All good points. I'm not an economist but I bet there are some papers out there trying to determine if inflation is controlled by off shoring and globalism. However, because of the global connected economy, inflation tends to move across the globe, like it has this year. And off shoring to us is not off shoring to Vietnam and China. So good questions.Zod said:What I've been wondering is:Has the controlled inflation over the past number of decades really been a reflection of Government and Central Bank policy, or was it more a reflection of globalism. IE prices were kept lower, by offsourcing those jobs to countries with low labour costs (And also countries with little to no environmental regulations).Had free trade agreements and globalism never started, would we have been able to keep rolling with fairly steady inflation.The other concern is moving around money with taxes, UBI, and what not, it would be pretty disruptive. If the supply of goods doesn't grow, does it really make a difference? Sure there could be more money in the pockets of the plebs, but if we don't increase productivity and make more goods, then it would also translate into more inflation?Money is a store of value, but economics is about allocating a finite supply of resources. Putting more money out there for the common folk to spend, doesn't help unless the supply of goods increases accordingly.

I think we should still use inmates for labor. it gives them a job, money and they get to be outside for a while.mickeyrat said:

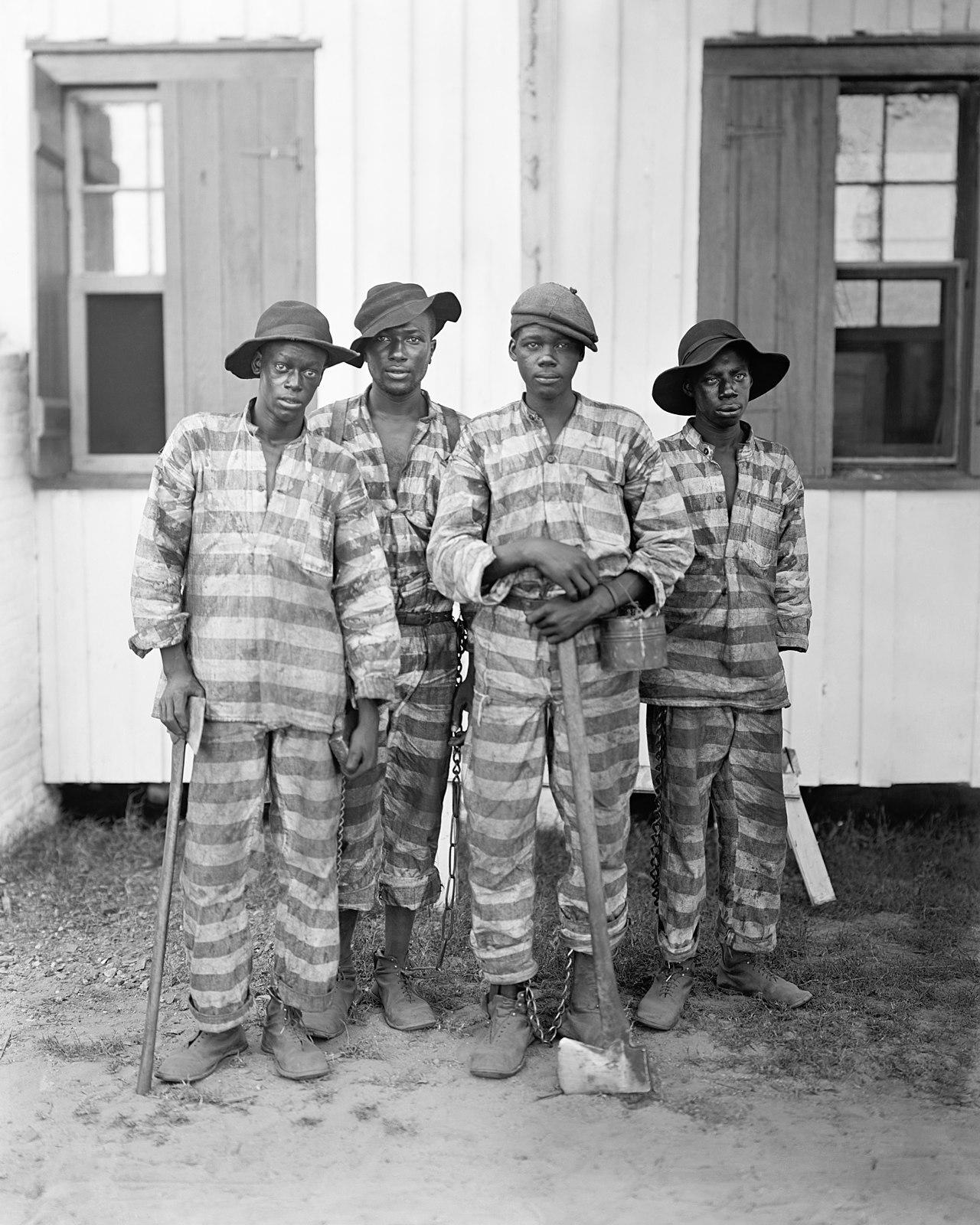

By MARGIE MASON and ROBIN McDOWELLTodayMore than 150 years ago, a prison complex known as the Lone Rock stockade operated at one of the biggest coal mines in Tennessee.

It was powered largely by African American men who had been arrested for minor offenses — like stealing a hog — if they committed any crime at all. Women and children, some as young as 12, were sent there as well.

The work, dangerous and sometimes deadly, was their punishment.

The state was leasing these prisoners out to private companies for a fee, in a practice known all across the South as convict leasing. In states like Texas, Florida, Georgia and Alabama , prisoners were also used to help build railroads, cut timber, make bricks, pick cotton and grow sugar on plantations.

Men convicted of a crime and leased to harvest timber in Florida, 1915. (Library of Congress via AP)__________

In a joint investigation, reporters from the Associated Press and Reveal at the Center for Investigative Reporting spent months unearthing this history. They focused on Tennessee Coal, Iron & Railroad, which ran the stockade and coal mine, and the company that later bought it, U.S. Steel.

