that interest is significant to this discussion, often represents triple or quadruple the cost of the house, and the higher rates of the 80s and early 90s make comparing housing costs from other generations difficult and something the younger and left leaning media typically ignores in its analysis.This makes it even more complex when interest is ignored, AND media attempts to compare to “wages.” Some wages have done great, but a lot of aggregate stats are dragged down by the fact lower wage workers have been hit hard by the slow growth of minimum wage. But using that unfortunate reality to leverage a wider argument about industries where wages have done well is a trick of the media.0 -

Sounds like my story and many of my millennial peersbenjs said:

In my generation, my few peers owning homes in urban environments talk about being "house poor" - meaning that they are forgoing most (if not all) discretionary pleasures for a decent amount of time, in order to own a house, because their mortgage payments are high enough to consume discretionary funds, and the down payment requirements up-front are quite large. This isn't new - that's been the case for a long time.static111 said:

What does 40 years have to do with anything. The price of entry is higher than it has ever been. What once a construction worker and waitress could afford at 12% is out of reach of dual income degrees households at 6% because the starting costs are sky fucking high. I don't know where to take the conversation from there. When home costs out paced wage growth and renting became cheaper than buying the system became fucked. No matter how good the stock market is housing in America is fucked and if people can't afford to own the same quality of home that their dead beat parents bought people stop giving a shit.Lerxst1992 said:Halifax2TheMax said:Lerxst1992 said:

Lying? Where does your ai excerpt say that?Are you capable of reasoned debate and discussion?Halifax2TheMax said:Lerxst1992 said:Tim Simmons said:Bari Weiss is a grifter. Was severely dunked on for bad takes, got butthurt about it, and failed upward. Congrats on her new job of making news for olds

She is lying about why she left the times? I mean, you don’t see what she says happened to her right here on this forum?It’s not a joke that you can watch your budget and come up with $48 per week and use the tax tools currently available to solve the affordability problem and build wealth without resorting to socialism in nyc? Or that housing costs now are actually very comparable to the 80s and 90s? We can’t even have a reasonable discussion about that on this forum without centrists being ridiculed.

But it’s the conservatives that are stupid.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

AI tells me that you’re lying.U.S. housing costs have increased dramatically by decade, with prices rising faster than wages, leading to greater unaffordability. For example, the median U.S. home price rose from $47,200 in 1980 to $119,600 in 2000 and $416,900 by 2025, while the median household income grew at a slower rate. This trend is reflected in the rising price-to-income ratio, which measures how many years of median income it takes to buy a home.Historical Home Prices and Income Trends- 1980s:The median home price was $47,200 in 1980 and rose to $82,800 by the mid-1980s, with a price-to-income ratio of 3.51 in 1985.

- 1990s:The median sales price increased to $119,600 by 2000, after reaching $79,100 in 1990.

- 2000s:A significant increase occurred, with the median home price in 2005 reaching $232,500, followed by a decline in the latter half of the decade.

- 2010s:Prices began to rebound after hitting a low in 2012, eventually increasing by about 5% annually over the decade.

- 2020s:Prices saw substantial growth, with the median home price reaching approximately $416,900 by 2025, an increase of about 25% in just three years (2020-2023).

after going back and forth multiple times, and I point out repeatedly how important mortgage rates are in the determination of housing cost, is this comment of yours honest? AI disagrees…

…

” It's a massive omission to ignore interest rates in the calculation of total housing costs, potentially leading to an extremely inaccurate and misleading figure. For most homeowners who use a mortgage, interest payments make up a substantial portion—often the largest single component—of their total expense over the life of the loan.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

You used the interest rate from 1985 on the housing cost of 2025, while using the interest rate of today on today’s housing cost, and a 40 year mortgage. This comparison somehow shows that millennials can afford a $400K+ house for only $200K+. Bunk.

Your math is fuzzy. Got a stock tip?

