Senate GOP to oppose Obama tax plan

gimmesometruth27

St. Fuckin Louis Posts: 25,307

this just goes to show you who the senate GOP is representing and pandering to. if you are in the 98% whose tax cuts are being held hostage by the senate GOP, how can you support or vote for them again? i can see why you would if you were in the top 2% of wage earners, but if you are middle class like me i just don't see it. so because they want tax cuts for the wealthiest 2% they will allow taxes to be raised on the lower and middle classes. and don't give me any excuse like "the rich create the jobs" because where are those jobs now? they have created nothing with those tax cuts...

GOP spokesman: Senate GOP to oppose Obama tax plan

http://news.yahoo.com/s/ap/20100913/ap_ ... s_tax_cuts

WASHINGTON – Senate Republicans will oppose any effort to renew soon-to-expire Bush administration tax cuts if upper income taxpayers are excluded from the reductions.

A spokesman for Senate GOP Leader Mitch McConnell said Monday that every Senate Republican has pledged to oppose President Barack Obama's tax-cutting plan. Obama would renew the tax cuts for most people, but let the top income tax rate rise back to almost 40 percent on family or small business income over $250,000.

McConnell has said a bill extending the tax cuts for only low- and middle-income earners cannot pass the Senate. Forty-one senators can block a bill with a filibuster, but McConnell spokesman Don Stewart declined to say whether all 41 Republicans would support a filibuster.

At issue is a year-end deadline to renew a variety of tax cuts enacted in 2001 — when the federal government was running a surplus.

On Sunday, House GOP Leader John Boehner said he would support renewing tax cuts for the middle class but not the wealthy if that was his only choice.

Democrats are worried that November elections could hand the GOP control of the House and perhaps the Senate. The White House and its Democratic allies hope to use the tax-cut fight to cast themselves as defenders of the middle class and Republicans as a party eager to revive the days of the still unpopular former President George W. Bush.

"We're going to take the next 50-some days to convince the public that's exactly what the Republicans would do — back to the Bush policies," said White House Press Secretary Robert Gibbs Gibbs said on NBC's "Today" show.

Gibbs said the middle class should not be used as a political football by Republicans maneuvering to give tax cuts to wealthy taxpayers, who he said don't need the reductions. Republicans say paring taxes for the wealthy would encourage them and the businesses they operate to create jobs.

Congressional analysts say renewing the tax cuts for everyone would cost the government $4 trillion over the next decade. With polls showing a broad public anger over spiraling federal deficits, Obama wants to exclude individuals earning over $200,000 and couples making over $250,000 — who account for $700 billion of that total.

"That's a debate we're happy to have," McConnell told the Washington Post. "That's the kind of debate that unifies my caucus."

Democrats aren't unified behind Obama and their House and Senate leaders. Several Senate Democrats say they would like all of the Bush tax cuts to be extended for another year or two as the economy slowly recovers from the recession.

"I don't think it makes sense to raise any federal taxes during the uncertain economy we are struggling through," Sen. Joe Lieberman, a Connecticut independent who aligns with Democrats, said Monday. "The more money we leave in private hands, the quicker our economic recovery will be. And that means I will do everything I can to make sure Congress extends the so-called Bush tax cuts for another year."

Treasury Secretary Timothy Geithner on Monday also called on Congress to move quickly to extend the tax cuts.

Geithner and the administration have tried to make the case that conditions would have been worse without Obama's economic policies, including the $814 billion stimulus package. Geithner said that a return to Republican policies would put the economic recovery in jeopardy.

"We can't afford to go back to the policies of the past decade when we passed large tax cuts for the wealthiest Americans without paying for them and saw little impact on job creation and years of stagnation in middle class wages," he said.

Republicans say the level of spending undertaken by the Obama administration has done little to boost the economy. Instead, it has increased the deficit to unsustainable levels, they say.