The team found someone living today whose ancestor was imprisoned in the Lone Rock stockade nearly 140 years ago. They also interviewed the descendent of a man who got rich from his role in pioneering Tennessee’s convict leasing system.

The reporters also heard from U.S. Steel. For the first time, it said it was willing to discuss its past with members of the affected community.

Listen to the podcast here:

Companies across the South profited off the forced labor of people in prison after the Civil War – a racist system known as convict leasing.

WHAT IS CONVICT LEASING?

Convict leasing was essentially a new form of slavery that started after the Civil War and went on for decades across the South. States — and companies — got rich by arresting mostly Black men and then forcing them to work for major companies.

The 13th Amendment, passed after the Civil War, banned slavery and involuntary servitude. But it made an exception for people convicted of a crime, offering legal cover for convict leasing.

Tennessee and many other states adopted similar language in their constitutions that still exists today.

An undated old photograph of the Lone Rock Stockade is shown, May, 28, 2022, in Tracy City, Tenn. (AP Photo/Brynn Anderson)WHAT WAS THE THE LONE ROCK STOCKADE?

The Lone Rock stockage operated in Tracy City, Tennessee for more than 25 years. The prisoners lived in cramped, unsanitary conditions. Built to hold 200 people at a time, the prison sometimes held 600.

The men risked their lives every day above ground too, manning fiery, dome-shaped coke ovens used in the iron-making process.

They were helping Tennessee, Coal, Iron and Railroad get rich. The company was an economic powerhouse, later bought by the world’s biggest company at the time: U.S. Steel Corporation.

HOW DID THE PRISON POPULATION CHANGE AFTER EMANCIPATION?

The racial makeup of prison populations changed almost overnight after the Civil War. In Tennessee, during slavery less than 5 percent of the prisoners were Black. In 1866, after emancipation, that number jumped to 52 percent. And by 1891 it had skyrocketed to 75 percent.

Photograph shows two white men overseeing African American men hammering boulders as others walk with wheelbarrows in a shallow pit phosphate mine, Dunnellon, Florida, 1890. (Library of Congress via AP)WHAT ARE BLACK CODES?

Black codes are laws passed by states that targeted African Americans for minor crimes such as vagrancy, jumping a ride on a train car or not having proof of employment.

In Tennessee, people were sentenced up to five years of hard labor in the coal mine for having interracial relationships.

WHAT DOES U.S. STEEL SAY NOW ABOUT THEIR USE OF CONVICT LEASING?