I never said that bit about the 200k, you are twisting words to feed your lame jokes and put downs. What I was likely talking about was the time value of money which apparently is not a concept understood on this forum, unless Matt ever comes back

Static at least had the courage to provide their own mathematics ( which was almost perfect) calculating total mortgage costs for the average price of a home 1985 versus 2025 using the applicable interest rate for each year, applied against the home price for each, the one thing they did not do was account for the 40 years time difference. Of course they refused to continue the discussion once I pointed out what it was missing. Once doing that the present value of both mortgage streams are extremely similar.

Tip?

I knew all about Larry Ellison before Matt Cameron joined this band. There's your tip.

But, when real estate prices are disproportionately higher compared to wages, a huge chunk of an urban population is priced out of purchases (i.e. the majority of my peers), so let's say they pursue a rental so as to have funds left to invest. Well, wait a minute - additional demand for rentals raises the prices of renting, which consume much of that 'discretionary' or investable money. Now, due to these new realities, many aren't able to both rent and invest, let alone buy and invest.

I understand this is anecdotal, but is this not a typical story these days?Scio me nihil scire

There are no kings inside the gates of eden0 -

Im actually enjoying this discussion, but maybe lets keep it on one thread so we dont piss off everyone else. Maybe we can start a nee thread. Bill Maher and the Housing Crisis in America. That way it will sound like its bills faultLerxst1992 said:

I apologize the result of this debate has evolved to different threads. Maybe discussing economics from a “textbook” or “industry” point of view adds value to a political forum??static111 said:

What does 40 years have to do with anything. The price of entry is higher than it has ever been. What once a construction worker and waitress could afford at 12% is out of reach of dual income degrees households at 6% because the starting costs are sky fucking high. I don't know where to take the conversation from there. When home costs out paced wage growth and renting became cheaper than buying the system became fucked. No matter how good the stock market is housing in America is fucked and if people can't afford to own the same quality of home that their dead beat parents bought people stop giving a shit.Lerxst1992 said:Halifax2TheMax said:Lerxst1992 said:

Lying? Where does your ai excerpt say that?Are you capable of reasoned debate and discussion?Halifax2TheMax said:Lerxst1992 said:Tim Simmons said:Bari Weiss is a grifter. Was severely dunked on for bad takes, got butthurt about it, and failed upward. Congrats on her new job of making news for olds

She is lying about why she left the times? I mean, you don’t see what she says happened to her right here on this forum?It’s not a joke that you can watch your budget and come up with $48 per week and use the tax tools currently available to solve the affordability problem and build wealth without resorting to socialism in nyc? Or that housing costs now are actually very comparable to the 80s and 90s? We can’t even have a reasonable discussion about that on this forum without centrists being ridiculed.

But it’s the conservatives that are stupid.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

AI tells me that you’re lying.U.S. housing costs have increased dramatically by decade, with prices rising faster than wages, leading to greater unaffordability. For example, the median U.S. home price rose from $47,200 in 1980 to $119,600 in 2000 and $416,900 by 2025, while the median household income grew at a slower rate. This trend is reflected in the rising price-to-income ratio, which measures how many years of median income it takes to buy a home.Historical Home Prices and Income Trends- 1980s:The median home price was $47,200 in 1980 and rose to $82,800 by the mid-1980s, with a price-to-income ratio of 3.51 in 1985.

- 1990s:The median sales price increased to $119,600 by 2000, after reaching $79,100 in 1990.

- 2000s:A significant increase occurred, with the median home price in 2005 reaching $232,500, followed by a decline in the latter half of the decade.

- 2010s:Prices began to rebound after hitting a low in 2012, eventually increasing by about 5% annually over the decade.

- 2020s:Prices saw substantial growth, with the median home price reaching approximately $416,900 by 2025, an increase of about 25% in just three years (2020-2023).

after going back and forth multiple times, and I point out repeatedly how important mortgage rates are in the determination of housing cost, is this comment of yours honest? AI disagrees…

…

” It's a massive omission to ignore interest rates in the calculation of total housing costs, potentially leading to an extremely inaccurate and misleading figure. For most homeowners who use a mortgage, interest payments make up a substantial portion—often the largest single component—of their total expense over the life of the loan.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

You used the interest rate from 1985 on the housing cost of 2025, while using the interest rate of today on today’s housing cost, and a 40 year mortgage. This comparison somehow shows that millennials can afford a $400K+ house for only $200K+. Bunk.

