Ticketmaster, Live Nation face US suit over resale tactics

it’s D-Day! 😋

Comments

-

I remember a prior TM settlement. It gave us ticket vouchers to horrible shows in a very small window of dates. So they screwed us for years, then made redeeming the settlement vouchers pretty much not even worth the time. It was this huge list of shows by state, and it was filled with C list bands with limited option in most states.Post edited by hrd2imgn on0

-

money add on

Ticketmaster and its parent Live Nation are back in the legal spotlight. But the new Federal Trade Commission (FTC) lawsuit, joined by seven states, is more than another story about pricey tickets.

It goes to the core of consumer protection law, asking how far “industry practice” can stretch before it becomes outright deception.

Alleged Unfair and Deceptive Practices

The FTC argues that Ticketmaster didn’t merely tolerate scalpers, it quietly profited from them. Professional ticket brokers allegedly used software and fake accounts to snap up large quantities of tickets, often bypassing purchase limits set by artists.

Instead of blocking those transactions, the Commission claims Ticketmaster knowingly allowed those tickets back onto its own resale platform, where they were sold at significant mark-ups. Ticketmaster, of course, collected fees on both ends.

https://www.lawyer-monthly.com

Post edited by D-Day on0 -

👆🏿! The article is longer… incl. junk fees…

👇🏿According to the FTC, this double-dipping amounted to $3.7 billion in resale fees between 2019 and 2024, a staggering figure that illustrates how secondary markets have been folded into the company’s primary business model.

On top of that, consumers were routinely hit with what the Commission describes as “junk fees” mandatory charges added late in the checkout process that dramatically inflated the advertised price.

FTC Chair Andrew Ferguson captured the issue plainly:

“American live entertainment is the best in the world and should be accessible to all of us. It should not cost an arm and a leg to take the family to a baseball game or attend your favorite musician’s show.”

Statutory Tests and Regulatory Tools in Play

What makes this case different from past enforcement efforts is its scope. Regulators are not chasing individual brokers; they are targeting Ticketmaster itself.

The complaint argues the company “knew or should have known” that brokers were gaming the system, yet failed to stop it because the company stood to benefit.

That matters because it could make this one of the first meaningful tests of the BOTS Act of 2016, which bans the use of software to circumvent ticket limits.

Until now, the statute has mostly been used against smaller players. By folding it into a high-profile action against Ticketmaster, the FTC is signaling that platforms can’t escape responsibility by blaming third parties.

The case also leans on Section 5 of the FTC Act and the Commission’s new Junk Fees Rule, which took effect in May 2025.

Together, those give regulators sharper tools: civil penalties for rule violations, restitution under Section 19, and broad injunctive powers.

This is notable because the Supreme Court’s AMG Capital decision in 2021 limited the FTC’s ability to obtain monetary relief under Section 13(b). In response, the agency has turned toward rules and statutes that explicitly provide for penalties and consumer refunds.

The Monopoly Shadow

The lawsuit cannot be separated from the broader antitrust storm swirling around Live Nation.

The Department of Justice is already pursuing its own case, arguing that the company has abused its dominance across ticketing, promotion, and venues.

A federal judge earlier this year rejected Live Nation’s motion to dismiss, leaving the path open for a trial that could reshape the industry.

Seen together, the DOJ’s case and the FTC’s complaint amount to a coordinated challenge. One focuses on monopoly power, the other on consumer deception.

Even if neither results in a court-ordered breakup, the combined pressure could force Live Nation to rethink practices that have long been standard in the industry.

Live Nation and Ticketmaster are unlikely to sit quietly. They have consistently argued that brokers are the problem, not the platform, pointing to millions spent on anti-bot technology.

They have defended their resale marketplace as a way to bring transparency to an inevitable secondary market, and they have insisted that many of the much-criticized fees are driven by venues and promoters rather than Ticketmaster itself.

Whether those defenses persuade the court will depend heavily on what the FTC can show about the company’s internal knowledge and practices.

If evidence reveals Ticketmaster encouraged or at least tolerated the very behavior it publicly condemned, the defenses may not hold.

Future Proceedings and Possible Outcomes

The case is set to play out in the Central District of California, where the possible outcomes stretch from injunctions requiring upfront, all-in pricing and tougher broker oversight, to civil penalties that could cost Ticketmaster hundreds of millions.