The United States Steel Corporation, also known as U.S. Steel, was founded by American business giants, which included J.P. Morgan and Andrew Carnegie. It has operations in the U.S. and Central Europe, and remains a leading steel producer.

Andrew Carnegie, shown in the center, in front of Rays Hill Tunnel in 1885 which was being dug in Pennsylvania for a railroad he and others were building along the route the Pennsylvania Turnpike now follows. (AP Photo)The company used convict labor for at least five years in Alabama in the early 1900s, but has never spoken openly about this dark chapter of its history. It has misrepresented its use of prison labor and has not acknowledged the men who died in its mines.

After being contacted by the AP and Reveal reporters, the company agreed for the first time to sit down and talk with members of the affected community. U.S. Steel also confirmed it owns a cemetery located at the site of its former coal mine: “U. S. Steel does not condone the practices of a century ago,” it said in a statement. “Given the amount of time that has lapsed, we, unfortunately, do not have comprehensive records relative to this situation."

“We would be pleased to consider a memorial plaque should members of the affected community express an interest. We would also be happy to meet with them and discuss these topics.”

AP Investigations_____

This story was supported by Columbia University’s Ira A. Lipman Center for Journalism and Civil and Human Rights in conjunction with the Arnold Foundation.

Sure. If I believe that answers to these and other questions can be summed up in a couple easy sentences I will stop being so long winded..mrussel1 said:1. I think you know that joblessness is calculated by those receiving benefits and looking for work. If you stop looking, you come off the unemployment number. But that's how it's been measured forever, so as a comparative, it's the one to use. But what are you going to do, count all the retirees and disability recipients, house wives/husbands? No. If you want that, you look at the participation rate.

2. Let's talk about localized supply chain in two ways. First, you ask whether we know that prices would increase. Well yes, I think it's pretty rational to know that considering the min wage laws and how we can't get people working for $15. But I brought up TVs for a reason. I don't know how old you are, but go and see how much a television was in the 70s, 80s and into the early 90's. A 27" TV would cost you $500 easy. Now adjust that for inflation.

Second, we have experienced 75 years of intercontinental peace. Why is that? it's one reason, interconnected economy. That's the greatest risk, to me, about protectionism and nationalism. And what you are advocating turns into nationalism. You may not believe that in your heart, but that's the next step. I don't see China as a military threat because they are too dependent on us financially, and likewise because of the treasury notes they own, we are dependent on them. Within a generation of dismantling a global economic system, there will be war. Real war because of resource scarcity. All you have to do is study the wars for 500 years and it's always the same story.

And btw, where is this massive unrest? You've already described striking as massive unrest, so where is this? We almost had a nationwide strike a week ago, but it was over unplanned fucking PTO. Not that it's not an important issue to the workers, but sorry that's not causing riots in the street.

You want so yell at the clouds about automation, good luck with that. It's not changing, and why would you want it to change? The answer isn't to stop progress, the answer is to retrain workers. That's the shortcoming of the gov't that needs to change. But you're not stopping progress. The arguments you are making are the same as were made during the Industrial Revolution, the Technological Revolution (second industrial revolution) and now with automation. The population has to adapt and some portion of the population (generally people late 'career') suffer. This isn't a new cycle.

But again, while you offer good arguments, I am firmly pro capitalism, with gov't controls. I'm as far from laissez-faire as I am from Communism. However, the language of the article you posted I find inflammatory and intentionally tries to draw a contrast between us and them. The issue is a huge number of Americans are neither. We aren't labor, we aren't "oligarchs". We are part of the managerial class. Articles like you wrote aren't getting them on board any train.

This is too much writing. Can we please make these arguments more concise and narrower points?>

If they freely choose to and are paid on scale with local workers and didn't. have to worry about the prison complex charging them fees for managing their money, or garnishing it toward the costs of incarceration etc, then still no. It is still a slippery slope on the way to forced and underpaid labor even with all the protections possible put in place. Not to mention that it could be used as a way for LE, Prisons, Private Equity and the Justice system to incarcerate more "workers"tempo_n_groove said:I think we should still use inmates for labor. it gives them a job, money and they get to be outside for a while.mickeyrat said:

By MARGIE MASON and ROBIN McDOWELLTodayMore than 150 years ago, a prison complex known as the Lone Rock stockade operated at one of the biggest coal mines in Tennessee.