Your math is fuzzy. Got a stock tip?

I never said that bit about the 200k, you are twisting words to feed your lame jokes and put downs. What I was likely talking about was the time value of money which apparently is not a concept understood on this forum, unless Matt ever comes back

Static at least had the courage to provide their own mathematics ( which was almost perfect) calculating total mortgage costs for the average price of a home 1985 versus 2025 using the applicable interest rate for each year, applied against the home price for each, the one thing they did not do was account for the 40 years time difference. Of course they refused to continue the discussion once I pointed out what it was missing. Once doing that the present value of both mortgage streams are extremely similar.

Tip?

I knew all about Larry Ellison before Matt Cameron joined this band. There's your tip.

The total costs of the two examples for the math you provided are 40 years apart. $100 from 40 years ago is worth more than it is today. Hopefully we can agree to understand how those two costs relate to each other we need to account for the difference in time? It’s an expansive topic in both finance and economics. Per google…

…

” The Time Value of Money (TVM) compares costs from different years by discounting future costs back to their present value to account for the lost earning potential (opportunity cost) and inflation that reduces future money's purchasing power. Using a formula, TVM calculates how much a future sum of money would be worth in today's dollars, allowing for a direct comparison of costs across different time periods.How TVM Works- Opportunity Cost:Money received today can be invested to earn a return. By delaying receiving money, you lose the potential to earn interest or investment gains, which is the opportunity cost.

- Inflation:The cost of goods and services increases over time due to inflation, meaning that a specific amount of money in the future will buy less than it does today. This erosion of purchasing power is a key reason why future money is worth less than present money.

- Discounting:To compare costs from different years, you "discount" a future cost to its present value. This means you calculate what that future cost is equivalent to in today's terms, using a discount rate (often related to inflation or investment returns).

ExampleImagine you're comparing a cost from last year to an estimated cost for next year.- A product that cost $100 last year might cost $103 next year due to a 3% inflation rate.

- The concept of the Time Value of Money recognizes that receiving $100 today is more valuable than receiving $100 next year because you could have invested it and earned interest. Conversely, if a future cost is $100, its present value will be less than $100 because of this lost earning potential and reduced purchasing power.

In PracticeWhen comparing costs from different years, you would use the TVM to:- Find the Present Value (PV):This is the value of a future amount of money in today's dollars. The formula is often expressed as, where FV is the future value, r is the discount rate, and n is the number of periods.PV=FV/(1+r)n

- Account for inflation:The discount rate (r) often reflects the expected rate of inflation and potential returns on investment, giving a realistic measure of what money will be worth in the future.

- Make Informed Decisions:By converting all costs to their present values, you can make more informed financial decisions, such as budgeting for future expenses or evaluating investment opportunities.

Scio me nihil scire

There are no kings inside the gates of eden0 -

This is textbook fascist dictatorship.josevolution said:Trump calls for jailing Democratic leaders as troops prepare for Chicago deployment - https://www.reuters.com/world/us/trump-calls-chicago-mayor-illinois-governor-be-jailed-2025-10-08/

so onto incarceration of elected officials

Something that ALL Americans should rise up against.

Unfortunately way too many "Americans" support this.

Some of whom post on here.0 -

Response generated by ChatGPT 5:Lerxst1992 said:

Housing costs are brutal. The history of this forum disagreement is someone a week or so ago posted an article that said “look at how much more expensive housing is today than 1985.” But the article also pointed out that interest rates are nearly half now vs then.benjs said:

In my generation, my few peers owning homes in urban environments talk about being "house poor" - meaning that they are forgoing most (if not all) discretionary pleasures for a decent amount of time, in order to own a house, because their mortgage payments are high enough to consume discretionary funds, and the down payment requirements up-front are quite large. This isn't new - that's been the case for a long time.static111 said:

What does 40 years have to do with anything. The price of entry is higher than it has ever been. What once a construction worker and waitress could afford at 12% is out of reach of dual income degrees households at 6% because the starting costs are sky fucking high. I don't know where to take the conversation from there. When home costs out paced wage growth and renting became cheaper than buying the system became fucked. No matter how good the stock market is housing in America is fucked and if people can't afford to own the same quality of home that their dead beat parents bought people stop giving a shit.Lerxst1992 said:Halifax2TheMax said:Lerxst1992 said:

Lying? Where does your ai excerpt say that?Are you capable of reasoned debate and discussion?Halifax2TheMax said:Lerxst1992 said:Tim Simmons said:Bari Weiss is a grifter. Was severely dunked on for bad takes, got butthurt about it, and failed upward. Congrats on her new job of making news for olds

She is lying about why she left the times? I mean, you don’t see what she says happened to her right here on this forum?It’s not a joke that you can watch your budget and come up with $48 per week and use the tax tools currently available to solve the affordability problem and build wealth without resorting to socialism in nyc? Or that housing costs now are actually very comparable to the 80s and 90s? We can’t even have a reasonable discussion about that on this forum without centrists being ridiculed.

But it’s the conservatives that are stupid.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

AI tells me that you’re lying.U.S. housing costs have increased dramatically by decade, with prices rising faster than wages, leading to greater unaffordability. For example, the median U.S. home price rose from $47,200 in 1980 to $119,600 in 2000 and $416,900 by 2025, while the median household income grew at a slower rate. This trend is reflected in the rising price-to-income ratio, which measures how many years of median income it takes to buy a home.Historical Home Prices and Income Trends- 1980s:The median home price was $47,200 in 1980 and rose to $82,800 by the mid-1980s, with a price-to-income ratio of 3.51 in 1985.

- 1990s:The median sales price increased to $119,600 by 2000, after reaching $79,100 in 1990.

- 2000s:A significant increase occurred, with the median home price in 2005 reaching $232,500, followed by a decline in the latter half of the decade.

- 2010s:Prices began to rebound after hitting a low in 2012, eventually increasing by about 5% annually over the decade.

- 2020s:Prices saw substantial growth, with the median home price reaching approximately $416,900 by 2025, an increase of about 25% in just three years (2020-2023).

after going back and forth multiple times, and I point out repeatedly how important mortgage rates are in the determination of housing cost, is this comment of yours honest? AI disagrees…

…

” It's a massive omission to ignore interest rates in the calculation of total housing costs, potentially leading to an extremely inaccurate and misleading figure. For most homeowners who use a mortgage, interest payments make up a substantial portion—often the largest single component—of their total expense over the life of the loan.* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

You used the interest rate from 1985 on the housing cost of 2025, while using the interest rate of today on today’s housing cost, and a 40 year mortgage. This comparison somehow shows that millennials can afford a $400K+ house for only $200K+. Bunk.

Your math is fuzzy. Got a stock tip?

I never said that bit about the 200k, you are twisting words to feed your lame jokes and put downs. What I was likely talking about was the time value of money which apparently is not a concept understood on this forum, unless Matt ever comes back

Static at least had the courage to provide their own mathematics ( which was almost perfect) calculating total mortgage costs for the average price of a home 1985 versus 2025 using the applicable interest rate for each year, applied against the home price for each, the one thing they did not do was account for the 40 years time difference. Of course they refused to continue the discussion once I pointed out what it was missing. Once doing that the present value of both mortgage streams are extremely similar.

Tip?

I knew all about Larry Ellison before Matt Cameron joined this band. There's your tip.

But, when real estate prices are disproportionately higher compared to wages, a huge chunk of an urban population is priced out of purchases (i.e. the majority of my peers), so let's say they pursue a rental so as to have funds left to invest. Well, wait a minute - additional demand for rentals raises the prices of renting, which consume much of that 'discretionary' or investable money. Now, due to these new realities, many aren't able to both rent and invest, let alone buy and invest.

I understand this is anecdotal, but is this not a typical story these days?