GOP spokesman: Senate GOP to oppose Obama tax plan

http://news.yahoo.com/s/ap/20100913/ap_ ... s_tax_cuts

WASHINGTON – Senate Republicans will oppose any effort to renew soon-to-expire Bush administration tax cuts if upper income taxpayers are excluded from the reductions.

A spokesman for Senate GOP Leader Mitch McConnell said Monday that every Senate Republican has pledged to oppose President Barack Obama's tax-cutting plan. Obama would renew the tax cuts for most people, but let the top income tax rate rise back to almost 40 percent on family or small business income over $250,000.

McConnell has said a bill extending the tax cuts for only low- and middle-income earners cannot pass the Senate. Forty-one senators can block a bill with a filibuster, but McConnell spokesman Don Stewart declined to say whether all 41 Republicans would support a filibuster.

At issue is a year-end deadline to renew a variety of tax cuts enacted in 2001 — when the federal government was running a surplus.

On Sunday, House GOP Leader John Boehner said he would support renewing tax cuts for the middle class but not the wealthy if that was his only choice.

Democrats are worried that November elections could hand the GOP control of the House and perhaps the Senate. The White House and its Democratic allies hope to use the tax-cut fight to cast themselves as defenders of the middle class and Republicans as a party eager to revive the days of the still unpopular former President George W. Bush.

"We're going to take the next 50-some days to convince the public that's exactly what the Republicans would do — back to the Bush policies," said White House Press Secretary Robert Gibbs Gibbs said on NBC's "Today" show.

Gibbs said the middle class should not be used as a political football by Republicans maneuvering to give tax cuts to wealthy taxpayers, who he said don't need the reductions. Republicans say paring taxes for the wealthy would encourage them and the businesses they operate to create jobs.

Congressional analysts say renewing the tax cuts for everyone would cost the government $4 trillion over the next decade. With polls showing a broad public anger over spiraling federal deficits, Obama wants to exclude individuals earning over $200,000 and couples making over $250,000 — who account for $700 billion of that total.

"That's a debate we're happy to have," McConnell told the Washington Post. "That's the kind of debate that unifies my caucus."

Democrats aren't unified behind Obama and their House and Senate leaders. Several Senate Democrats say they would like all of the Bush tax cuts to be extended for another year or two as the economy slowly recovers from the recession.

"I don't think it makes sense to raise any federal taxes during the uncertain economy we are struggling through," Sen. Joe Lieberman, a Connecticut independent who aligns with Democrats, said Monday. "The more money we leave in private hands, the quicker our economic recovery will be. And that means I will do everything I can to make sure Congress extends the so-called Bush tax cuts for another year."

Treasury Secretary Timothy Geithner on Monday also called on Congress to move quickly to extend the tax cuts.

Geithner and the administration have tried to make the case that conditions would have been worse without Obama's economic policies, including the $814 billion stimulus package. Geithner said that a return to Republican policies would put the economic recovery in jeopardy.

"We can't afford to go back to the policies of the past decade when we passed large tax cuts for the wealthiest Americans without paying for them and saw little impact on job creation and years of stagnation in middle class wages," he said.

Republicans say the level of spending undertaken by the Obama administration has done little to boost the economy. Instead, it has increased the deficit to unsustainable levels, they say.

"You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."

"Well, you tell him that I don't talk to suckas."

Post edited by Unknown User on

0

Comments

-

unsung I stopped by on March 7 2024. First time in many years, had to update payment info. Hope all is well. Politicians suck. Bye. Posts: 9,487The answer is to stop spending, NOT raise taxes.0

unsung I stopped by on March 7 2024. First time in many years, had to update payment info. Hope all is well. Politicians suck. Bye. Posts: 9,487The answer is to stop spending, NOT raise taxes.0 -

stop spending where? the problem is neither side can agree where to begin. i have my own ideas, but they don't really matter since i am not making policy...unsung wrote:The answer is to stop spending, NOT raise taxes."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