It was powered largely by African American men who had been arrested for minor offenses — like stealing a hog — if they committed any crime at all. Women and children, some as young as 12, were sent there as well.

The work, dangerous and sometimes deadly, was their punishment.

The state was leasing these prisoners out to private companies for a fee, in a practice known all across the South as convict leasing. In states like Texas, Florida, Georgia and Alabama , prisoners were also used to help build railroads, cut timber, make bricks, pick cotton and grow sugar on plantations.

Men convicted of a crime and leased to harvest timber in Florida, 1915. (Library of Congress via AP)__________

In a joint investigation, reporters from the Associated Press and Reveal at the Center for Investigative Reporting spent months unearthing this history. They focused on Tennessee Coal, Iron & Railroad, which ran the stockade and coal mine, and the company that later bought it, U.S. Steel.

The team found someone living today whose ancestor was imprisoned in the Lone Rock stockade nearly 140 years ago. They also interviewed the descendent of a man who got rich from his role in pioneering Tennessee’s convict leasing system.

The reporters also heard from U.S. Steel. For the first time, it said it was willing to discuss its past with members of the affected community.

Listen to the podcast here:

Companies across the South profited off the forced labor of people in prison after the Civil War – a racist system known as convict leasing.

WHAT IS CONVICT LEASING?

Convict leasing was essentially a new form of slavery that started after the Civil War and went on for decades across the South. States — and companies — got rich by arresting mostly Black men and then forcing them to work for major companies.

The 13th Amendment, passed after the Civil War, banned slavery and involuntary servitude. But it made an exception for people convicted of a crime, offering legal cover for convict leasing.

Tennessee and many other states adopted similar language in their constitutions that still exists today.

An undated old photograph of the Lone Rock Stockade is shown, May, 28, 2022, in Tracy City, Tenn. (AP Photo/Brynn Anderson)WHAT WAS THE THE LONE ROCK STOCKADE?

The Lone Rock stockage operated in Tracy City, Tennessee for more than 25 years. The prisoners lived in cramped, unsanitary conditions. Built to hold 200 people at a time, the prison sometimes held 600.

The men risked their lives every day above ground too, manning fiery, dome-shaped coke ovens used in the iron-making process.

They were helping Tennessee, Coal, Iron and Railroad get rich. The company was an economic powerhouse, later bought by the world’s biggest company at the time: U.S. Steel Corporation.

HOW DID THE PRISON POPULATION CHANGE AFTER EMANCIPATION?

The racial makeup of prison populations changed almost overnight after the Civil War. In Tennessee, during slavery less than 5 percent of the prisoners were Black. In 1866, after emancipation, that number jumped to 52 percent. And by 1891 it had skyrocketed to 75 percent.

Photograph shows two white men overseeing African American men hammering boulders as others walk with wheelbarrows in a shallow pit phosphate mine, Dunnellon, Florida, 1890. (Library of Congress via AP)WHAT ARE BLACK CODES?

Black codes are laws passed by states that targeted African Americans for minor crimes such as vagrancy, jumping a ride on a train car or not having proof of employment.

In Tennessee, people were sentenced up to five years of hard labor in the coal mine for having interracial relationships.

WHAT DOES U.S. STEEL SAY NOW ABOUT THEIR USE OF CONVICT LEASING?

The United States Steel Corporation, also known as U.S. Steel, was founded by American business giants, which included J.P. Morgan and Andrew Carnegie. It has operations in the U.S. and Central Europe, and remains a leading steel producer.

Andrew Carnegie, shown in the center, in front of Rays Hill Tunnel in 1885 which was being dug in Pennsylvania for a railroad he and others were building along the route the Pennsylvania Turnpike now follows. (AP Photo)The company used convict labor for at least five years in Alabama in the early 1900s, but has never spoken openly about this dark chapter of its history. It has misrepresented its use of prison labor and has not acknowledged the men who died in its mines.

After being contacted by the AP and Reveal reporters, the company agreed for the first time to sit down and talk with members of the affected community. U.S. Steel also confirmed it owns a cemetery located at the site of its former coal mine: “U. S. Steel does not condone the practices of a century ago,” it said in a statement. “Given the amount of time that has lapsed, we, unfortunately, do not have comprehensive records relative to this situation."