For a week or so, we (left vs center) can’t agree that interest is significant to this discussion, often represents triple or quadruple the cost of the house, and the higher rates of the 80s and early 90s make comparing housing costs from other generations difficult and something the younger and left leaning media typically ignores in its analysis.This makes it even more complex when interest is ignored, AND media attempts to compare to “wages.” Some wages have done great, but a lot of aggregate stats are dragged down by the fact lower wage workers have been hit hard by the slow growth of minimum wage. But using that unfortunate reality to leverage a wider argument about industries where wages have done well is a trick of the media.

"Each time housing affordability comes up, someone points out that interest rates were far higher in the 1980s. It’s true — mortgages above 12% were common. But that point misses the forest for the trees. High rates back then applied to homes that cost a fraction of what they do today.A house purchased in 1985 often sold for around three or four times the median household income. Today, in many cities, it’s eight to ten times. Even with lower interest, the math simply doesn’t balance out — especially once you add in property taxes, insurance, maintenance, and the near-universal expectation of dual incomes.

The deeper issue is how cheap credit reshaped the market itself. Instead of making homes more affordable, decades of low rates allowed prices to inflate dramatically. Borrowing capacity rose faster than wages, so demand pushed up prices far beyond what middle-income earners could sustain. The very policies meant to encourage homeownership ended up pricing out the next generation.

Meanwhile, wage growth has diverged sharply. A handful of high-paying industries have surged, but the broad middle has stagnated. When commentators say “aggregate wage data exaggerates the problem,” they overlook that the middle class is the problem — it’s where the collapse in affordability hits hardest.

So while it’s fair to note that interest rates shape total home costs, it’s misleading to suggest today’s buyers are exaggerating their struggle. For their parents, high interest was temporary; for their children, high principal is permanent."

'05 - TO, '06 - TO 1, '08 - NYC 1 & 2, '09 - TO, Chi 1 & 2, '10 - Buffalo, NYC 1 & 2, '11 - TO 1 & 2, Hamilton, '13 - Buffalo, Brooklyn 1 & 2, '15 - Global Citizen, '16 - TO 1 & 2, Chi 2

EV

Toronto Film Festival 9/11/2007, '08 - Toronto 1 & 2, '09 - Albany 1, '11 - Chicago 10 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

“A trick of the media.”

All you need to know.

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

https://www.redfin.com/neighborhood/219261/NY/New-York/Long-Island/housing-marketCrazy how expensive it is I don’t know too many folks that make enough to afford to buy!jesus greets me looks just like me ....0

-

Am I correct in that 15% of 750 is over 100k for a down payment that would leave you with a mortgage of over 500kjesus greets me looks just like me ....0