This is generally my position as well, though I have to admit I'm not as familiar with the specifics of the Obama plan as I should be. My biggest concern would be how the plan defines the "wealthiest" Americans and whether that includes small business owners that don't file as a corporation. Whether gimmesometruth wants to believe it or not, that is where the majority of job creation comes from. Perhaps not top-paying employment, but let's face it, we can't all be rock stars.unsung wrote:The answer is to stop spending, NOT raise taxes.0 -

Anywhere, everywhere. The amount of waste in federally-run programs -- even in the small slices that I have a direct view into -- is mind-boggling.gimmesometruth27 wrote:

stop spending where? the problem is neither side can agree where to begin. i have my own ideas, but they don't really matter since i am not making policy...unsung wrote:The answer is to stop spending, NOT raise taxes.0 -

the wealthiest individuals are defined as any individual making over $250,000 or any couple making over $400,000. these are the top 2% of all wage earners.MotoDC wrote:

This is generally my position as well, though I have to admit I'm not as familiar with the specifics of the Obama plan as I should be. My biggest concern would be how the plan defines the "wealthiest" Americans and whether that includes small business owners that don't file as a corporation. Whether gimmesometruth wants to believe it or not, that is where the majority of job creation comes from. Perhaps not top-paying employment, but let's face it, we can't all be rock stars.unsung wrote:The answer is to stop spending, NOT raise taxes.

WHERE ARE THE JOBS THAT WERE REPORTEDLY CREATED BY THESE TAX CUTS? what happened when we were hemoraging over 700,000 jobs a month under bush's last few months?? same tax cuts were in place there, yet no jobs were created. that is a bullshit talking point that the rich are the only ones create the jobs. if they were creating jobs it would be pulling us out of this recession because more people would be working. when unemployment is nearly 10%, where are the jobs that these people are allegedly creating?"You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

from 2005...

http://www.commondreams.org/headlines05/1118-02.htm

Research Dispels Bush Claims That Tax Cuts Create Jobs

by Haider Rizvi

NEW YORK - Despite considerable opposition from lawmakers, including some within his Republican party, President George W. Bush seems determined to push ahead with plans to introduce further cuts in taxes for the rich, continuing to assert that it would create more jobs for the poor.

But the findings of a new study suggest that Bush's claim on job creation is based more on political rhetoric than actual facts related to the nation's economic realities.

"It's a great sound bite that unfortunately does not hold true in the real world economy," say authors of the report, entitled, "Nothing to Be Thankful For: Tax Cuts and the Deteriorating U.S. Job Market."

Changes in tax policy suggest no evidence of their impact on job creation or destruction, according to the 22-page study released Tuesday by United for a Fair Economy (UFE), an independent group that tracks the growing economic divide between the nation's haves and have-nots.

Since 1950, significant tax increases and decreases have both been followed by job losses and job gains, say the researchers.

Based on statistical analysis of changes in tax polices and rates of job growth in the past 60 years, the report points out that tax reduction does, however, disproportionately lead to economic disparity between the rich and poor.

"No workers have really benefited from President Bush's tax policy," says Gloribell Mota, a bilingual education specialist at UFE. "But Blacks and Latinos have suffered disproportionately."

The study shows that African American unemployment remains about twice as high as that of White workers. Moreover, it indicates no sign of growth in quality jobs (defined as paying at least 16 dollars per hour and including health benefits and a pension plan) for workers from any racial background, including Whites.

Last year, one million people fell below the poverty line, a disproportionate number of them children, while the number of billionaires rose to 374, the study says, adding that the number of people living in poverty rose from 11.3 percent in 2000 to 12.7 percent in 2004.

The study also shows that the percentage of American workers benefiting from employment-based health insurance was down from 63 percent in 2000 to less than 60 percent in 2004. This despite the fact that U.S. workers are spending more than 1800 hours per year at work while their counterparts in other technologically advanced nations work for 1600 hours a year--a difference of five full work weeks.