“We would be pleased to consider a memorial plaque should members of the affected community express an interest. We would also be happy to meet with them and discuss these topics.”

AP Investigations_____

This story was supported by Columbia University’s Ira A. Lipman Center for Journalism and Civil and Human Rights in conjunction with the Arnold Foundation.

My old company employed some inmates. They couldn't work OT because they would be in a lot of trouble not making it back on time.

It would be for city/state improvements and whatnot. Chain gangs are still used to clean up trash on the highways. I see nothing wrong with that.static111 said:If they freely choose to and are paid on scale with local workers and didn't. have to worry about the prison complex charging them fees for managing their money, or garnishing it toward the costs of incarceration etc, then still no. It is still a slippery slope on the way to forced and underpaid labor even with all the protections possible put in place. Not to mention that it could be used as a way for LE, Prisons, Private Equity and the Justice system to incarcerate more "workers"tempo_n_groove said:I think we should still use inmates for labor. it gives them a job, money and they get to be outside for a while.mickeyrat said:

By MARGIE MASON and ROBIN McDOWELLTodayMore than 150 years ago, a prison complex known as the Lone Rock stockade operated at one of the biggest coal mines in Tennessee.

It was powered largely by African American men who had been arrested for minor offenses — like stealing a hog — if they committed any crime at all. Women and children, some as young as 12, were sent there as well.

The work, dangerous and sometimes deadly, was their punishment.

The state was leasing these prisoners out to private companies for a fee, in a practice known all across the South as convict leasing. In states like Texas, Florida, Georgia and Alabama , prisoners were also used to help build railroads, cut timber, make bricks, pick cotton and grow sugar on plantations.

Men convicted of a crime and leased to harvest timber in Florida, 1915. (Library of Congress via AP)__________

In a joint investigation, reporters from the Associated Press and Reveal at the Center for Investigative Reporting spent months unearthing this history. They focused on Tennessee Coal, Iron & Railroad, which ran the stockade and coal mine, and the company that later bought it, U.S. Steel.

The team found someone living today whose ancestor was imprisoned in the Lone Rock stockade nearly 140 years ago. They also interviewed the descendent of a man who got rich from his role in pioneering Tennessee’s convict leasing system.

The reporters also heard from U.S. Steel. For the first time, it said it was willing to discuss its past with members of the affected community.

Listen to the podcast here:

Companies across the South profited off the forced labor of people in prison after the Civil War – a racist system known as convict leasing.

WHAT IS CONVICT LEASING?

Convict leasing was essentially a new form of slavery that started after the Civil War and went on for decades across the South. States — and companies — got rich by arresting mostly Black men and then forcing them to work for major companies.

The 13th Amendment, passed after the Civil War, banned slavery and involuntary servitude. But it made an exception for people convicted of a crime, offering legal cover for convict leasing.

Tennessee and many other states adopted similar language in their constitutions that still exists today.

An undated old photograph of the Lone Rock Stockade is shown, May, 28, 2022, in Tracy City, Tenn. (AP Photo/Brynn Anderson)WHAT WAS THE THE LONE ROCK STOCKADE?

The Lone Rock stockage operated in Tracy City, Tennessee for more than 25 years. The prisoners lived in cramped, unsanitary conditions. Built to hold 200 people at a time, the prison sometimes held 600.

The men risked their lives every day above ground too, manning fiery, dome-shaped coke ovens used in the iron-making process.

They were helping Tennessee, Coal, Iron and Railroad get rich. The company was an economic powerhouse, later bought by the world’s biggest company at the time: U.S. Steel Corporation.

HOW DID THE PRISON POPULATION CHANGE AFTER EMANCIPATION?

The racial makeup of prison populations changed almost overnight after the Civil War. In Tennessee, during slavery less than 5 percent of the prisoners were Black. In 1866, after emancipation, that number jumped to 52 percent. And by 1891 it had skyrocketed to 75 percent.

Photograph shows two white men overseeing African American men hammering boulders as others walk with wheelbarrows in a shallow pit phosphate mine, Dunnellon, Florida, 1890. (Library of Congress via AP)WHAT ARE BLACK CODES?

Black codes are laws passed by states that targeted African Americans for minor crimes such as vagrancy, jumping a ride on a train car or not having proof of employment.

In Tennessee, people were sentenced up to five years of hard labor in the coal mine for having interracial relationships.