-

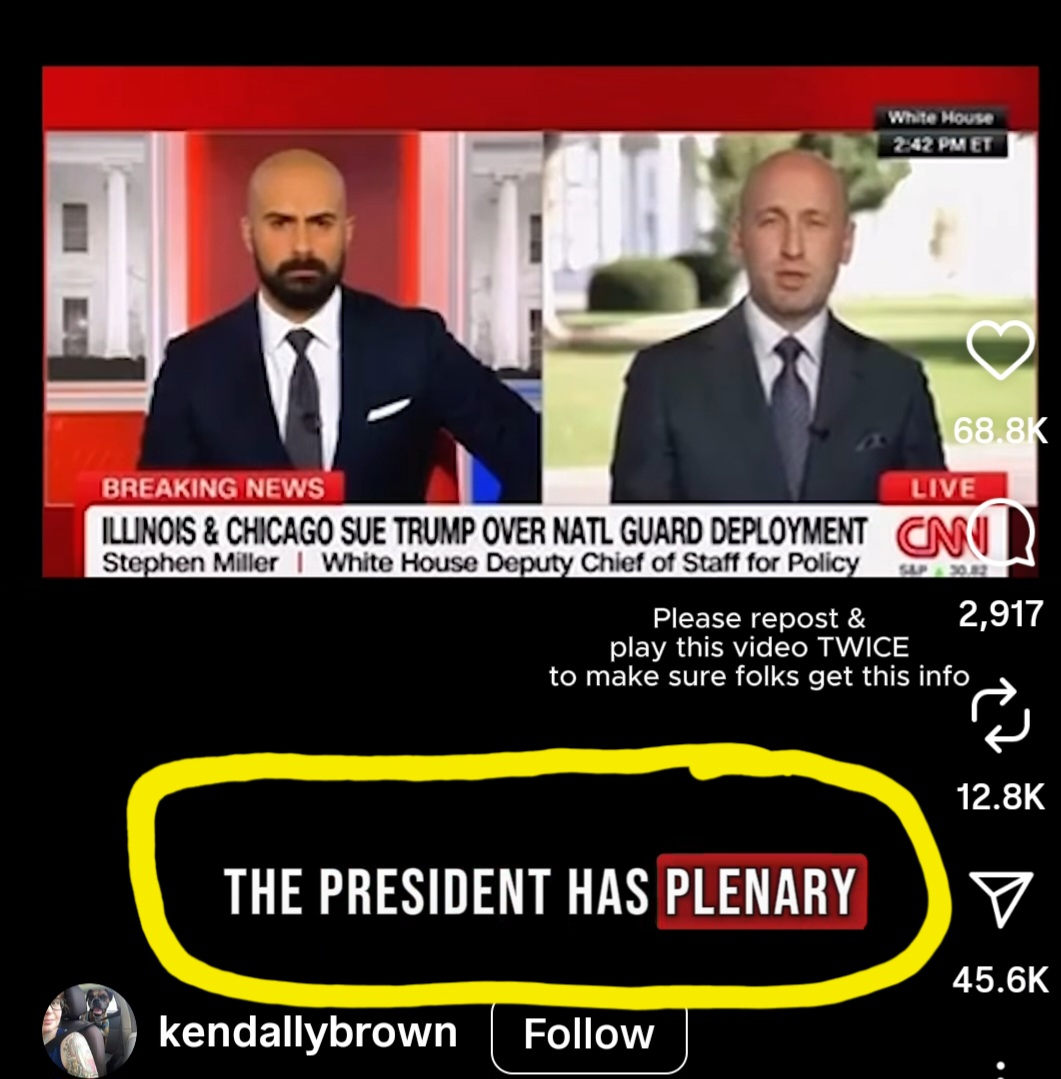

Clearly even notzee wannabe herr miller knows the wh is moving towards a fascist dictatorship.

https://www.instagram.com/reel/DPhvnJhCVoW/?igsh=eGpwNXp4NTV4Nm9l

0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

‘Murikkka, land of the free. Sure. And don’t know if everyone caught it but Kristi Gnome claimed that they’ve arrested the girlfriend of the leader of antiiiiiiifa and as they torture, oops I mean, question, oops I mean prosecute her, they’ll be lead to the leader and the financiers and the members in the street because they’re going to dismantle antiiiiiiiiiiifa brick by brick because we’re coming for you. She said this shouting during a cabinet meeting. I look forward to the indictments and our streets being free of antiiiiiiifa. Compared them to Hamas, you know same-same. Good fucking luck. But really, what you should be worried about is whether AOC is married or Mamdani’s government owned grocery stores and free public busses.

US anti-fascism expert blocked from flying to Spain at airport

Rutgers University professor who published book on antifa was informed at boarding gate that his trip was cancelled

A Rutgers University professor who taught a course on anti-fascism was blocked from leaving the US for Spain on Wednesday night, according to media reports, hours after Donald Trump hosted a White House roundtable highlighting the impact of antifa – or “anti-fascist” – far-left activists.

Mark Bray, an historian who published the 2017 book Antifa: The Anti-Fascist Handbook, and has taught courses on anti-fascism at the New Jersey university, was attempting to board a plane at Newark airport bound for Europe when he was informed at the boarding gate that the reservations for him and his family had been cancelled.

The professor, nicknamed “Dr Antifa” by a group of students, had said he was moving to Europe after receiving death threats. Turning Point USA activists have claimed he is a “financier” for the leftwing movement.