In June 2003, the Bush administration had claimed that the president's tax cut policy would create more than five million jobs by the end of 2004, but the study shows that only 2.6 million jobs were created--1.6 million less than what would have been expected without any special economic stimulus.

"Contrary to what President Bush and his policy makers are saying, tax cuts do not automatically create jobs," said Liz Stanton, director of research at UFE and co-author of the report.

"Their policy is bankrupt," she added. "It is time to recognize that jobs are both created and destroyed during times of tax decreases."

Stanton and other researchers say the weakening of job creation during an economic recovery such as the one currently being experienced by the country is "unprecedented since the First World War."

On Tuesday, Republicans tried hard to advance their tax cut plans, but failed to muster enough support in a Senate body to extend tax cuts for capital gains and dividends beyond their planned expiration in 2008.

The Senate Finance Committee voted 14-6 to endorse a package that would cut taxes by $80 billion over five years but would omit the administration's priority of preserving reduced tax rates for investment income.

Some Republicans who voted for the bill later indicated that they would try to reinstate the extension before the legislation is debated by the full Senate or signed by the president.

Meanwhile, critics of the administration's policies are wary that millions of Americans would not be able to participate in the national feast of Thanksgiving next week.

"This is because the multiple breadwinners each family needs these days don't have jobs," said Anisha Desai, co-author of the study. "Of those that do, many are not making enough money to pay for turkey and trimmings for everybody in the family.""You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

from 2006....

http://www.faireconomy.org/press_room/2 ... b_creation

No Correlation Between Bush Tax Cuts and

Job Creation, Report Shows

"By cutting taxes on income, we helped create jobs," President Bush said in an address Friday to business executives at the Economic Club in Chicago.

BOSTON–As President Bush and his senior advisors traveled across the country this past weekend touting 2005 job growth numbers and demanding that Congress make the administration's tax cuts permanent, a study examines the administration's claim that tax cuts create jobs–and finds it without merit.

While two million jobs were created in 2005, this is 3.5 million jobs short of expectations by the President's Council of Economic Advisors, who estimate job growth at 3.1% in a normal year. Jobs grew by only 1.5% in 2005.

"The president's tax-cutting policy is a failure in regard to job creation, and we need to recognize it as such, " said Anisha Desai, program director at UFE and one of the report's co-authors. "While there is no evidence that massive tax cuts create jobs, there is considerable evidence that they contribute to economy-choking deficits."

The report reviewed administration claims that "tax cuts create jobs" and found the following:

Tax cuts have no predictable effect on employment, either in job creation or job destruction.

Since 2003, job creation has fallen millions of jobs short of the administration's promises.

The current weakness in job creation during an economic recovery is unprecedented since World War II.

The report highlighted other concerns about jobs and the economy as well. For example, the number of good quality jobs (defined as those paying at least $16 an hour, providing employer-paid health insurance, and providing a pension) has remained flat at 25% of all workers. Significant racial disparities exist: black employment is at 89.6%, compared to 95.2% for whites. And Latino workers average more than $10,000 per year less in earnings than whites, and this gap is increasing.

The report, entitled "Nothing to Be Thankful For: Tax Cuts and the Deteriorating U.S. Job Market" was co-authored by Anisha Desai, Scott Klinger, Gloribell Mota, and Liz Stanton. The authors are available for interviews by calling 617-423-2148 ext. 119, or emailing 20ckasicafaireconomy.org">ckasicafaireconomy.org. Call for hard copies.

United for a Fair Economy (www.faireconomy.org) is a national non-profit that spotlights the growing economic divide in the U.S."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

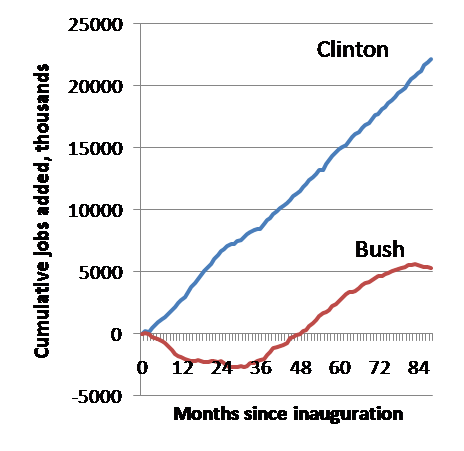

from 2008...Paul Krugman..