WHAT DOES U.S. STEEL SAY NOW ABOUT THEIR USE OF CONVICT LEASING?

The United States Steel Corporation, also known as U.S. Steel, was founded by American business giants, which included J.P. Morgan and Andrew Carnegie. It has operations in the U.S. and Central Europe, and remains a leading steel producer.

Andrew Carnegie, shown in the center, in front of Rays Hill Tunnel in 1885 which was being dug in Pennsylvania for a railroad he and others were building along the route the Pennsylvania Turnpike now follows. (AP Photo)The company used convict labor for at least five years in Alabama in the early 1900s, but has never spoken openly about this dark chapter of its history. It has misrepresented its use of prison labor and has not acknowledged the men who died in its mines.

After being contacted by the AP and Reveal reporters, the company agreed for the first time to sit down and talk with members of the affected community. U.S. Steel also confirmed it owns a cemetery located at the site of its former coal mine: “U. S. Steel does not condone the practices of a century ago,” it said in a statement. “Given the amount of time that has lapsed, we, unfortunately, do not have comprehensive records relative to this situation."

“We would be pleased to consider a memorial plaque should members of the affected community express an interest. We would also be happy to meet with them and discuss these topics.”

AP Investigations_____

This story was supported by Columbia University’s Ira A. Lipman Center for Journalism and Civil and Human Rights in conjunction with the Arnold Foundation.

My old company employed some inmates. They couldn't work OT because they would be in a lot of trouble not making it back on time.

I agree. Junior Congressional staffers should not be able to work at any company that is overseen by a state or federal regulator. So basically no major companies. She can become a plumber. That will be allowed.static111 said:

This is the sector which she was previously regulating, it's not like she was overseeing banking and took up a job with an energy company...I see no qualms there. The fact that someone can transition directly from any sector that they were personally involved with overseeing as a staffer, advisor etc. should in my opinion give anyone pause. That situation is rife for quid pro quo agreements, you scratch our backs and we will make sure you have a cushy landing in the private sector, unofficially of course. If say there was a cooling off period maybe a year or what have you along with some disclosures, before being able to take a position in a sector that you were directly overseeing via a government agency, that would not be perfect but it would be better.mrussel1 said:I agree. Junior Congressional staffers should not be able to work at any company that is overseen by a state or federal regulator. So basically no major companies. She can become a plumber. That will be allowed.static111 said:

You'll have to excuse the sarcasm. This is ridiculous.

There is a cooling off period for lobbyists. But this is a junior staffer. And so you understand, Congress isn't regulating the banks, the CFPB regulates the banks which is part of the executive branch. The OCC, the FDIC and all the alphabet agencies are part of the executive branch and underneath the yoke of the CFPB. So I don't know what kind of quid pro quo you could even pull off here, particularly with someone at that level.static111 said:This is the sector which she was previously regulating, it's not like she was overseeing banking and took up a job with an energy company...I see no qualms there. The fact that someone can transition directly from any sector that they were personally involved with overseeing as a staffer, advisor etc. should in my opinion give anyone pause. That situation is rife for quid pro quo agreements, you scratch our backs and we will make sure you have a cushy landing in the private sector, unofficially of course. If say there was a cooling off period maybe a year or what have you along with some disclosures, before being able to take a position in a sector that you were directly overseeing via a government agency, that would not be perfect but it would be better.mrussel1 said:I agree. Junior Congressional staffers should not be able to work at any company that is overseen by a state or federal regulator. So basically no major companies. She can become a plumber. That will be allowed.static111 said:

You'll have to excuse the sarcasm. This is ridiculous.

Oh, apparently her father also works at the firm...so there is no way any conflicts of interest could be present...(you'll have to excuse the sarcasm, this is ridiculous)

LONDON — The pound hit an all-time low against the U.S. dollar on Monday, adding to global recession fears and reflecting a highly negative review of the new British government’s plan for big tax cuts funded by big borrowing.

The pound sank to $1.03 in Asian trading early Monday, before regaining some ground and stabilizing around $1.08 — still well below where it was Friday morning before the government unveiled the details of its plan to cut taxes in an effort to boost growth.

The slide may be good news for the many American tourists who visit here and suddenly find their dollars going much further. The U.S. dollar is in strong position, after a series of interest rate hikes by the Federal Reserve.