The idea of a forced corporate breakup still hangs in the air because of the DOJ’s separate antitrust suit, though for now that remains more of a distant threat than an immediate reality.

What’s harder to ignore is that regulators’ patience with Ticketmaster appears to have finally worn thin.

Judges will now be asked to decide whether high fees and opaque practices are simply the price of doing business in a tough market, or whether they’ve crossed the legal line into deception and unfairness.

Awards for law firmsTicketmaster’s reputation as a controversial market leader has never been enough, by itself, to justify litigation. What distinguishes this action is the FTC’s detailed claim that systemic profit motives, rather than isolated failures, drove consumer harm.

If substantiated, the case could not only reshape ticketing practices but also redefine the reach of consumer protection law in the digital economy.

People Also Ask

What is the FTC’s lawsuit against Ticketmaster about?

The FTC accuses Ticketmaster and Live Nation of knowingly profiting from ticket brokers who used bots and fake accounts to bypass limits. The complaint says the companies collected $3.7 billion in resale fees between 2019 and 2024 and misled consumers with hidden “junk fees.”What laws are being tested in the Ticketmaster case?

The lawsuit draws on the BOTS Act of 2016, Section 5 of the FTC Act, and the FTC’s new Junk Fees Rule. It could become one of the first major tests of the BOTS Act against a dominant platform rather than small brokers.Could Ticketmaster and Live Nation be broken up?

The DOJ has a separate antitrust case aimed at Live Nation’s market dominance. While a corporate breakup remains a distant possibility, combined regulatory pressure could force significant changes to how Ticketmaster operates.What penalties could Ticketmaster face?

If the FTC prevails, potential remedies include injunctions requiring upfront pricing, stricter broker oversight, consumer refunds under Section 19, and civil penalties that could run into the hundreds of millions.How does this affect consumers and artists?

For consumers, the case could lead to clearer ticket pricing and fewer inflated resale costs. For artists, it may strengthen control over ticket limits and reduce the influence of scalpers in the secondary market.0 -

There‘s a brand new report about amazon‘s prime tactics

There‘s a brand new report about amazon‘s prime tactics

https://www.ftc.gov/news-events/news/press-releasesback to TMThe FTC press release - a section:(…) Ticketmaster is the leading provider of tickets for concerts—controlling about 80% or more of major concert venues’ primary ticketing—and it also has a growing share of ticket resales in the secondary market. From 2019 to 2024 alone, consumers spent more than $82.6 billion purchasing tickets from Ticketmaster.

The FTC alleges that in public, Ticketmaster maintains that its business model is at odds with brokers that routinely exceed ticket limits. But in private, Ticketmaster acknowledged that its business model and bottom line benefit from brokers preventing ordinary Americans from purchasing tickets to the shows they want to see at the prices artists set.

The FTC’s complaint against Ticketmaster alleges that:

- Despite implementing security measures, Ticketmaster is aware that brokers routinely bypass such measures by creating thousands of Ticketmaster accounts and using proxy IP addresses in order to purchase event tickets.

- Ticketmaster nevertheless allows brokers to post these illegally obtained tickets for resale on its platform, then profits from the additional fees and markups it unilaterally adds to the resale tickets.

- In fact, a senior Ticketmaster executive admitted in an internal email that copied Live Nation leadership, that the companies “turn a blind eye as a matter of policy” to brokers’ violations of posted ticket limits. For example, an internal review showed that just five brokers controlled 6,345 Ticketmaster accounts and possessed 246,407 concert tickets to 2,594 events.

- Ticketmaster and Live Nation even offer technological support to brokers through a software platform called TradeDesk, which enables brokers to track and aggregate tickets purchased from multiple Ticketmaster accounts into a single interface for simpler resale management. Through TradeDesk, Ticketmaster can identify which high-volume brokers are exceeding ticket limits through the use of hundreds, or even thousands, of Ticketmaster accounts.

- The companies also have consistently declined to deploy additional technology that would more effectively prevent brokers from evading ticket limits because such tactics would decrease their revenue, according to internal company documents. For example, the company in 2021 opted against using third-party identity verification because it was “too effective.”