Job-destroying Democrats in action

Dean Baker is upset at a news report suggesting that John McCain — unlike Barack Obama! — is concerned with job creation.

I feel his pain. If there’s one thing that stands out above all over the economic record of the past 16 years, it’s the contrast between stellar employment performance under Clinton and dismal performance under Bush. You can offer various excuses and explanations, but how anyone can suggest that Republicans are more committed to and/or credible about job creation is a mystery."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

gimmesometruth27 wrote:

the wealthiest individuals are defined as any individual making over $250,000 or any couple making over $400,000. these are the top 2% of all wage earners.MotoDC wrote:

This is generally my position as well, though I have to admit I'm not as familiar with the specifics of the Obama plan as I should be. My biggest concern would be how the plan defines the "wealthiest" Americans and whether that includes small business owners that don't file as a corporation. Whether gimmesometruth wants to believe it or not, that is where the majority of job creation comes from. Perhaps not top-paying employment, but let's face it, we can't all be rock stars.unsung wrote:The answer is to stop spending, NOT raise taxes.

WHERE ARE THE JOBS THAT WERE REPORTEDLY CREATED BY THESE TAX CUTS? what happened when we were hemoraging over 700,000 jobs a month under bush's last few months?? same tax cuts were in place there, yet no jobs were created. that is a bullshit talking point that the rich are the only ones create the jobs. if they were creating jobs it would be pulling us out of this recession because more people would be working. when unemployment is nearly 10%, where are the jobs that these people are allegedly creating?

tax cuts were not responsible for the economic collapse. Nor will tax cuts alone get us out of the problem we are in as a country. If you want to blame bush for obama's problems, then you also have to blame clinton for Bush's, and then blame Bush 1 for the trouble clinton had in his early years. Keep also in mind that The contract with america crowd came in and basically forced a balanced budget on clinton.

The government doesn't create wealth nor do they create jobs. Everyone should pay the same percent of their income. Whether it be 10, 20, 30, whatever it is. Because someone has more is not a reason to take from them to give to everyone else. That is why social security is failing. People are taking out more than they put in. Doesn't work in the long run no matter what we do.that’s right! Can’t we all just get together and focus on our real enemies: monogamous gays and stem cells… - Ned Flanders

It is terrifying when you are too stupid to know who is dumb

- Joe Rogan0 -

I run/own a business myself, and let me tell you, if I got a tax cut boy the first thing I'd do, instead of keeping the extra money for myself of course, is go hire a bunch of people just out of the goodness of my heart.

"First they ignore you, then they ridicule you, then they fight you, then you win ."

"First they ignore you, then they ridicule you, then they fight you, then you win ."

"With our thoughts we make the world"0 -

gimmesometruth27 wrote:

the wealthiest individuals are defined as any individual making over $250,000 or any couple making over $400,000. these are the top 2% of all wage earners.MotoDC wrote:

This is generally my position as well, though I have to admit I'm not as familiar with the specifics of the Obama plan as I should be. My biggest concern would be how the plan defines the "wealthiest" Americans and whether that includes small business owners that don't file as a corporation. Whether gimmesometruth wants to believe it or not, that is where the majority of job creation comes from. Perhaps not top-paying employment, but let's face it, we can't all be rock stars.unsung wrote:The answer is to stop spending, NOT raise taxes.

WHERE ARE THE JOBS THAT WERE REPORTEDLY CREATED BY THESE TAX CUTS? what happened when we were hemoraging over 700,000 jobs a month under bush's last few months?? same tax cuts were in place there, yet no jobs were created. that is a bullshit talking point that the rich are the only ones create the jobs. if they were creating jobs it would be pulling us out of this recession because more people would be working. when unemployment is nearly 10%, where are the jobs that these people are allegedly creating?