It is anxiety-producing, however, for many British households, which were already facing soaring energy bills and inflation running at 10 percent. They may soon confront higher costs for imported goods and services, including everything from fuel for vehicles to food on plates.

Britain was able to put on a show for the world last week, with an elaborate state funeral for Queen Elizabeth II. But now financial and economic concerns are front-and-center once more. And the honeymoon for Prime Minister Liz Truss — just three weeks into the job — is decidedly over.

While Truss had pledged tax cuts during her leadership campaign, the scale of the cuts still shocked many economic observers.

“In the current economic environment it is a huge gamble,” wrote Thomas Pope, an economist with the Institute for Government.

continues....

FRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

static111 said:Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

Gas prices are sticky when crude oil prices go downwardstatic111 said:Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

Gas has been notorious for raising prices at the jump and lowering them at a much slower pace.Cropduster-80 said:Gas prices are sticky when crude oil prices go downwardstatic111 said:Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

part of that deals with lag time and price futures. You are buying at one price and then the price goes down after you bought it, you are still selling it at that higher price

when prices go up, you instantly raise prices to reflect the future price you are paying for next months delivery

that deals with gas pricing at the retail level (gas stations)

That’s what I’m saying. It’s truetempo_n_groove said:Gas has been notorious for raising prices at the jump and lowering them at a much slower pace.Cropduster-80 said:Gas prices are sticky when crude oil prices go downwardstatic111 said:Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

part of that deals with lag time and price futures. You are buying at one price and then the price goes down after you bought it, you are still selling it at that higher price

when prices go up, you instantly raise prices to reflect the future price you are paying for next months delivery

that deals with gas pricing at the retail level (gas stations)

I saw a bit by Andy Rooney when I was a kid of him buying 1 gallon of gas and asking for his 1/10th of a cent back. They are still stealing that 1/10th, lol.

They always profit so they know what they are doing.Cropduster-80 said:That’s what I’m saying. It’s truetempo_n_groove said:Gas has been notorious for raising prices at the jump and lowering them at a much slower pace.Cropduster-80 said:Gas prices are sticky when crude oil prices go downwardstatic111 said:Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

part of that deals with lag time and price futures. You are buying at one price and then the price goes down after you bought it, you are still selling it at that higher price

when prices go up, you instantly raise prices to reflect the future price you are paying for next months delivery

that deals with gas pricing at the retail level (gas stations)

I saw a bit by Andy Rooney when I was a kid of him buying 1 gallon of gas and asking for his 1/10th of a cent back. They are still stealing that 1/10th, lol.

There are a lot of steps, a lot of separate companies, and a lot of time before a gallon of oil is extracted, shipped, refined, shipped again, and put in a gas station tank. It’s not a simple A to B transaction where you can directly correlate a spot price of crude to a price per gallon

most of these contracts are made way into the future so an oil field is delivering it no matter the current market price. When the spot price of oil went negative during covid it basically meant they had all this oil coming out and no buyers. You had oil tankers sitting in lines outside ports waiting for buyers so they could offload. The price at the pump wasn’t negative. There are still a lot of costs involved in transporting and refining so it’s separate in a sense from a spot price. Gas prices went down. It wasn’t free

“They” isn’t a singular thing. It’s lots of companies along the chaintempo_n_groove said:They always profit so they know what they are doing.Cropduster-80 said:That’s what I’m saying. It’s truetempo_n_groove said:Gas has been notorious for raising prices at the jump and lowering them at a much slower pace.Cropduster-80 said:Gas prices are sticky when crude oil prices go downwardstatic111 said:Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___

Associated Press reporters Chris Megerian and Josh Boak in Washington contributed.

part of that deals with lag time and price futures. You are buying at one price and then the price goes down after you bought it, you are still selling it at that higher price

when prices go up, you instantly raise prices to reflect the future price you are paying for next months delivery

that deals with gas pricing at the retail level (gas stations)

I saw a bit by Andy Rooney when I was a kid of him buying 1 gallon of gas and asking for his 1/10th of a cent back. They are still stealing that 1/10th, lol.