- In addition, Ticketmaster deceived the American people by advertising list prices for tickets that were substantially lower than the actual cost consumers paid after fees and markups were added. The FTC alleged that Ticketmaster hid the mandatory fees, which are as high as 44% of the cost of the ticket, that it didn’t add the fees to the price of tickets until the very end of the transaction, and still failed to clearly detail the extra fees before consumers paid for the tickets. The fees totaled $16.4 billion from 2019-2024.

- Despite publicly claiming that they support consumers knowing the “full cost of their tickets from the start,” company executives acknowledged internally that Ticketmaster engaged in deceptive pricing and deliberately continued that approach after internal research showed consumers were less likely to purchase tickets when they are informed of the true cost upfront. (…)

—?—One detail is part of the whole mess but not mentioned: not to display every unsold/available ticket on screen all the time. This invisibility should also come to an end.Post edited by D-Day on0 -

today‘s news

(…)0

(…)0 -

big ticketing news -

same mess, different country “Restricting ticket touts was one of the Labour government’s election pledges, as fans complained of massively inflated prices for resold tickets.

“Restricting ticket touts was one of the Labour government’s election pledges, as fans complained of massively inflated prices for resold tickets.The decision comes a week after dozens of artists including Sam Fender, Dua Lipa and Coldplay urged Sir Keir Starmer to protect fans from exploitation.

A consultation on the changes had canvassed views on capping costs at up to 30% above the face value of a ticket. But the government has decided to set the limit at the original cost, or face value, while also promising to take measures to cap extra fees to prevent the price limit being undermined.

The Department for Culture, Media and Sport (DCMS) will announce its intentions to end industrial-scale ticket touting, making resale tickets £37 cheaper on average, saving fans collectively £112m per year.

Resale platforms will have a legal duty to monitor and enforce the new regulations.

Housing Secretary Steve Reed told BBC Breakfast touts making profits at the expense of fans was "such an important issue" as it was "hugely damaging to individuals having to pay through the nose for tickets".

He stressed the government was "committed to outlawing it".

Professional touts

The move comes after the open letter by some of the biggest names in music.

The music stars urged the prime minister to stop the "extortionate and pernicious" websites that exploit fans.

Other signatories included consumer watchdog Which?, the Football Supporters' Association, and groups representing the music and theatre industries, venues and ticket retailers.

According to analysis by the Competition and Markets Authority, tickets currently sold on the resale market are typically marked up by more than 50%.

Investigations by Trading Standards have previously uncovered evidence of tickets being resold for up to six times their original cost.

Rocio Concha, director of policy and advocacy at Which?, said the change was "great news for music and sports fans", adding that the plan would "rein in professional touts and put tickets back in the hands of real fans".

She urged the government to "show that the price cap is a priority by including the necessary legislation in the King's Speech".

'Exorbitant' prices

Ahead of the announcement, Ticketmaster's parent company Live Nation Entertainment said it already limits resale in the UK to face value prices and described the reported plan as "another major step forward for fans".

Resale sites like Viagogo and Stubhub have previously claimed that a price cap could push customers towards unregulated sites and social media, putting them at increased risk of fraud.

But Tom Kiehl, chief executive of UK Music, said a cap on secondary ticket prices was needed in order to protect both the industry and fans from "exorbitant" prices.

"The music industry itself is worth £8bn to the economy, and relies on that strong relationship between music fans and and the artist," he told BBC Radio 4's Today programme on Tuesday.

"And what you have at the moment is the resale market, which isn't working."”

——

The max. 30% above face value mentioned in the article above was nonsense. The government’s smart move to 0% profit is a serious signal and zero profit can only be a must have key to kill the ticket resale business.