Of course he doesn't belive it just look at the website he got his info from. CommonDreams.org is a national nonprofit, progressive, nonpartisan citizens' organization founded in 1997 by political activists Craig Brown. Nonpartisan?

gimmie you think $250,000 is wealthy ?

and if thats a bullshit point that the rich are the only ones that create jobs, :eh: When have you known of anybody that was broke or on wellfare to be giving interviews or hiring ?

The reason people aren't hiring anyone right now is becuse they are scared to death and don't know if there taxes are going to go up and also it has to do with the healthcare bill. People don't go into bussiness to hire people they go into bussiness to make money and then if they do make money then they can afford to hire people.Who in their right mind would commit to an expansion under the current circumstances when it could conceivably cost your company its existence!?

If your so worried about jobs then how come you haven't said anything about all the jobs that have been destyoed by obama and his reckless policies. For example the moratorium down in the gulf.

http://news.yahoo.com/s/ap/20100821/ap_ ... moratorium

http://www.instituteforenergyresearch.o ... -the-gulf/

when we have a plane crash do we stop all air trvel ? Or when we have a certain car recalled do we shut down the entire company ?

Obama is the most anti-business President in American history but he seems to relish the opportunity to enrich and empower foreign companies at the expense of American ones.

But you just keep drinkin that progressive Kool-Aid gimmie 0

0 -

i knew you are going to continue to vote for the gop because you post as if you are a partisan. you would rather vote against your own interests, but then again so would the majority of those that watch fox, because they are spoonfed that "the rich create the jobs", well where the hell are the jobs they allegedly create? they are not there. at all.. everything is spoken about in future terms "if the rich knew what they are going to pay in taxes, then they would know how many people they can hire" bullshit. if they needed workers they would hire them, make a little less profit, but still have a productive and successful business...any vote for these guys is a vote for raising your own taxes, unless you are in the richest 2%, because they are gonna let ALL of the tax cuts expire if they are allowed to expire for the rich. in that case that you are in the top 2% i say congratulations. i just think it is very childish for the senators in the gop to derail obama;s entire economic policy so that they can defend the richest 2% that have not created the jobs they keep saying they will. if the tax cuts are extended will jobs magically appear the day after the extension of the tax cuts???? the answer is a definite "no". and the articles i posted back that up. and you want to talk about obama stealing jobs? how about you try telling that to the millions a month that lost jobs under bush, because it is a significantly higher number than under obama...i expected nothing less from the party of no....prfctlefts wrote:Of course he doesn't belive it just look at the website he got his info from. CommonDreams.org is a national nonprofit, progressive, nonpartisan citizens' organization founded in 1997 by political activists Craig Brown. Nonpartisan?

gimmie you think $250,000 is wealthy ?

and if thats a bullshit point that the rich are the only ones that create jobs, :eh: When have you known of anybody that was broke or on wellfare to be giving interviews or hiring ?

The reason people aren't hiring anyone right now is becuse they are scared to death and don't know if there taxes are going to go up and also it has to do with the healthcare bill. People don't go into bussiness to hire people they go into bussiness to make money and then if they do make money then they can afford to hire people.Who in their right mind would commit to an expansion under the current circumstances when it could conceivably cost your company its existence!?

If your so worried about jobs then how come you haven't said anything about all the jobs that have been destyoed by obama and his reckless policies. For example the moratorium down in the gulf.

http://news.yahoo.com/s/ap/20100821/ap_ ... moratorium

http://www.instituteforenergyresearch.o ... -the-gulf/

when we have a plane crash do we stop all air trvel ? Or when we have a certain car recalled do we shut down the entire company ?

Obama is the most anti-business President in American history but he seems to relish the opportunity to enrich and empower foreign companies at the expense of American ones.