There are a lot of steps, a lot of separate companies, and a lot of time before a gallon of oil is extracted, shipped, refined, shipped again, and put in a gas station tank. It’s not a simple A to B transaction where you can directly correlate a spot price of crude to a price per gallon

most of these contracts are made way into the future so an oil field is delivering it no matter the current market price. When the spot price of oil went negative during covid it basically meant they had all this oil coming out and no buyers. You had oil tankers sitting in lines outside ports waiting for buyers so they could offload. The price at the pump wasn’t negative. There are still a lot of costs involved in transporting and refining so it’s separate in a sense from a spot price. Gas prices went down. It wasn’t free

I'm well aware of the past decade and why anyone in oil is reluctant to go back to lower prices. I have even told people about their current business model and why the hell would you want profits to go down after a decade of crap.Cropduster-80 said:“They” isn’t a singular thing. It’s lots of companies along the chaintempo_n_groove said:They always profit so they know what they are doing.Cropduster-80 said:That’s what I’m saying. It’s truetempo_n_groove said:Gas has been notorious for raising prices at the jump and lowering them at a much slower pace.Cropduster-80 said:Gas prices are sticky when crude oil prices go downwardstatic111 said:Funny how once the prices are high all the old expensive gas sitting in the ground has to be sold before the prices fall, but if prices are low and the price of crude goes up the price at the pump goes up instantly...mickeyrat said:Russia-Ukraine war Inflation Elections COVID-19 Global trade Economy Prices Vienna National elections OPEC Government and politicsOPEC+ makes big oil cut to boost prices; pump costs may riseBy DAVID McHUGHTodayFRANKFURT, Germany (AP) — The OPEC+ alliance of oil-exporting countries decided Wednesday to sharply cut production to support sagging oil prices, a move that could deal the struggling global economy another blow and raise politically sensitive pump prices for U.S. drivers just ahead of key national elections.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The group said the decision was based on the “uncertainty that surrounds the global economic and oil market outlooks.” Saudi Energy Minister Abdulaziz bin Salman stressed the group’s stated role as a guardian of stable energy markets.

“We are here to stay as a moderating force, to bring about stability,” he told reporters.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia's war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

U.S. President Joe Biden considered the OPEC+ decision “short-sighted while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin’s invasion of Ukraine,” White House press secretary Karine Jean-Pierre told reporters aboard Air Force One.

“It’s clear that OPEC+ is aligning with Russia with today’s announcement,” she said.

Bin Salman rejected questions referencing the reaction in Washington or implying that OPEC was assisting Russia, saying the discussion was in a nonpolitical “silo” where the focus was prudent management of oil markets.

Following a token trim last month, Wednesday's decision is an abrupt turnaround from months of restoring deep cuts made during the depths of the pandemic. As demand rebounded, global energy prices have swung wildly since Russia invaded Ukraine, helping fuel inflation that is squeezing economies worldwide.

Part of the OPEC+ cut is “on paper” because members already can’t supply enough oil to hit their allotments, said Gary Peach, oil markets analyst at energy information firm Energy Intelligence. “Only about half of that is real barrels,” he said.

A cut with oil near $90, which is “a comfortable price for all producers,” might not sit well with customers, but the oil ministers are “looking into the tunnel of recession ” that could lower demand in coming months, Peach said. “They decided to pre-empt that.”

The recent fall in oil prices has been a boon to U.S. drivers, who saw lower gasoline prices at the pump before costs recently started ticking up, and for Biden as his Democratic Party gears up for congressional elections next month.

Biden has tried to receive credit for gasoline prices falling from their average June peak of $5.02 — with administration officials highlighting a late March announcement that a million barrels a day would be released from the strategic reserve for six months. High inflation is a fundamental drag on Biden’s approval and has dampened Democrats’ chances in the midterm elections.

Oil supply could face further cutbacks in coming months when a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other members of the Group of Seven wealthy democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap.

The EU agreed Wednesday on new sanctions that are expected to include a price cap on Russian oil, meant to starve Putin's country of money for its war machine. It comes amid an energy crisis created by Russian reductions in natural gas supplies to Europe, whose leaders accuse Moscow of retaliation for their support for Ukraine and imposing of sanctions.

Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” analysts at Commerzbank said. “Higher prices beforehand — boosted by production cuts elsewhere — would therefore doubtless be very welcome.”

International benchmark Brent has sagged as low as $84 in recent days after spending most of the summer months over $100 per barrel. U.S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

___