“‘Someone’ cancelled my family’s flight out of the country at the last second,” Bray posted on Bluesky social media. “We got our boarding passes. We checked our bags. Went through security. Then at our gate our reservation ‘disappeared.’”

A petition calling for his removal from the university had been launched in the weeks following the assassination of the Turning Point USA founder Charlie Kirk and Bray’s home address was revealed on social media.

One threat included a vow to kill him in front of his students, according to the Washington Post. The threats led to Bray’s decision to relocate to Spain with his wife and two children and to continue to teach his students remotely.

“Since my family and I do not feel safe in our home at the moment, we are moving for the year to Europe,” Bray said in an email to students on Sunday. “Truly I am so bummed about not being able to spend time with you all in the classroom.”

Bray told the New York Times earlier on Wednesday that “my role in this is as a professor. I’ve never been part of an antifa group, and I’m not currently.” But he added that “there’s an effort underway to paint me as someone who is doing the things that I’ve researched, but that couldn’t be further from the truth.”

Bray told the outlet that the family were rebooked for Thursday evening but were in the dark about why the earlier booking had been cancelled. “I may sound conspiratorial, but I don’t think it is a coincidence,” he said. “We’re at a hotel and we’re just going to try again.”

After Kirk’s assassination, the rightwing influencer Jack Posobiec called Bray a “domestic terrorist professor” on X. The Rutgers chapter of Turning Point USA then circulated a petition that accused the professor of being an “outspoken, well-known antifa member” and called for his dismissal.

The Rutgers chapter of Turning Point USA has said it does not support harassment or doxing, but Bray is on a list of academics the group identifies as advancing left-leaning classroom propaganda.

“Do you want to become a socialist? If so, make sure to pay this professor a visit!!!! All jokes aside help us report this professor who has ties to Antifa which now is designated as a domestic terrorist organization,” the Rutgers chapter posted on Instagram several days ago.

In a statement, Rutgers said it did not comment on personnel or student conduct matters.

“Rutgers University is committed to providing a secure environment – to learn, teach, work and research – where all members of our community can share their opinions without fear of intimidation or harassment,” it added.

https://www.theguardian.com/us-news/2025/oct/09/anti-fascism-mark-bray-rutgers-university

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.Yup, nothing to see here. Everything is fine, just fine. Plus, he won’t live that long. No worries.

Steve Bannon says ‘there is a plan’ for Trump to be president in 2028: ‘We had longer odds in 2016 and 2024’

‘Trump is going to be president in ‘28,’ vows former Trump advisor, who claims winning a third term could be easier than previous electoral victorieshttps://www.independent.co.uk/news/world/americas/us-politics/steve-bannon-trump-third-term-b2851461.html

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

As if you need convincing. From Letter From An American.

Trump appears to want the world to conform to his ideology in foreign affairs as well as in the domestic sphere, claiming the ultimate power over life and death without regard to the rule of law. When a reporter asked him yesterday why he didn’t ask Congress for a declaration of war against those South American drug cartels he claims are at war with the United States, Trump answered: “Well, I don’t think we’re gonna necessarily ask for a declaration of war, I think we’re just gonna kill people that are bringing drugs into our country. OK? We're going to kill them. You know? They're going to be, like dead. OK?"

And, today the Department of Justice announced it will monitor polling sites in six jurisdictions in the upcoming November 4 elections. The observers will go to California and New Jersey, two Democratic-dominated states that will be holding elections with national consequences.Post edited by Halifax2TheMax on09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.CCOOTWH threatening to withhold federal dollars to NYC if Mamdani the bus driver gets elected. Talk about a fascist trying to interfere with a democratic process. Might as well ask Putin on the ritz to nuke NYC if Mamdani wins with a promise not to retaliate. What a beacon of shining light on a hill. Proud?09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

* The following opinion is mine and mine alone and does not represent the views of my family, friends, government and/or my past, present or future employer. US Department of State: 1-888-407-4747.