But you just keep drinkin that progressive Kool-Aid gimmie "You can tell the greatness of a man by what makes him angry." - Lincoln

"You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

I think the tax cut issue is a brilliant strategy by the democrats. It's a good strategy because Obama can claim to be the defender of the middle class heading into November while still raising taxes. The GOP is awkwardly forced to oppose the plan because it will cost their voters $700B, which the democrats can then appropriate the money to their voters . . . or pay for the military for one year :shock: . Genius.Be Excellent To Each OtherParty On, Dudes!0

-

gimmesometruth27 wrote:the wealthiest individuals are defined as any individual making over $250,000 or any couple making over $400,000. these are the top 2% of all wage earners.

Where did you see this?

I heard on the news..it wasn't Fox News...that they were only going to keep the tax break for individuals earning less than $200,000 and families earning less than $250,000. That's a big difference from what you are stating. I gotta find out which is right.hippiemom = goodness0 -

Jason P wrote:I think the tax cut issue is a brilliant strategy by the democrats. It's a good strategy because Obama can claim to be the defender of the middle class heading into November while still raising taxes. The GOP is awkwardly forced to oppose the plan because it will cost their voters $700B, which the democrats can then appropriate the money to their voters . . . or pay for the military for one year :shock: . Genius.

no its not a strategy, the gop is just blocking everything...

Senate Republicans firm on tax cuts for rich

http://news.yahoo.com/s/nm/us_usa_taxes

WASHINGTON (Reuters) – Republicans in the U.S. Senate poured cold water on Monday on hopes for a compromise with President Barack Obama that would have allowed Bush-era tax cuts for the wealthiest Americans to expire.

Taxes have become a flashpoint going into a November 2 election in which Republicans are seeking to wrest control of Congress from the president's fellow Democrats. Obama says the cost of keeping the tax cuts for the rich is too high as the United States emerges from recession with a massive budget deficit.

The uncertainty over tax policy is hanging over the slow economic recovery and is keeping investors guessing about what will happen to taxes on capital gains and dividends.

Prospects faded for breaking the deadlock when Republicans gave a cool reception to a signal on Sunday by John Boehner, their party's leader in the House of Representatives, that he might be willing to bend.

In a political gambit, Senate Republican Leader Mitch McConnell proposed a freeze on all tax brackets, insisting that cuts for wealthier Americans, as well as for the middle class, must be kept in place.

"I'm introducing legislation today that ensures that no one in this country will pay higher income taxes next year than they are right now," McConnell said on the Senate floor.

With control of the Senate, Democrats should be able to dictate whether there is a vote on the tax question ahead of the election but it is far from clear if they have enough party unity on the issue. McConnell may be hoping for enough defectors to bring his measure to the floor.

If Congress fails to take any action on the tax cuts enacted for all Americans under George W. Bush, Obama's Republican predecessor, then they will expire at the end of this year.

Positions are so deeply entrenched and the risks so high for both sides that lawmakers may opt to put the issue on hold until after the election.

"WRESTLING MATCH"

Obama raised the stakes last week by accusing Republicans of holding middle-class tax cuts hostage to salvage lower rates for the rich.

In Fairfax, Virginia, on Monday, the president pressed his case for keeping the Bush tax cuts only for families making $250,000 or less a year and blamed the Republican leadership for a "wrestling match" that has held up action.

"We just can't afford it," he said of the estimated $700 billion that would be needed over a decade to keep the tax cuts for higher income brackets.

Obama has portrayed his push for maintaining lower taxes for most Americans as critical to bolstering the economy, which is expected to weigh heavily on the prospects for Democrats in the November elections.

Republicans say wealthier Americans are drivers of the economy and that tax cuts for them help the whole country.

Democrats could bring up the measure in the Senate next week, hoping to force Republicans to vote against a popular middle-class tax cut ahead of the elections. Democratic aides cautioned that no firm decisions had been made.