btw

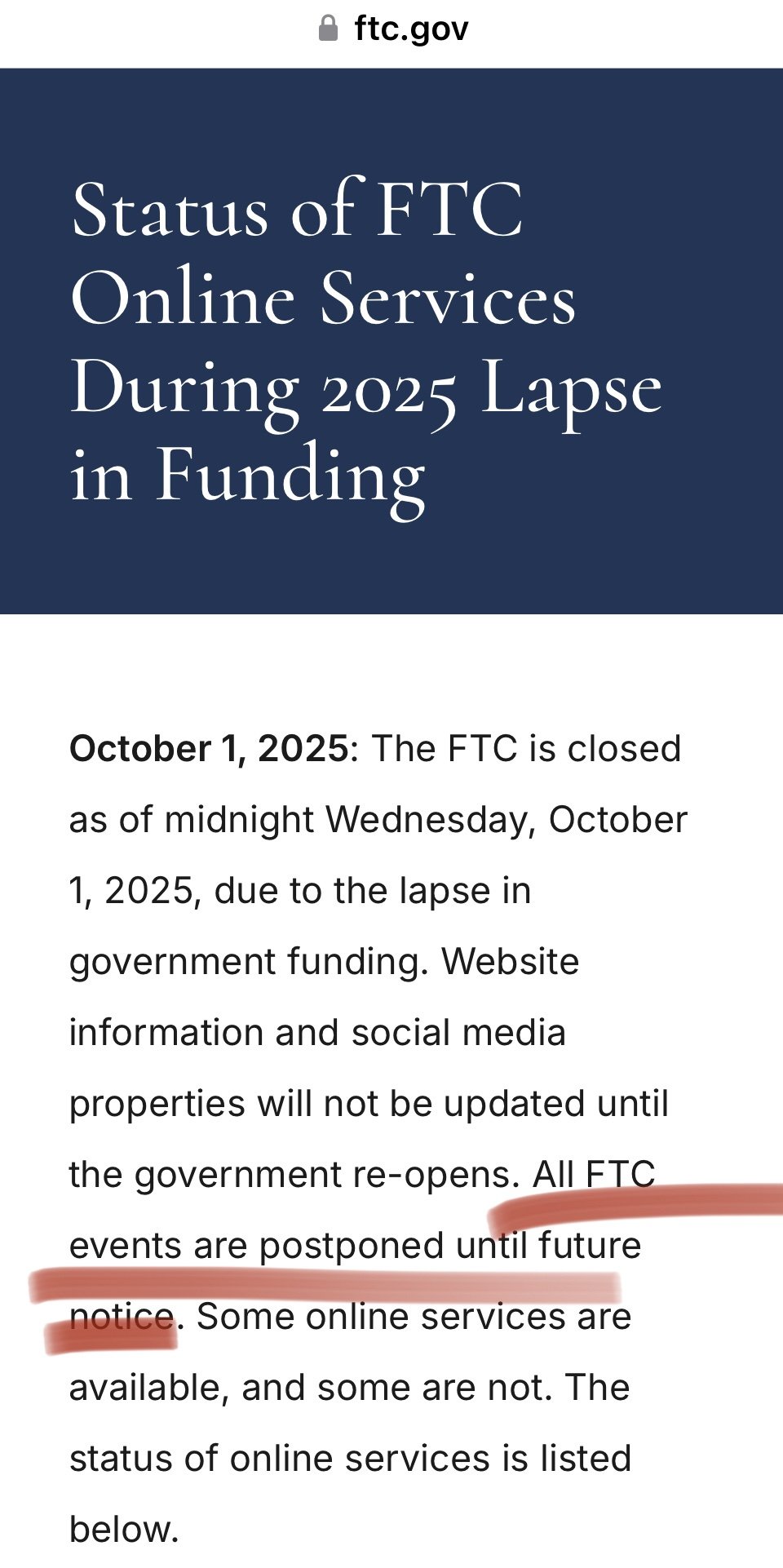

shutdown is over - FTC is back in business.

Post edited by D-Day on0 -

Senate hearing on live event ticketing

(Jan 28, 2026)

There is another q&a in February.

There is another q&a in February.

!Are all unsold/available tickets on screen visible all the time.

answered by tm andif it’s true tickets are invisible ONLY because of scalpers, bots and bookers and the chance to make profit.Post edited by D-Day on0

Categories

- All Categories

- 149.1K Pearl Jam's Music and Activism

- 110.3K The Porch

- 284 Vitalogy

- 35.1K Given To Fly (live)

- 3.5K Words and Music...Communication

- 39.4K Flea Market

- 39.4K Lost Dogs

- 58.7K Not Pearl Jam's Music

- 10.6K Musicians and Gearheads

- 29.1K Other Music

- 17.8K Poetry, Prose, Music & Art

- 1.1K The Art Wall

- 56.8K Non-Pearl Jam Discussion

- 22.2K A Moving Train

- 31.7K All Encompassing Trip

- 2.9K Technical Stuff and Help