A “1939 moment “. Interesting choice of words, Herr Pigseth.

https://www.instagram.com/reel/DQzZ4VcjkcO/?igsh=MXF4dDBjaWxkOTc4ag==09/15/1998 & 09/16/1998, Mansfield, MA; 08/29/00 08/30/00, Mansfield, MA; 07/02/03, 07/03/03, Mansfield, MA; 09/28/04, 09/29/04, Boston, MA; 09/22/05, Halifax, NS; 05/24/06, 05/25/06, Boston, MA; 07/22/06, 07/23/06, Gorge, WA; 06/27/2008, Hartford; 06/28/08, 06/30/08, Mansfield; 08/18/2009, O2, London, UK; 10/30/09, 10/31/09, Philadelphia, PA; 05/15/10, Hartford, CT; 05/17/10, Boston, MA; 05/20/10, 05/21/10, NY, NY; 06/22/10, Dublin, IRE; 06/23/10, Northern Ireland; 09/03/11, 09/04/11, Alpine Valley, WI; 09/11/11, 09/12/11, Toronto, Ont; 09/14/11, Ottawa, Ont; 09/15/11, Hamilton, Ont; 07/02/2012, Prague, Czech Republic; 07/04/2012 & 07/05/2012, Berlin, Germany; 07/07/2012, Stockholm, Sweden; 09/30/2012, Missoula, MT; 07/16/2013, London, Ont; 07/19/2013, Chicago, IL; 10/15/2013 & 10/16/2013, Worcester, MA; 10/21/2013 & 10/22/2013, Philadelphia, PA; 10/25/2013, Hartford, CT; 11/29/2013, Portland, OR; 11/30/2013, Spokane, WA; 12/04/2013, Vancouver, BC; 12/06/2013, Seattle, WA; 10/03/2014, St. Louis. MO; 10/22/2014, Denver, CO; 10/26/2015, New York, NY; 04/23/2016, New Orleans, LA; 04/28/2016 & 04/29/2016, Philadelphia, PA; 05/01/2016 & 05/02/2016, New York, NY; 05/08/2016, Ottawa, Ont.; 05/10/2016 & 05/12/2016, Toronto, Ont.; 08/05/2016 & 08/07/2016, Boston, MA; 08/20/2016 & 08/22/2016, Chicago, IL; 07/01/2018, Prague, Czech Republic; 07/03/2018, Krakow, Poland; 07/05/2018, Berlin, Germany; 09/02/2018 & 09/04/2018, Boston, MA; 09/08/2022, Toronto, Ont; 09/11/2022, New York, NY; 09/14/2022, Camden, NJ; 09/02/2023, St. Paul, MN; 05/04/2024 & 05/06/2024, Vancouver, BC; 05/10/2024, Portland, OR; 05/03/2025, New Orleans, LA;

Libtardaplorable©. And proud of it.

Brilliantati©0 -

from September....The Admiral

Autocracy in America

Duration: 43:01

Published: Fri, 26 Sep 2025 10:00:00 -0000

Media: https://chrt.fm/track/B6G873/traffic.megaphone.fm/ATL6885170549.mp3?updated=1758828528

Podcast: https://www.podcastrepublic.net/podcast/1763234285

<p>Despite growing up in the Soviet Union, host Garry Kasparov admired American values—believing America was one of the good guys. But is that still the case? </p>

<p>In the final episode of the secon...

Subscribe to this podcast: https://feeds.megaphone.fm/autocracyinamerica

----

Sent from Podcast Republic 25.11.3R

https://play.google.com/store/apps/details?id=com.itunestoppodcastplayer.app_____________________________________SIGNATURE________________________________________________

Not today Sir, Probably not tomorrow.............................................. bayfront arena st. pete '94

you're finally here and I'm a mess................................................... nationwide arena columbus '10

memories like fingerprints are slowly raising.................................... first niagara center buffalo '13

another man ..... moved by sleight of hand...................................... joe louis arena detroit '140

Categories

- All Categories

- 149.1K Pearl Jam's Music and Activism

- 110.3K The Porch

- 284 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help