The danger for Democrats -- even if Republicans manage to block the move -- is their opponents on the campaign trail could then cast them as tax raisers in a struggling economy.

Don Stewart, McConnell's spokesman, said Senate Republicans were united and had enough votes to block Obama's plan.

Some Democrats have distanced themselves from Obama's call to let tax cuts expire for individuals earning more than $200,000 per year and families earning more than $250,000, arguing the economic recovery is too weak to impose tax hikes.

Republicans are also sending mixed signals.

Boehner said on Sunday that, if given no other choice, he would support extending tax cuts for the middle class even if cuts for the wealthy are allowed to expire.

But Eric Cantor, the No. 2 Republican in the House, showed no sign of backing away on Monday from a full renewal of the Bush cuts and called for a vote on whether to extend them.

Several opinion polls show a majority of Americans support letting the tax cuts for the rich expire but the issue has made some Democrats nervous before the election in which many of their seats are in jeopardy.

Lawmakers are just back from a summer recess and most analysts believe that, with roughly two weeks of legislating time left before they break again, the tax issue could get punted to after the election.

Also, there is still no consensus on how to deal with levies on capital gains and dividends, now taxed at 15 percent for high earners. Republicans want to keep that rate, while Obama wants to raise both to 20 percent for individuals making more than $200,000 and families earning above $250,000.

If Congress fails to act, the rate will hit about 40 percent for high earners.

"I don't think it makes sense to raise any federal taxes during the uncertain economy we are struggling through," Independent Senator Joe Lieberman, a former Democrat, said in a statement on Monday."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

wrong. it is individuals making less than $250,000 and couples making less than $400,000. there are soundbites stating this all over the news...i will try to find a link i guess...cincybearcat wrote:gimmesometruth27 wrote:the wealthiest individuals are defined as any individual making over $250,000 or any couple making over $400,000. these are the top 2% of all wage earners.

Where did you see this?

I heard on the news..it wasn't Fox News...that they were only going to keep the tax break for individuals earning less than $200,000 and families earning less than $250,000. That's a big difference from what you are stating. I gotta find out which is right."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0 -

gimmesometruth27 wrote:Jason P wrote:I think the tax cut issue is a brilliant strategy by the democrats. It's a good strategy because Obama can claim to be the defender of the middle class heading into November while still raising taxes. The GOP is awkwardly forced to oppose the plan because it will cost their voters $700B, which the democrats can then appropriate the money to their voters . . . or pay for the military for one year :shock: . Genius.

no its not a strategy, the gop is just blocking everything...

Senate Republicans firm on tax cuts for rich

http://news.yahoo.com/s/nm/us_usa_taxes

And yet people still don't buy into the liberal media...just look at that title...GOP actually wants tax cuts for ALL, nit just the "rich".

Anyhow, it's dicey business opposing the tax cuts and delaying them to stand up for all...not sure if it's smart politics.hippiemom = goodness0 -

gimmesometruth27 wrote:

wrong. it is individuals making less than $250,000 and couples making less than $400,000. there are soundbites stating this all over the news...i will try to find a link i guess...cincybearcat wrote:gimmesometruth27 wrote:the wealthiest individuals are defined as any individual making over $250,000 or any couple making over $400,000. these are the top 2% of all wage earners.

Where did you see this?

I heard on the news..it wasn't Fox News...that they were only going to keep the tax break for individuals earning less than $200,000 and families earning less than $250,000. That's a big difference from what you are stating. I gotta find out which is right.

I'm just telling you what I heard.hippiemom = goodness0 -

i'm gonna have to get back to you, i can't watch all of these videos looking for it and still see patients at work...not enough time in a workday for both...cincybearcat wrote:I'm just telling you what I heard."You can tell the greatness of a man by what makes him angry." - Lincoln

"Well, you tell him that I don't talk to suckas."0

Categories

- All Categories

- 149.1K Pearl Jam's Music and Activism

- 110.3K The Porch

- 284 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help